Ethereum costs remained underneath stress on Sunday as sentiment within the crypto trade deteriorated. The ETH token is buying and selling at $3,187, down greater than 36% from its all-time excessive, that means it’s in a extreme bear market. The coin might fall additional as a harmful sample approaches.

Ethereum worth is about to kind a harmful sample

Copy hyperlink to part

The day by day timeframe chart exhibits that Ethereum worth has remained underneath stress over the previous few months, shifting from an all-time excessive of $4,950 to the present $3,185.

ETH continues to kind a collection of lows and highs, an indication that any try at a pullback is funding robust resistance.

The Relative Power Index (RSI) has risen from July's overbought degree of 87 to its present degree of 35. This crash occurred when the RSI fashioned a double high sample.

In the meantime, the typical directional index (ADX) has risen to 37, indicating that the continued downtrend has gained momentum in current days.

The coin has additionally misplaced key assist ranges, comparable to final December's all-time excessive of $4,100. Additionally under the important thing assist degree of $4,000, the 50-day and 200-day exponential shifting averages (EMAs) are about to cross, forming a death-cross sample, one of the vital harmful indicators in technical evaluation.

Subsequently, the probably Ethereum worth prediction is bearish, and the subsequent essential assist degree to have a look at is $2,877, the very best degree in June of this yr. Conversely, a transfer above the $3,500 resistance would invalidate the bearish outlook.

Ethereum worth chart |Supply: TradingView

There are numerous bearish components in ETH worth

Copy hyperlink to part

A possible Ethereum worth crash has a number of notable bearish components that might push the value decrease within the quick time period.

First, knowledge compiled by SoSoValue exhibits that US traders proceed to dump ETH ETFs. These funds shed greater than $728 million in property final week, greater than the $507 million misplaced the earlier week.

The Spot Ethereum ETF misplaced greater than $1.24 billion this month, erasing good points from the previous two consecutive weeks. Cumulative inflows have elevated from about $15 billion this yr to $13.1 billion now. They at present have property of $20 billion.

Second, Ethereum costs might proceed to plummet on account of worsening community exercise, seemingly attributable to decreased market participation.

Based on the info, the variety of transactions within the community decreased by 25% over the previous 30 days to 45.7 million, whereas energetic addresses decreased barely to eight.19 million. Community fees decreased by 44% to 26.9 million.

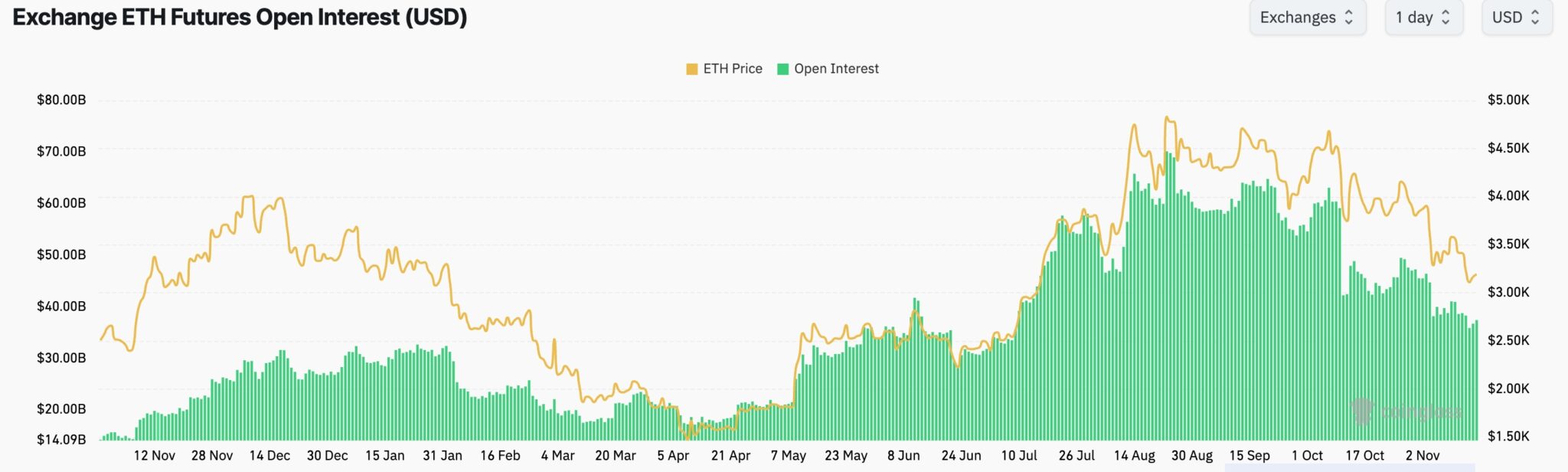

Third, Ethereum futures open curiosity decreased by almost $70 billion in August to $37.4 billion. One of many causes for that is the huge liquidation occasion that occurred on October eleventh. Ethereum funding charges have been in a secure state for the previous few weeks.

ETH futures open curiosity |Supply: Coinglass

Subsequently, the token might proceed to say no within the quick time period as weak fundamentals and technicals coincide.