Previous Ethereum addresses are being distributed on the quickest tempo since 2021. The market wants to soak up round 45,000 ETH from early traders day by day.

Previous Ethereum wallets are getting into a section of accelerated circulation, with gross sales returning to ranges not seen since 2021. There are additionally indicators of staking by storing ETH in storage addresses, vaults, and sensible contracts, however older whales are inflicting peak volumes.

Following the latest wave of promoting, ETH fell to $3,152.17 resulting from a mixture of weak market circumstances and extended liquidations. After the newest liquidation spherical, ETH open curiosity has decreased to $17 billion.

Primarily based on Glassnode knowledge, nearly all of gross sales got here from older wallets. 3-10 years. These sellers are realizing earnings to keep away from getting caught in one other bear market.

Whereas Ethereum supporters nonetheless see this as a long-term guess, whales are dropping the urge for food to trip out one other bear market. Distribution started in August however accelerated final month resulting from deteriorating sentiment and the impression of the file liquidation occasion on October eleventh.

Ethereum nonetheless has excessive unrealized positive aspects

Ethereum whale strategic buying and selling means the token now has extra alternatives to comprehend earnings. The Market Worth to Realized Worth Ratio (MVRV) signifies the buildup of wallets with giant quantities of unrealized earnings. Unfavourable MVRV is an indication of market capitulation, which ETH had not even reached throughout earlier declines. Traditionally, particularly throughout lengthy bear markets, ETH spends a number of months with unfavorable MVRV.

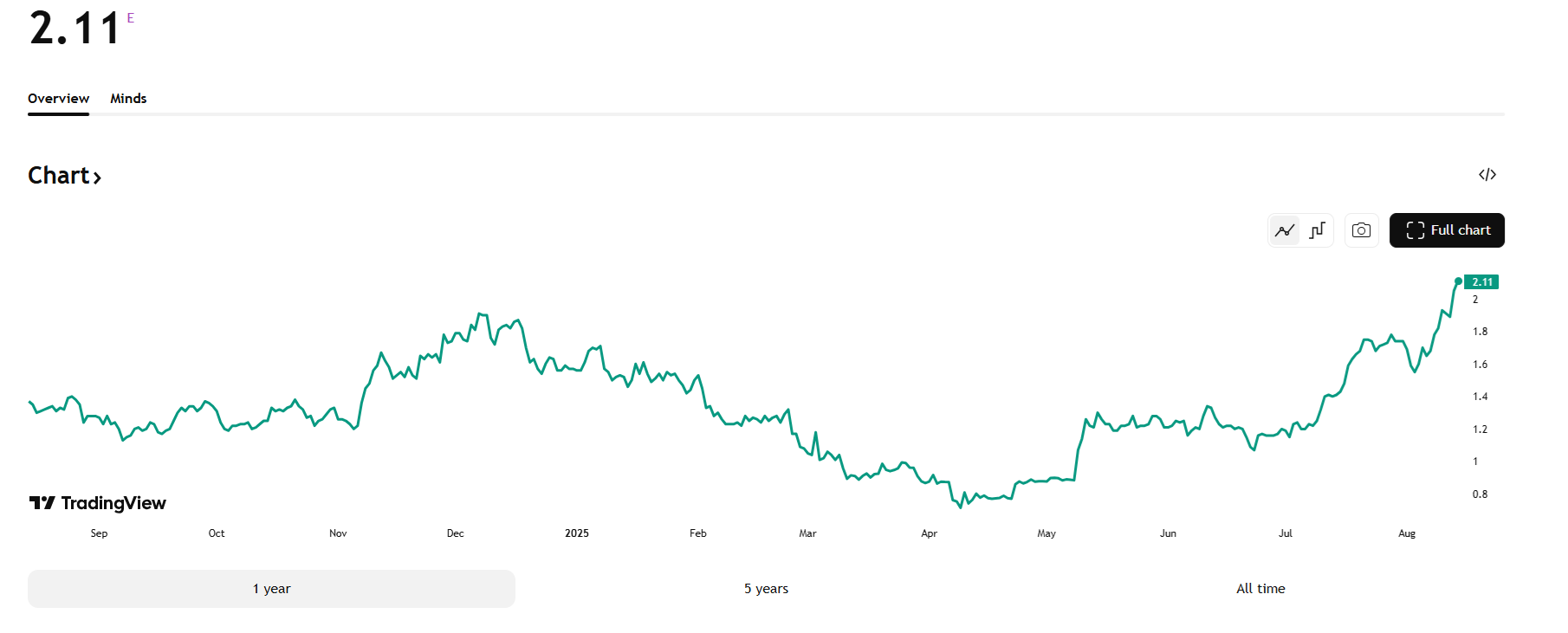

The MVRV ratio is at its highest stage in 2025 at 2.1 factors, which might create promoting strain if some whales resolve to lift their common costs. ETH continues to be actively traded and a few of the provide remains to be used for short-term swaps.

Primarily based on the MVRV ratio, ETH nonetheless has vital unrealized worth. Whales are energetic in taking earnings, however they’re additionally on the purchase facet when the market is down. |Supply: TradingView.

Ethereum additionally confirmed weak point because the altcoin season is just not wanting promising. As funds change fingers, token buying and selling could grow to be extra energetic. Ether sentiment is presently at its lowest stage in a yr. ETH’s Concern and Greed Index is at 29 factors, indicating that buying and selling sentiment is anxious.

Seven brothers' wallets purchase decline

ETH confirmed continued whale exercise throughout the market decline. Final week, main whales expanded their positions to incorporate borrowed funds from Aave.

one in every of seven brothers pockets It has gathered ether from Uniswap up to now 24 hours and presently holds over $260 million in wrapped ETH in varied types.

The opposite pockets used the Cow protocol for a number of Ethereum purchases and is presently being held. $322 million Included in varied wrapped ETH tokens and different belongings. The Seven Siblings pockets absorbed 1.2 million Ether within the latest crash, making it one of many greatest on-line patrons. This time, Whale actively used the acquisition of ETH. borrow $10 million for Spark protocol, demonstrating confidence in eventual market restoration.

Traditionally, the involvement of the Seven Brothers Related Pockets signifies a localized backside available in the market. Different whales additionally purchased dip, soak up 2.53 million cash at $3,150 per Ether, establishing a brand new assist zone.

a pockets The one linked to BitMine additionally confirmed buy exercise, and one other well-known whale additionally added 16,937 Ethereumclose to weekly manufacturing of recent tokens.