Ethereum fell to six-week lows and slid beneath the $4,000 stage amid the weaker market.

The Altcoin King now prices $3,938, indicating that bearish momentum continues to dominate. Regardless of the decline, sure on-chain indicators recommend that this recession might present alternatives for buy.

Ethereum buyers have alternatives

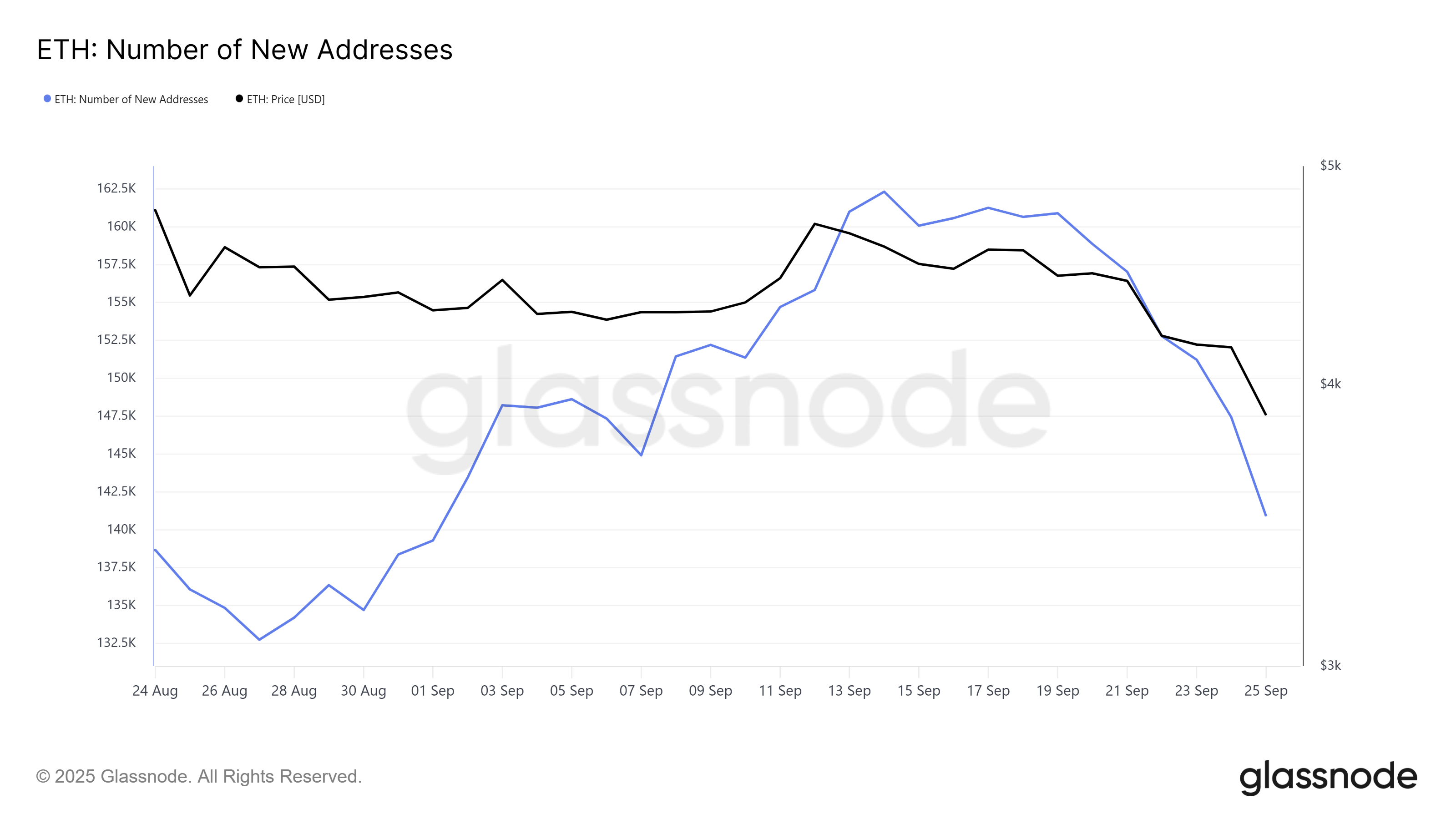

Creating new addresses on the Ethereum Community has been considerably slower and exercise collided with the month quickly. This decline signifies a decline in curiosity from potential buyers. With out new participation, Ethereum is struggling to generate upward momentum.

