Two trade commerce funds (ETFs) that permit buyers to wager in opposition to Ethereum with leverage have emerged as their finest performances from the beginning of the 12 months (YTD). Bloomberg senior ETF analyst Eric Balknas shared this on X, mentioning that he wasn't anticipating it.

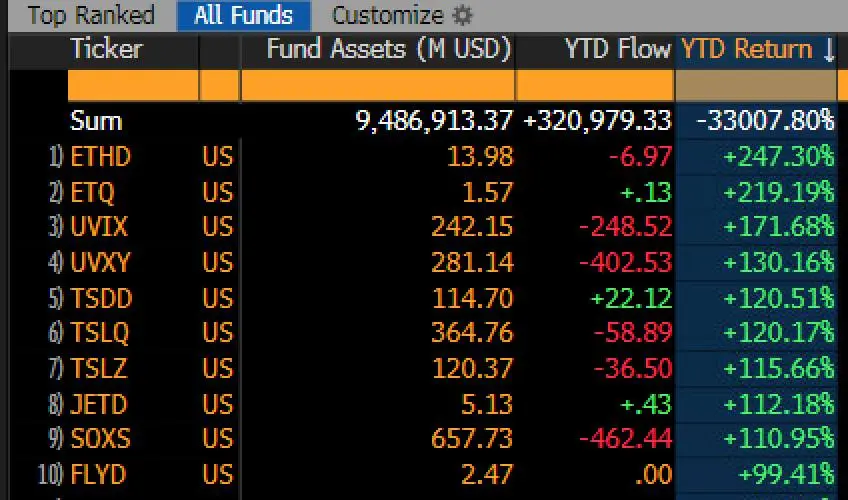

In keeping with Bloomberg information, the 2 ETFs, the ProShares Ultrashort Ether ETF (ETHD) and the T-Rex 2x reverse ether each day goal ETF (ETQ), are up 247.30% and 219% YTD, respectively. The double-longer Vix futures ETF predicted Bulk Eggs could be third within the first place.

Leveraged brief ETH futures ETH is one of the best efficiency of the 12 months. (Supply: Eric Balchunas))

Balkuna stated:

“The most effective performing ETF of the 12 months is the -2x Ether Etf Sethd, a rise of 247%.

Relatively than straight shorten Ethereum, the 2 ETH ETFs are as an alternative utilizing ETH futures contracts to wager on belongings, however their flying efficiency underscores the token battle. Tokens have already been one of many worst years of report, with YTD and value exceeding 50% at an invisible stage since 2022.

Curiously, the 2 funds have minimal managed belongings, with ETHD successful $13.98 million in AUM following a $6.97 million outflow this 12 months. The ETQ is just not good, with solely $1.57 million AUM regardless of a barely constructive netflow.

Two funds have additionally been down in the long run. ETQ had a efficiency of three.56% in six months, whereas ETHD has dropped by 18.09%.

Ethereum takes a break from the battle after suspending at tariffs

In the meantime, ETH took a break from the battle with a surge in worth over 10% after President Donald Trump introduced a suspension of tariffs in all international locations besides China for 90 days. Following the information, ETH has gone from $1,440.82 to $1,687.18, sparking rebound hypothesis.

Naturally, the worth of the brief ETF is price it, with ETHD dropping 24% to $55.60 and ETQ dropping 24.66% to $23.59. Nevertheless, they remained YTD, and ETH's outlook stays comparatively adverse, with tokens already ejecting a few of their current earnings.

Regardless of double-digit share features, ETH is properly beneath $2,000 and constructive feelings are very slim. A part of the issue behind the worsening feelings is the give up of some long-term holders.

In keeping with Blockchain Evaluation Platform Lookonchain, the whales, which held ETH as a result of they have been price $8, dumped 10,702 ETH for $16.86 million after two years of dormant. The tackle has a historical past of promoting ETH throughout main dips, which shall be added to the rising ETH sell-0ff.

Nonetheless, some market specialists consider {that a} sale by long-term holders may symbolize a very good shopping for alternative. Crypto analyst Ali Martinez believes this may very well be a very good entry level for many who wish to accumulate.

He stated:

“Lengthy-term #ethereum $eth proprietor is in 'Suball' mode. Within the reverse case, this might point out a dangerous accumulation zone and a dangerous accumulation zone. ”

His views are in keeping with these of others who consider that ETH is already on the backside and has future bullish occasions that might result in value will increase. Crypto Influencer Ted Pillows believes Pectra upgrades, ETH staking ETFs and tokenization booms may result in a major rise in ETH costs.

Nevertheless, many consider that present market uncertainty doesn’t help rebounding, and ETH can fall. Cryptoquant analyst Mac_D has recognized $1,290 as the following main help stage for ETH.