The most important Altcoin Ethereum exhibits poor efficiency in opposition to Bitcoin (BTC) because the relative energy with key digital property has weakened up to now few classes.

Regardless of BTC hitting its all-time excessive yesterday, ETH costs have struggled to proceed, buying and selling sideways for the previous 4 days. Technical indicators level to curiosity on consumed purchases and lift considerations that the coin can see the additional draw back if momentum is just not picked up.

Ethereum is weak in opposition to Bitcoin

The ETH to BTC (ETH/BTC) ratio has been declining over the previous few days, highlighting that Ethereum has misplaced its place in Bitcoin as a consequence of its relative efficiency. At press time, that is at present 0.036.

ETH/BTC ratio. Supply: TradingView

The ETH/BTC ratio measures the relative energy of ETH in comparison with BTC, indicating how worthwhile the previous is from the latter standpoint, and which property outweigh the opposite.

If it falls like this, it signifies that ETH is under Bitcoin. Because of this, BTC's current rally to the brand new all-time excessive is probably not sufficient to elevate ETH. This makes Altcoin's costs extra weak to sideways or downward pressures over the subsequent few buying and selling classes.

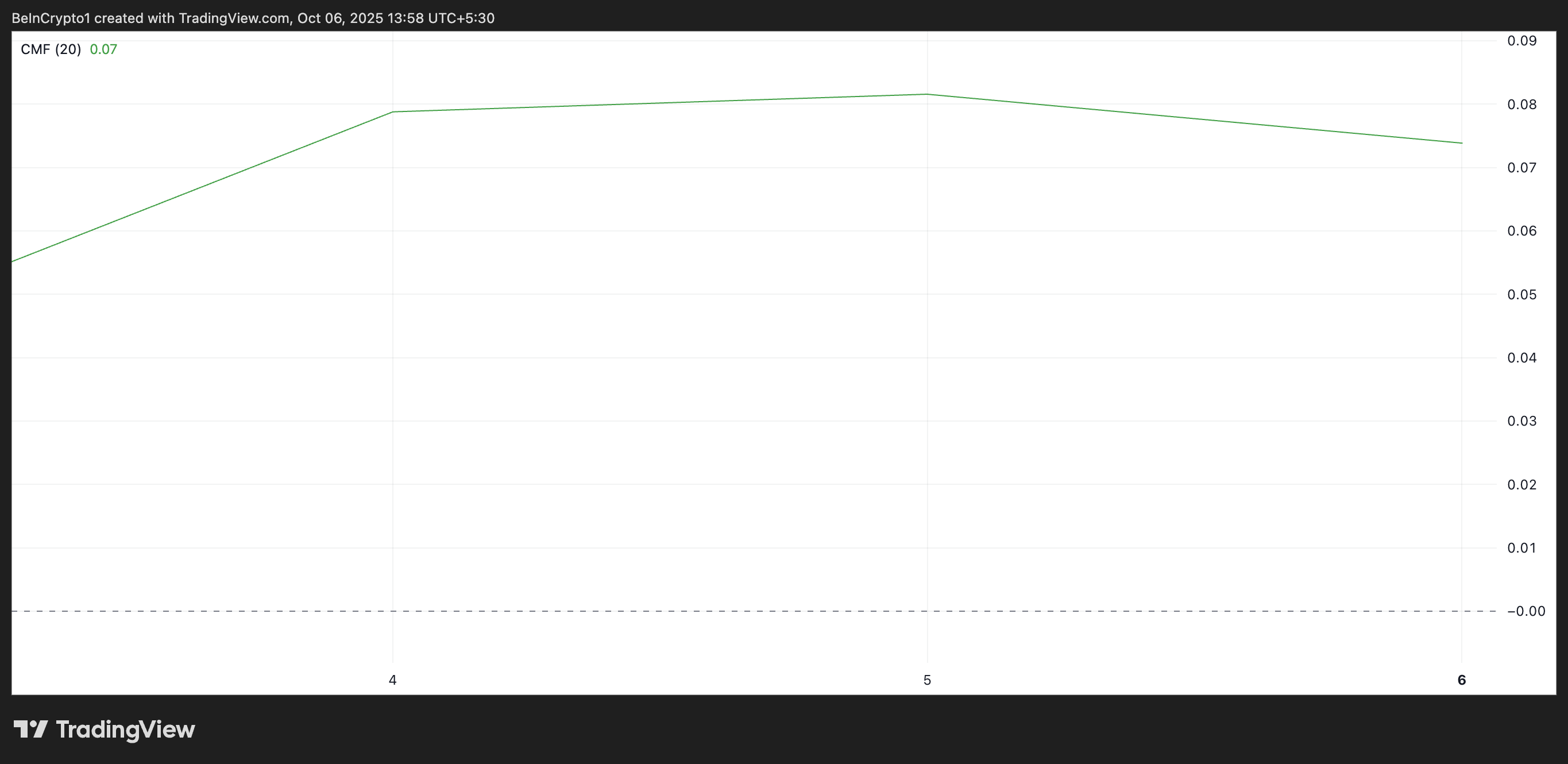

Moreover, Eth's Chaikin Cash Circulate (CMF) on the day by day chart has flattened over the previous few classes and began transferring downwards. This means that capital inflows into ETH will sluggish additional delay the potential for a surge to $5,000.

eth chaikin cash stream. Supply: TradingView

The CMF indicator measures how an asset enters and leaves the asset. As soon as it flattens after which falls, it signifies that it weakens the stress of shopping for and weakens the momentum of promoting. This ensures that ETH can have a tough time gaining upward traction even when BTC gathers.

