Excessive lipids have lately surpassed the commerce quantity of everlasting alternate Dydx, reaching $1.5 trillion. Regardless of being a a lot newer platform, Hyperliquid's token buyback and lack of money incentives have resulted in long-term stability.

To be truthful, Hyperliquid has additionally been concerned in a lot bigger controversy, and is well-known for abolishing Jellyjelly earlier this 12 months in response to a shorter squeeze. However, the platform has rebuilt its status and produced a large quantity of its manufacturing.

Excessive lipid buying and selling quantity exceeds dydx

Hyperliquid, a high-performance L1 buying and selling blockchain, has loved many successes lately. Earlier this month, it gained over 60% of the everlasting commerce market, and its hype token reached three months excessive quickly after.

Yesterday, analysts observed Hyperliquid's highest ever buying and selling quantity exceeded DYDX, reaching $1.5 trillion at this time.

Dydx is a decentralized, everlasting alternate that has been lively for 5 years, however the Hyperliquid platform was launched in 2023 solely.

However, the younger protocol overtook it. After launching the native token in 2021, Dydx started adopting it to refund customers' transaction charges and elevated its quantity. He then constructed group hype round unofficial “buying and selling contests” along with his rivals.

Excessive lipids, alternatively, weren’t depending on Dydx's incentive methods. After final 12 months's personal TGE, we had been capable of accumulate an enormous quantity by options, phrase of mouth and product high quality.

2024 was the height 12 months for Crypto Perpetuals Buying and selling, and the hype took benefit of the second. This clearly proves to be a extra sturdy method.

Moreover, Hyperliquid is directed in direction of token repurchase, which is the smallest quantity of transaction charge measured in a couple of months, to a small extent.

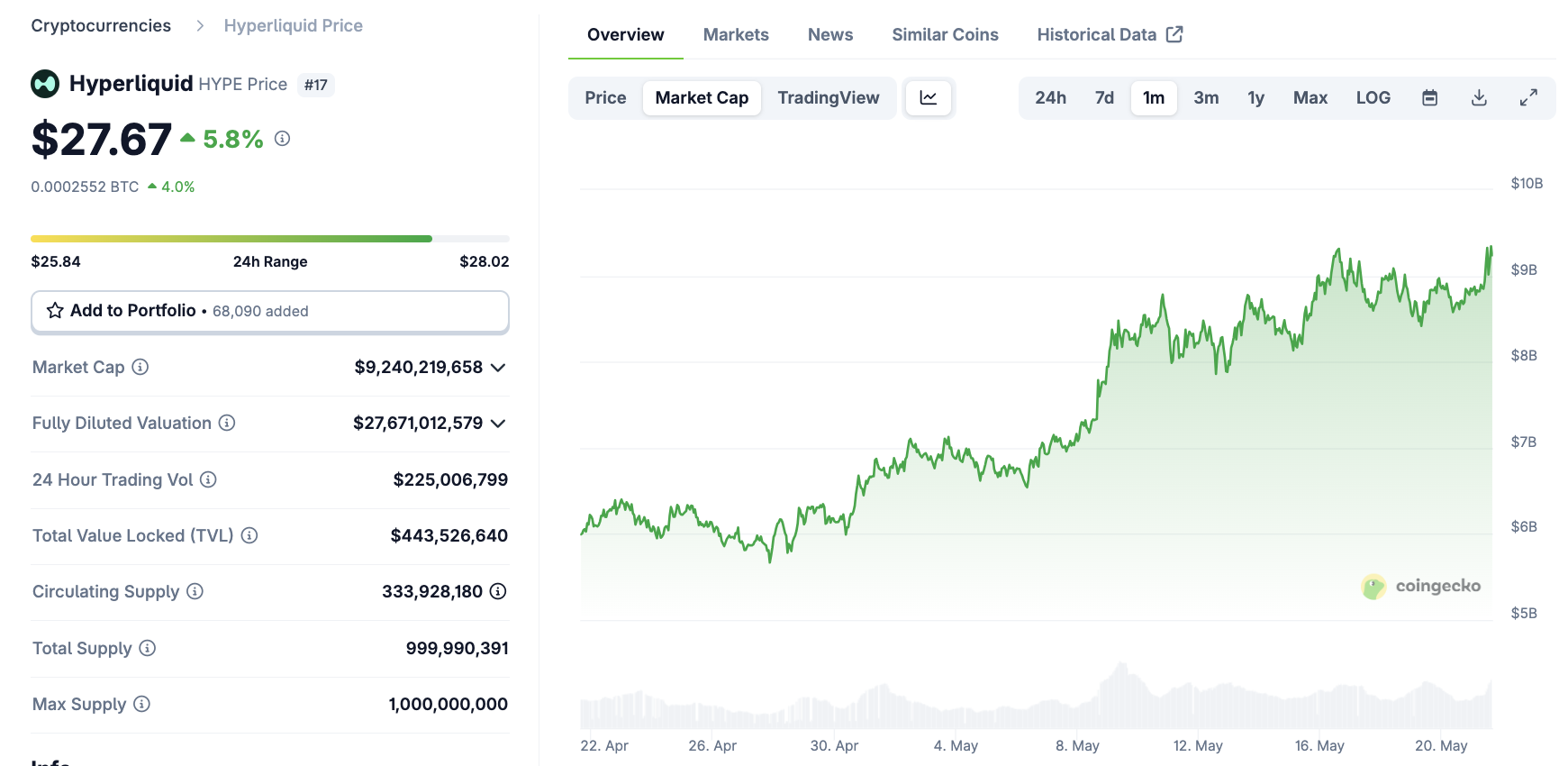

This has resulted within the firm repurchasing 17% of its circulating hype tokens, providing some necessary advantages. Final month, Hype's market capitalization has steadily risen to $10 billion.

Market capitalization of excessive lipids (hype). Supply: Coingecko

Regardless of its robust rise, excessive lipids have seen some main controversy. For instance, regardless of clear on-chain proof final 12 months, it denied claims of the Lazarus Group's safety breaches.

It unleashed a serious scandal when it listed Jerry Jerry in March 2025 in response to a brief squeeze. This has resulted in accusations of market manipulation and heavy losses.

Dydx has not suffered from such public conflicts for months, however the excessive lipids acted shortly to rebuild its status. To date, this appears to have labored.

Immediately, excessive lipids have reached a brand new historical past of open curiosity, exceeding $8 billion. If this momentum might be maintained, the alternate can construct a lead that can lead Defi's everlasting market.