Ethereum (ETH) worth has rebounded sharply from the crash lows round $3,430 and has risen to about $4,130 on the time of writing, a rise of about 20%. Though this appears to be like like a robust restoration, worth charts and on-chain information counsel this transfer will not be straightforward.

Ethereum may proceed to rise, however there could possibly be a brief interval of decline earlier than the following excessive is fashioned.

Whales choose up ETH, however cautious teams keep market polarization

Ethereum’s present rally seems to be pushed by massive wallets reasonably than small holders. Since October 11, Whale Pockets holdings have elevated from 128 million ETH to 136 million ETH, in accordance with Santiment information.

This equates to roughly 80,000 ETH, or roughly $330 million at present Ethereum (ETH) costs. The gradual however regular improve in whale holdings signifies quiet accumulation after the crash and suggests confidence amongst long-term buyers.

Ethereum whales slowly including: Santiment

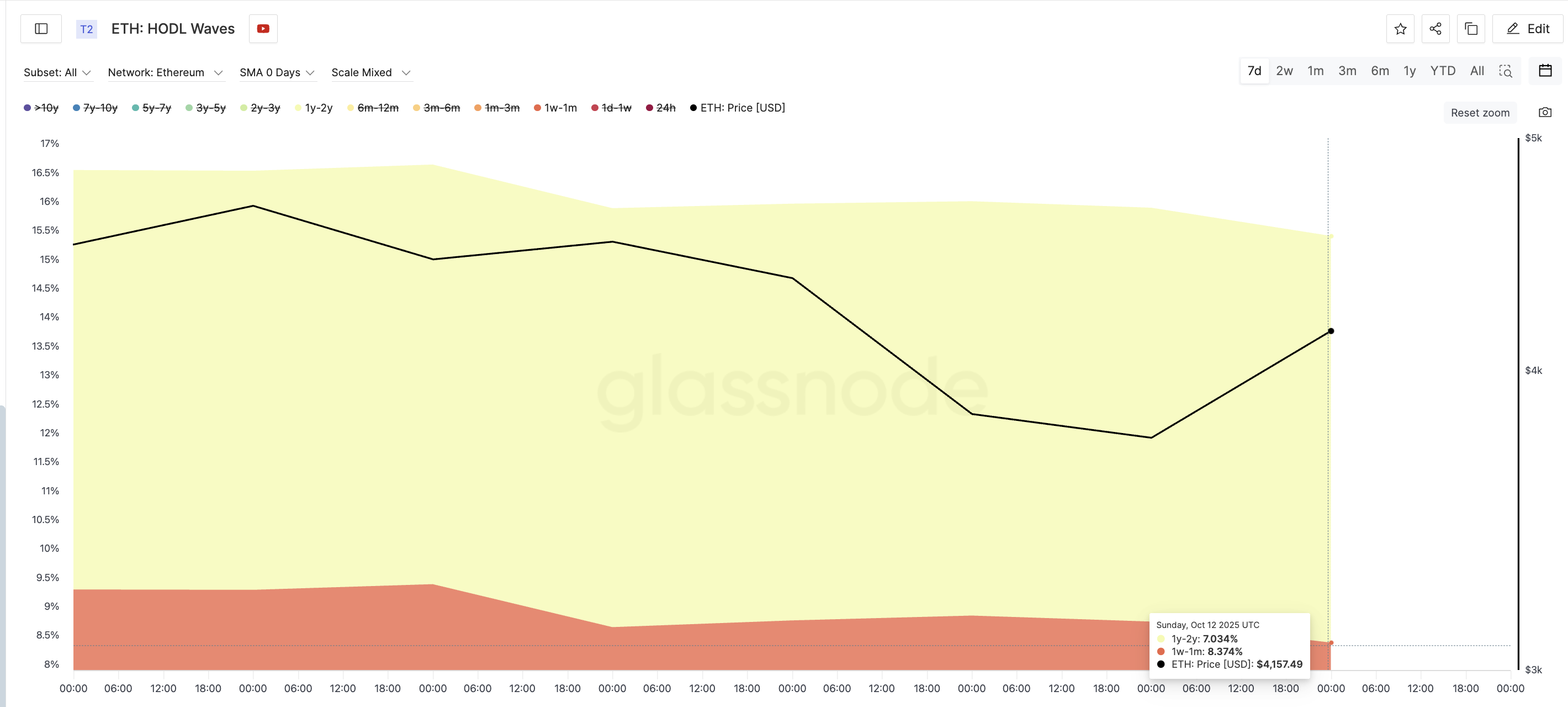

Nevertheless, some keyholder teams don’t categorical related beliefs. In response to Glassnode’s HODL Waves, which categorizes cash by holding interval, two main cohorts have diminished their publicity. The one-week to one-month cohort, which usually consists of short-term merchants who react rapidly to volatility, diminished its share from 8.84% to eight.37%.

Need extra token insights like this? Join editor Harsh Notariya's each day crypto e-newsletter right here.

Alternatively, within the 1-2 yr cohort, there are a lot of medium- to long-term holders who contribute to cost stability in instances of uncertainty, however after the crash, the share declined from 7.16% to 7.03%.

Ethereum holders stay cautious: Glassnode

These are usually the cohorts that create short-term momentum and maintain long-term restoration. Their present warning explains why Ethereum's rebound, whereas promising, nonetheless appears to be like uneven. Till these merchants and holders re-enter the market, the restoration is more likely to stay largely whale-driven. If this occurs, Ethereum’s worth development will grow to be much more risky close to the resistance zone.

Cup sample suggests an increase in Ethereum worth, however a fall may come subsequent

On the 4-hour chart, Ethereum has fashioned a cup sample, usually seen as a bullish reversal sign. this construction, the formation seems to be steady on either side, with costs trending upwards from round $3,640 in the direction of the $4,130-$4,390 vary. The lengthy backside core of the October 11 crash is excluded from the sample because it was a speedy anomaly that didn’t have an effect on the broader construction.

Quantity developments help this formation. A heavy purple candle appeared on the left facet through the fall. Quantity then flattened out on the base because the market stabilized. And at last, the buys returned and the inexperienced bar began rising on the appropriate facet.

Primarily based on this setup, Ethereum worth may rise to round $4,390, finishing the cup and aligning each rims on the identical degree. As soon as that degree is reached, the decline in ETH worth is more likely to proceed as a deal with begins to type.

Ethereum Value Evaluation: TradingView

Through the deal with part, ETH may drop to $4,070, or maybe even $3,950, with out invalidating the construction. Nevertheless, a detailed under $3,950 will break the sample and point out weak point. If the deal with varieties properly and momentum is maintained, a breakout above $4,390 may set off the following leg up. In that case, short-term targets can be $4,550 and $4,750.

Ethereum worth may rise or fall to those ranges earlier than the following rally — right here's why The submit appeared first on BeInCrypto.