Ethereum is going through main challenges this month. It has dropped 10% of its worth within the final 20 days and is at the moment buying and selling at $2,021.

This worth extension has rattled buyers' belief and has led to a constant capital outflow from Spot ETH Alternate Commerce Funds (ETFs) since its launch in March.

Investor belief in ETH as Spot ETFS bleeding

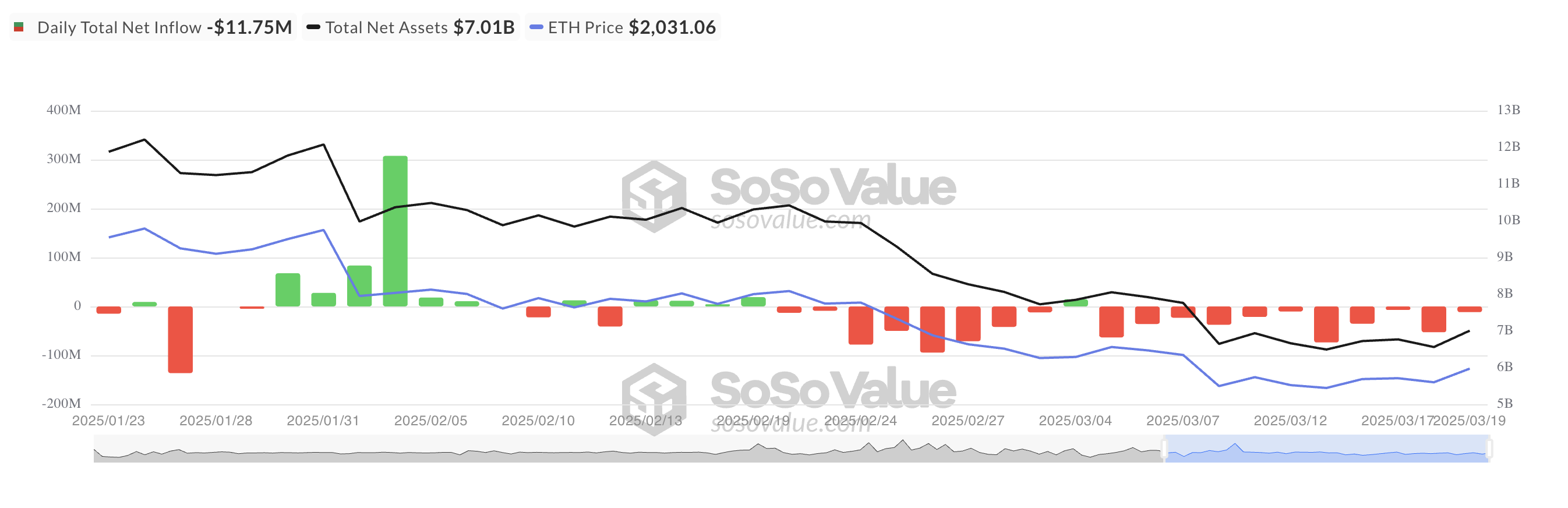

In keeping with SoSovalue's on-chain information, Spot ETH ETF at the moment has 11 consecutive days of leaks, with whole withdrawals exceeding $370 million.

All Ethereum spot ETF internet movement. Supply: SosoValue

Investor sentiment stays overwhelmingly bearish, with solely in the future inflow recorded this month. All US SPOTETFs at the moment have a complete asset worth of $7.01 billion, with a 44% drop for the reason that begin of the 12 months.

When Spot ETH ETF experiences a internet outflow, buyers will scale back their confidence within the coin's worth efficiency and withdraw more cash than they contribute. Steady outflows are a serious indicator of buyers' bearish sentiment and might strengthen gross sales stress on ETH costs.

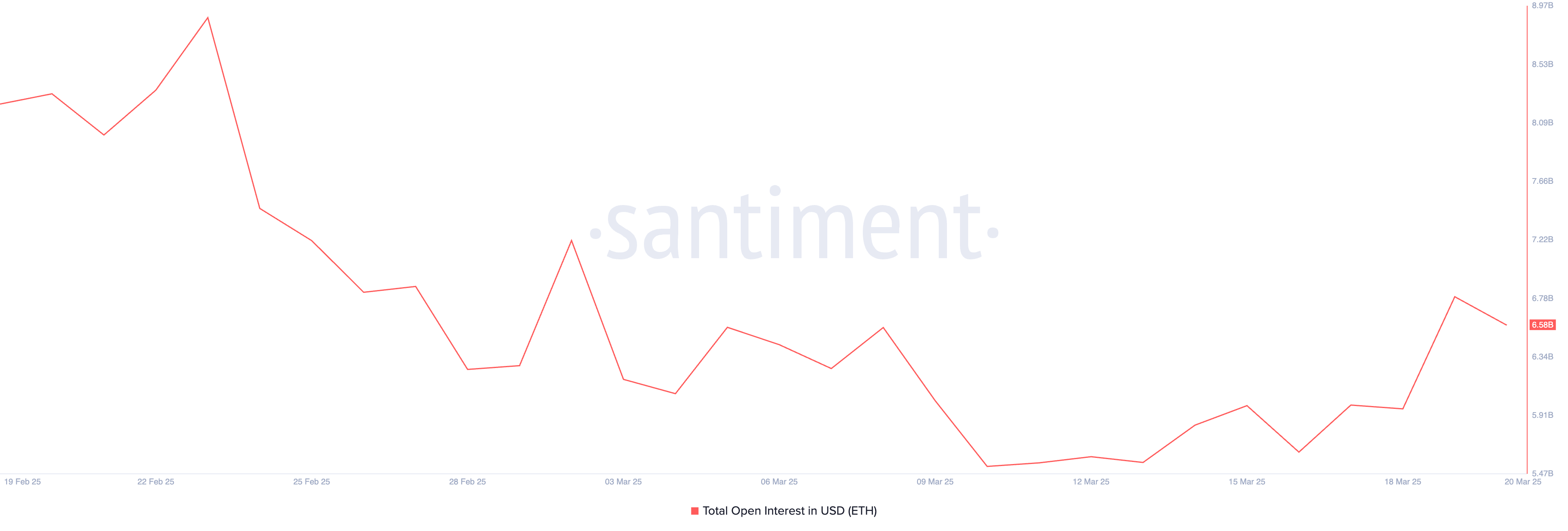

Moreover, the decline in open curiosity (OI) of cash displays declining demand. On the press convention, this was $6.58 billion, a 20% drop prior to now month.

ETH open curiosity. Supply: Santiment

The OI of an asset measures the whole variety of unresolved spinoff contracts, similar to unresolved futures and choices. When it falls, it signifies that the dealer is closing the closed place relatively than opening a brand new place.

This means decreased market participation and weakening ETH's momentum. It suggests uncertainty and lack of convictions within the worth route of main altcoins, which contributes to the decline.

Eth Eyes Restoration for Macd Golden Cross to Purchase Sparks

Amid a wider market restoration final week, ETH's shifting common convergence divergence (MACD) shaped a golden cross. Its MACD line (blue) is positioned above the sign line (orange) on the each day chart as bullish stress is starting to realize momentum.

The MACD indicator measures the energy and route of the asset's momentum. This helps merchants determine potential development reversals and modifications in momentum. It means that the looks of golden crosses is usually interpreted by merchants as a purchase order sign.

If we improve the stress, ETH may reverse the present downward development, probably rising to $2,224.

ETH worth evaluation. Supply: TradingView

Conversely, if costs drop, ETH may commerce at $1,924, beneath $2,000.