Ethereum stays certain to vary between the 100-200-day shifting common, indicating the combination stage.

Nonetheless, a decisive breakout in both path is prone to outline the following main pattern, with market sentiment leaning in direction of a possible bullish breakout within the coming days.

By Shayan

Day by day Charts

ETH is at the moment consolidating a 100-200-day shifting common, and is within the essential stage with value motion.

Costs have been pulled again to retest this degree after surpassing the extraordinarily 200-day MA of round $2.5,000, an space that has served as a robust resistance in latest weeks. This pullback is essential. If bullish demand resurfaces and holds ETH above this shifting common, it may goal a 2.8k resistance zone and hearth upwards on one other leg.

For the time being, cryptocurrency seems to vary between $2.5,000 and $2.8k, and a transparent breakout from this zone may set the stage within the path of the following vital pattern. Market individuals are intently watching the bullish continuation that would solidify the inversion construction of ETH.

4-hour chart

Within the decrease timeframe, ETH's latest rally encountered resistance with a key bearish block between $2625 and $2670. This denial has introduced costs again to the $2.5,000 assist degree, a traditionally vital zone of ETH.

This space now serves as an vital battlefield. If patrons can defend it, Ethereum will regain momentum and recombine the breakouts onto the availability overhead.

Nonetheless, failing to carry $2.5k may cause an prolonged integration or perhaps a retreat to low assist.

By Shayan

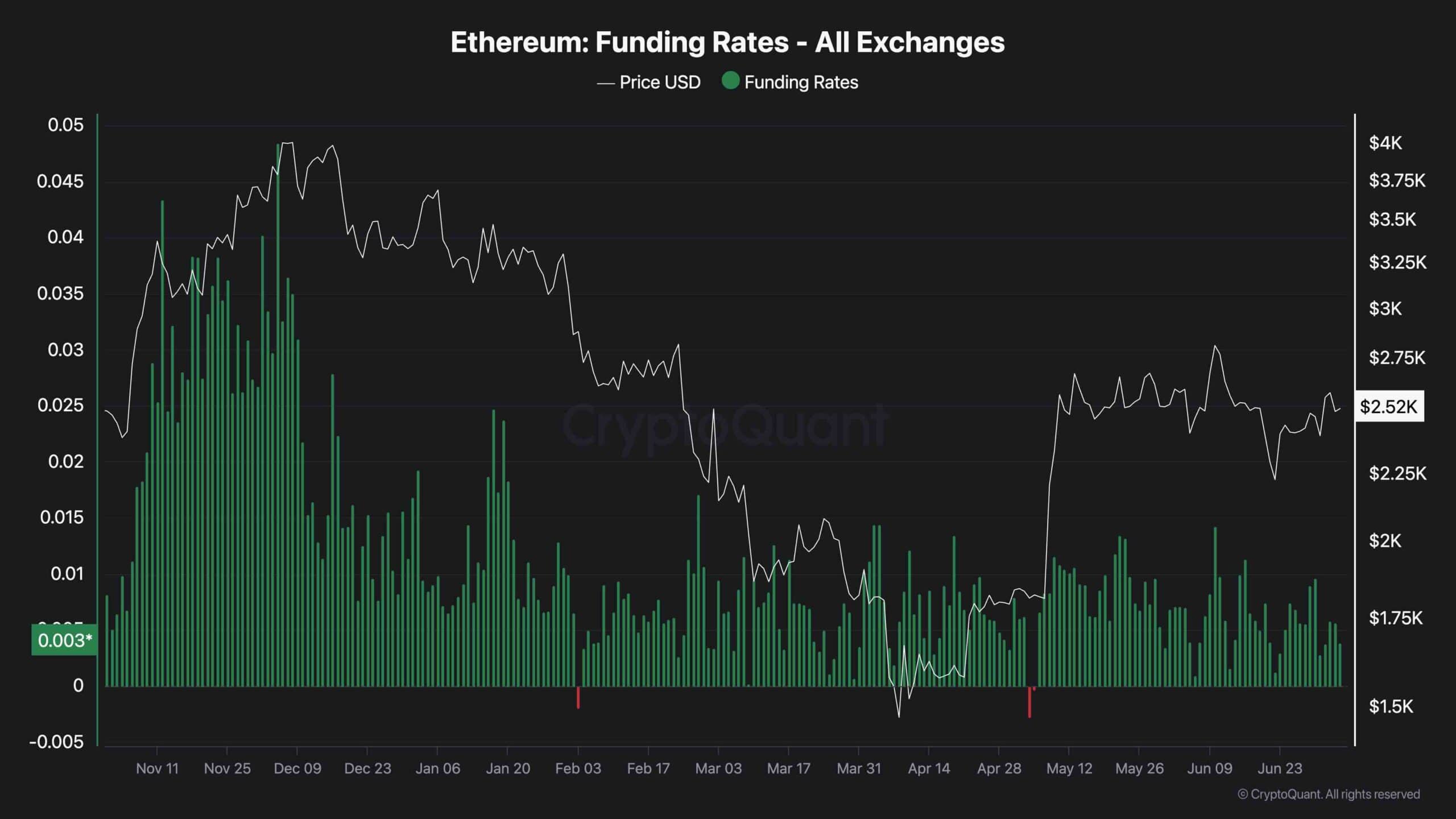

Funding charges stay an vital indicator of market sentiment in Ethereum's futures market. In wholesome uptrends, this metric often strikes upwards, reflecting elevated confidence and positioning from merchants through the years in each spot and chronic markets.

Nonetheless, ETH's funding charges are at the moment declining amid value consolidation between the 100-200-day shifting common. This implies indicators of diminished bullish convictions and purchaser fatigue, rising the potential for short-term, lateral, steady motion.

For Ethereum to surpass its 2.6k$2.6k and 28k resistance zones, stronger demand should movement into the derivatives market, bringing the funding fee to a extra optimistic degree. The combination section may final till that shift is realized.