Merchants on excessive lipid platforms recognized by X's pseudonym Qwatio have suffered a significant loss after repeatedly shortening Bitcoin (BTC) and Ethereum (ETH) throughout latest market rises. Merchants have been liquidated 5 instances over the weekend alone, bringing the overall variety of liquidations to 10 in only a few days.

Based on the Crypto Market Exercise Tracker LookonChain, Qwatio positioned a extremely leveraged wager on BTC and ETH, which led to a lack of round $3.7 million final week.

Coinglass knowledge reveals {that a} whole of 387 BTC value roughly $42.18 million and a pair of,990 ETH of $7.65 million have been settled from Qwatio's accounts. Holding a steadiness of $16.28 million, the account steadiness was value $610,000, recording a realised lack of $15.67 million.

Excessive lipid merchants will endure losses after the primary quarter bull run

Merchants opened a leveraged brief place at BTC and ETH, hours earlier than President Donald Trump signed an govt order to ascertain the Nationwide Cryptocurrency in March.

The market noticed the order as bullish and pushed the Crypto market to a excessive together with BTC, inflicting early losses for Qwatio. They’re additionally recognized for establishing a significant place in Melania Coin throughout its preliminary preliminary launch in 2025.

After dropping hundreds of {dollars}, Qwatio continued to short-circuit two largest cash by market capitalization into the second quarter of the yr. On July 4, after already liquidated 10 instances, the merchants opened one other brief place towards Bitcoin, betting 21 BTC on $2.3 million, however the belongings have been buying and selling at $109,135.

The coin has since fallen to $108,993, and Qwatio hopes to go additional all the way down to the analyst's predictions that BTC claims to be in “weak constructive” short-term market sentiment.

Brief and lengthy liquidation of the market is quickly growing

Qwatio's losses got here towards the backdrop of a number of liquidations within the crypto derivatives market. For the 24-hour interval ending July seventh, whole liquidation of all main cryptocurrencies reached $184.16 million, in line with Coinglas.

This quantity included $47.14 million in strengths and $137.01 million in brief positions. This places a powerful stress on bearish merchants because the market is buying and selling inexperienced.

Ethereum led the liquidation whole, sweeping $64.14 million, $4,962 million from brief positions and $1,452 million from lengthy positions. Bitcoin continues, with $35.38 million settled and features a brief place of $31.25 million.

Many merchants like Qwatio misdirected the market path and weren’t adorned with the power of the market's progress.

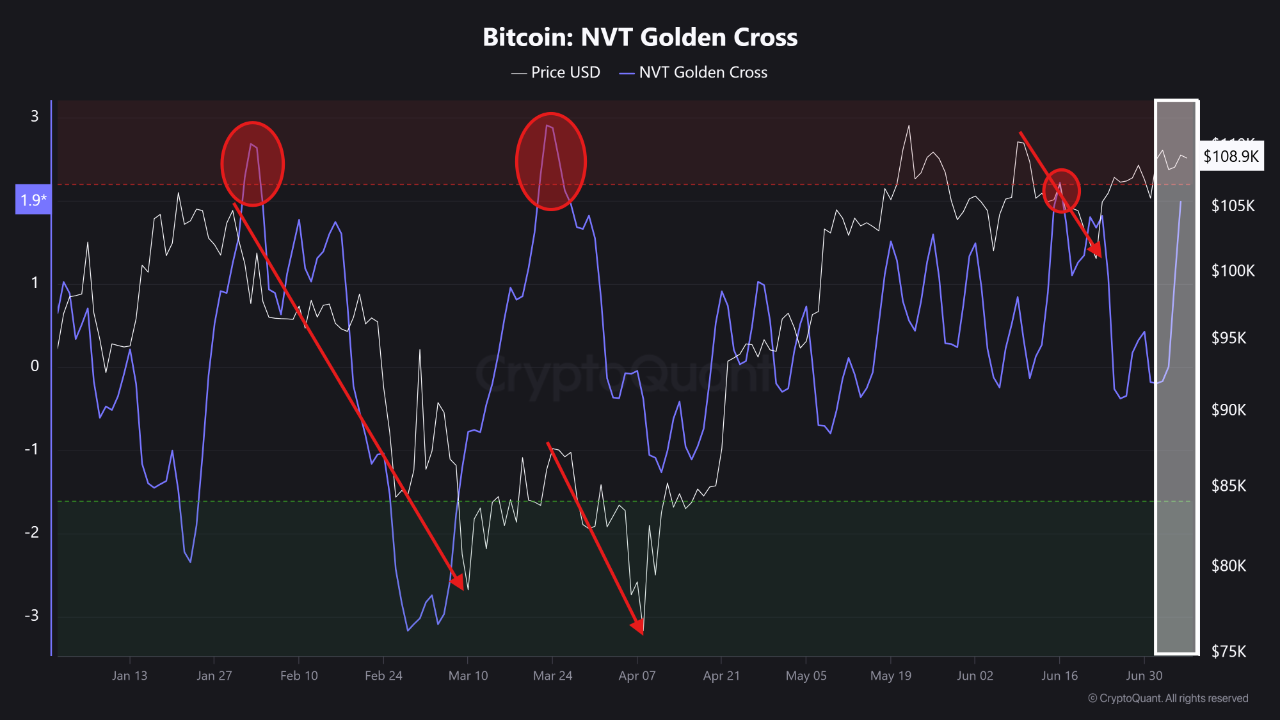

NVT Golden Cross on BTC Chart spells worth toppings

Based on Cryptoquant Take, NVT Golden Cross has made its three most up-to-date tops in 2025: March 24, March 24, and June 16. On every event, the indicator peaks above the two.2 threshold, with BTC worth highs at $97,600, $87,500 and $106,800. Every peak was adopted by corrections of -23.65%, -16.06%, and -9.87%.

Supply: Cryptoquant

As of the most recent studying, the NVT GC is standing at 1.98, however has not resumed its 2.2 sign line but, however there’s room for worth momentum. Analysts consider there can be a worth hike for a couple of days if the NVT exceeds 2.2.

Bitcoin's worth rise has sparked a series response throughout derivatives platforms, significantly with benance, the place brief positions are rising.

Many merchants appeared to interpret the gathering as a gross sales alternative. Nonetheless, the continued rise in BTC costs has compelled many of those brief sellers to liquidate or margin calls.

Liquidation has inspired a bullish suggestions loop and accelerated the motion of rising costs. When bearish bets are squeezed out of the market, it builds a bullish momentum, a sample seen on this week's buying and selling conduct.