The dearth of latest entrants into the ecosystem underscores considerations about slowing demand. A recent inflow normally supplies vital assist for long-term gatherings as extra customers can improve community development.

Need extra token insights like this? Join Editor Harsh Notariya's every day crypto e-newsletter.

New deal with for Ethereum. Supply: GlassNode

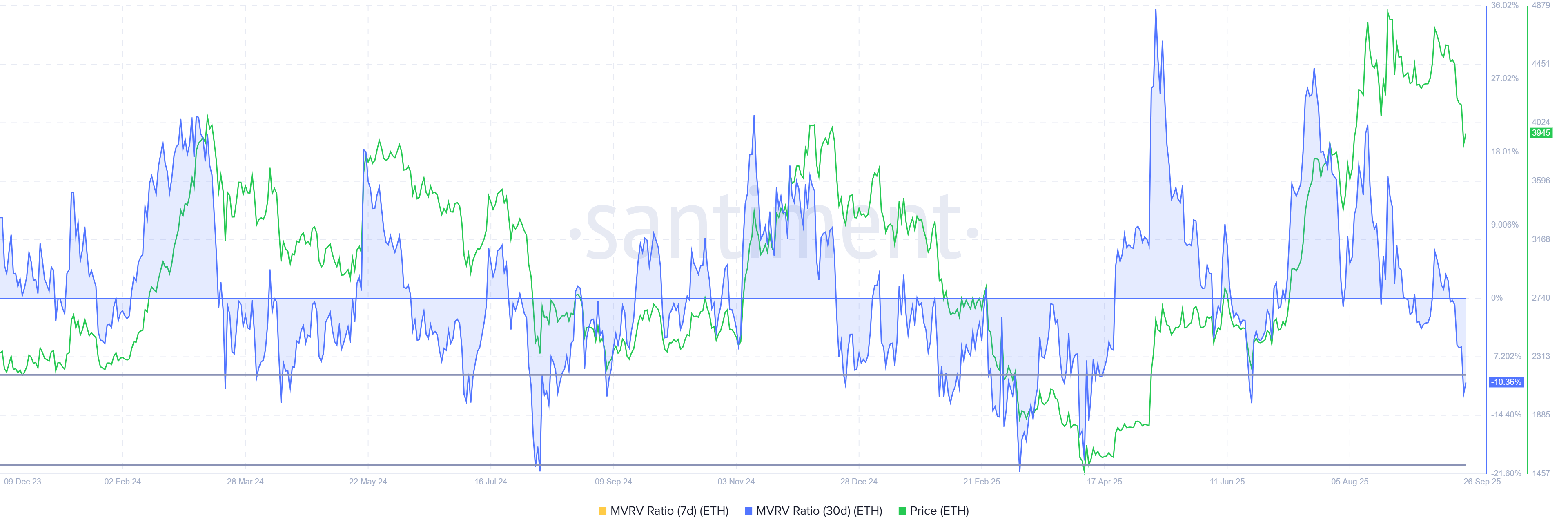

In the meantime, Ethereum's MVRV ratio exhibits a extra optimistic outlook. At present, the metric locations ETH throughout the alternative zone. This ranges from -9% to -30%. Traditionally, this zone has marked a degree the place losses usually happen as a speedy accumulation.

When earnings decline and holdings fall into losses, buyers have a tendency to carry or purchase at a low stage as a substitute of promoting. This habits usually creates the idea for restoration. The potential of demand being up to date is vital even amid bear stress, as ETH stays on this zone.

Ethereum MVRV ratio. Supply: Santiment

ETH costs require push

On the time of urgent, the Ethereum priced at $3,938 and was sought to determine $3,910 as a assist flooring. This decline marks a big break beneath the $4,000 stage, highlighting short-term weaknesses.

Given present indicators, ETH can stay within the vary beneath $4,074 resistance till the emergence of stronger bullish cues. Market sentiment suggests consolidation slightly than a pointy restoration, protecting buyers cautious.

ETH value evaluation. Supply: TradingView

Nonetheless, if Ethereum helps $4,074, the push to $4,222 might final. The transfer would require investor participation, sustaining an inflow to counter the bearish momentum and finally negating short-term destructive outlook.

Submit Ethereum costs are down six weeks, however falling into the chance zone first appeared in Beincrypto.