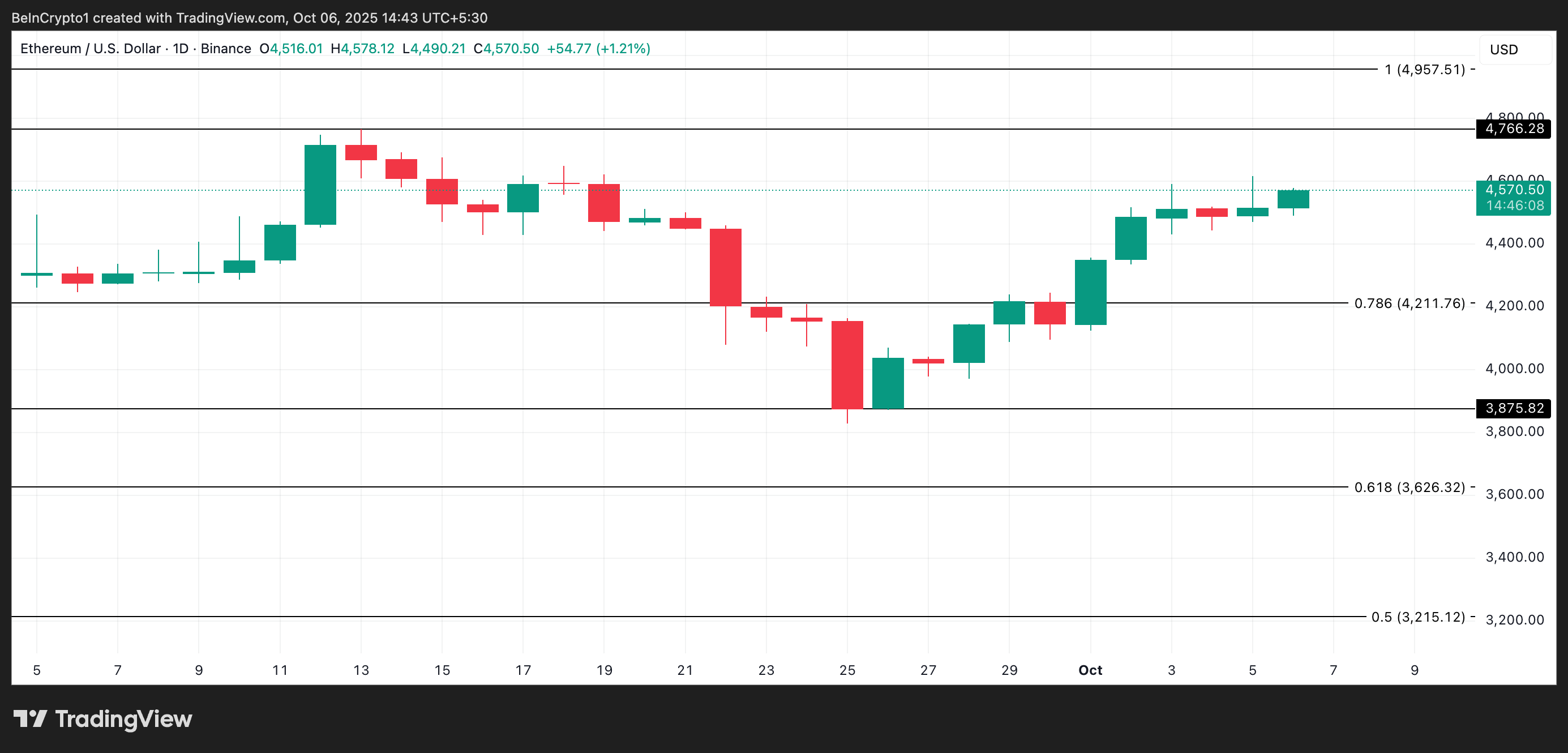

Ethereum stalls amid market uncertainty: $4,211 or $4,957 subsequent?

The horizontal development with flattening momentum indicators displays indecisiveness amongst merchants, as each consumers and sellers are utterly uncontrolled. If the downward stress is elevated, this might set a bigger stage of correction.

On this state of affairs, the coin's worth may plummet to $4,211.

ETH worth evaluation. Supply: TradingView

In the meantime, if Bullside's energy grew, ETH may try to satisfy on August twenty fourth in direction of its all-time excessive that it final reached. Nevertheless, for this to occur, the worth of the ETH should first break the fast resistance of $4,766.

Ethereum's momentum stalls as ETH is behind Bitcoin. The pending $5,000 goal first appeared on Beincrypto.