Based on the info, the Etherum Reward Quantity has overturned the quantity of Bitcoin, and a sign that robust speculative curiosity is flooded with belongings.

Ether Leeum Reward Quantity was fired with Value Rally.

Based on the info from the analytical firm GlassNode, Ethereum may surpass Bitcoin by way of future buying and selling quantity. Right here, the quantity of buying and selling signifies the quantity of transactions that have been naturally given on one other centralized change. Within the present context of the subject, the quantity associated to the long run market is very .

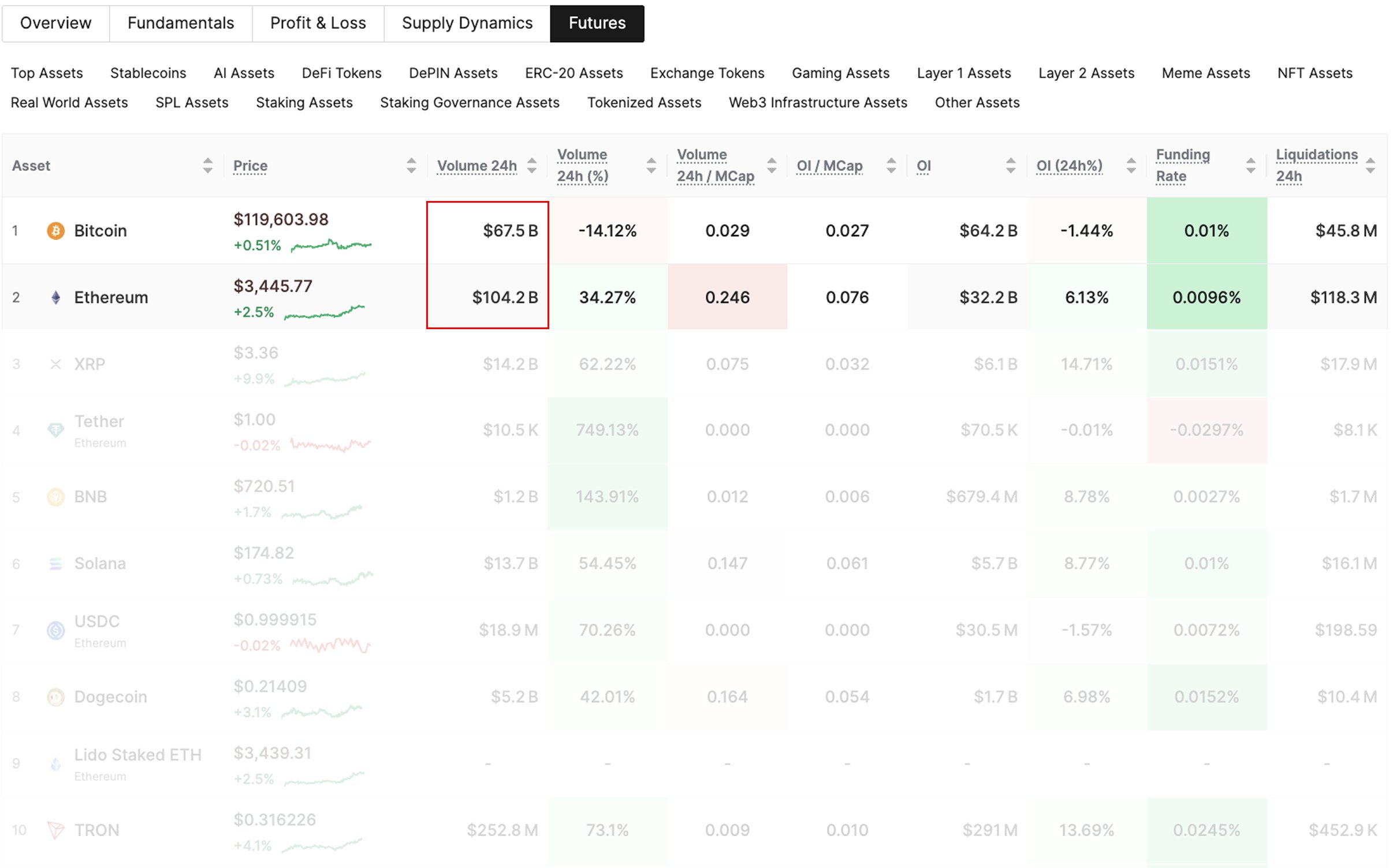

Under is a desk that reveals how the comparability between Bitcoin and Ethereum compares this metrics on the standpoint of GlassNode.

Seems just like the ETH futures quantity far outweighs the BTC one | Supply: Glassnode on X

As you may see, Bitcoin has registered $ 67.5 billion in futures buying and selling, particularly decrease than $ 14.2 billion by Ethereum. Cryptocurrency often doesn’t occur as a result of it observes extra speculative demand than ETH or altcoins.

In the identical desk, the info from a number of different futures associated indicators are additionally displayed. The BTC Open Curiosity has reached $ 64.2 billion on the submit -post level of monitoring the full future place on all derivatives platforms.

The identical indicator for ETH was $ 32.2 billion, and its unique digital belongings are nonetheless far forward of the full market positioning. In different phrases, the 24 -hour change of this metric decreased 6.1% of Ether Leeum and 1.4% of Bitcoin.

New demand for ETH has occurred as the worth of robust inflows (ETF) has fallen from the market.

Apparently, all of those pursuits have been towards Cryptocurrency, however the common funding charge remains to be not optimistic. The speed of financing is an indicator of a periodic payment that merchants change within the futures market.

When this metrics are inexperienced, lengthy traders imply that they pay a premium to quick traders to keep up their place. This pattern means that there’s a robust considering between retailers.

On this desk, it’s clear that the financing charge reached 0.0096percentof Etherrium even after the surge in future buying and selling quantity. That is lower than 0.01percentof Bitcoin. Due to this fact, a brand new positioning for ETH happens, however traders are nonetheless not optimistic.

“This setting has no indicators of robust dumping pursuits, OIs and overheating.”

ETH value

On the time of writing, Ether Leeum trades $ 3,600, up nearly 21% final week.

The worth of the coin has surged through the previous few days | Supply: ETHUSDT on TradingView

DALL-E, GlassNode.com's most important picture, TradingView.com chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We help the strict sourcing normal and every web page is diligent within the high know-how consultants and the seasoned editor's crew. This course of ensures the integrity, relevance and worth of the reader's content material.