Ethereum is buying and selling flat simply above the psychological $3,000 degree, teasing merchants with near-breakout pressure. As of December 22, 2025, Ethereum's value is $3,049, with a market cap of $368 billion and backed by a 24-hour buying and selling quantity of $17.78 billion. Value motion stays compressed inside a slender intraday vary of $2,969 to $3,065, reflecting indecision reasonably than inertia.

Ether chart outlook

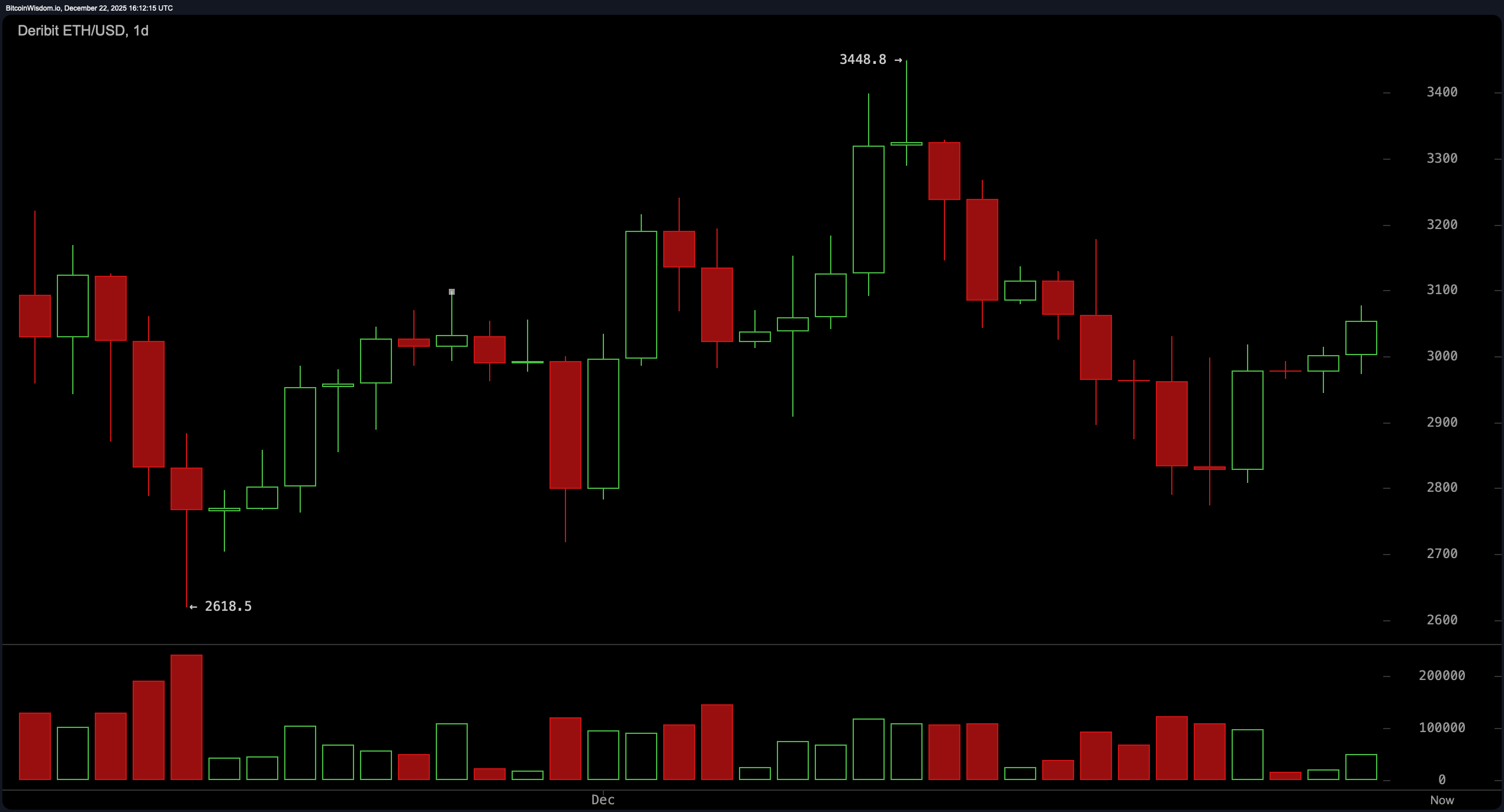

On the day by day chart, Ethereum's broader construction is finest described as a strategic battle between bulls and bears. After being rejected close to $3,450, the asset reversed with conviction however didn’t capitulate, as a substitute showing to stay strong throughout the vary outlined by the $2,620 low and $3,450 excessive.

Quantity elevated on account of the pullback, suggesting that the transfer was not attributable to purchaser exhaustion, however reasonably lively circulation. Costs are nonetheless holding a sequence of lows, lending cautious optimism to the present setup. Resistance is stubbornly situated between $3,300 and $3,450, whereas assist is seen at $2,900, adopted by a key band between $2,750 and $2,620.

ETH/USD 1-day chart by way of Deribit for December 22, 2025.

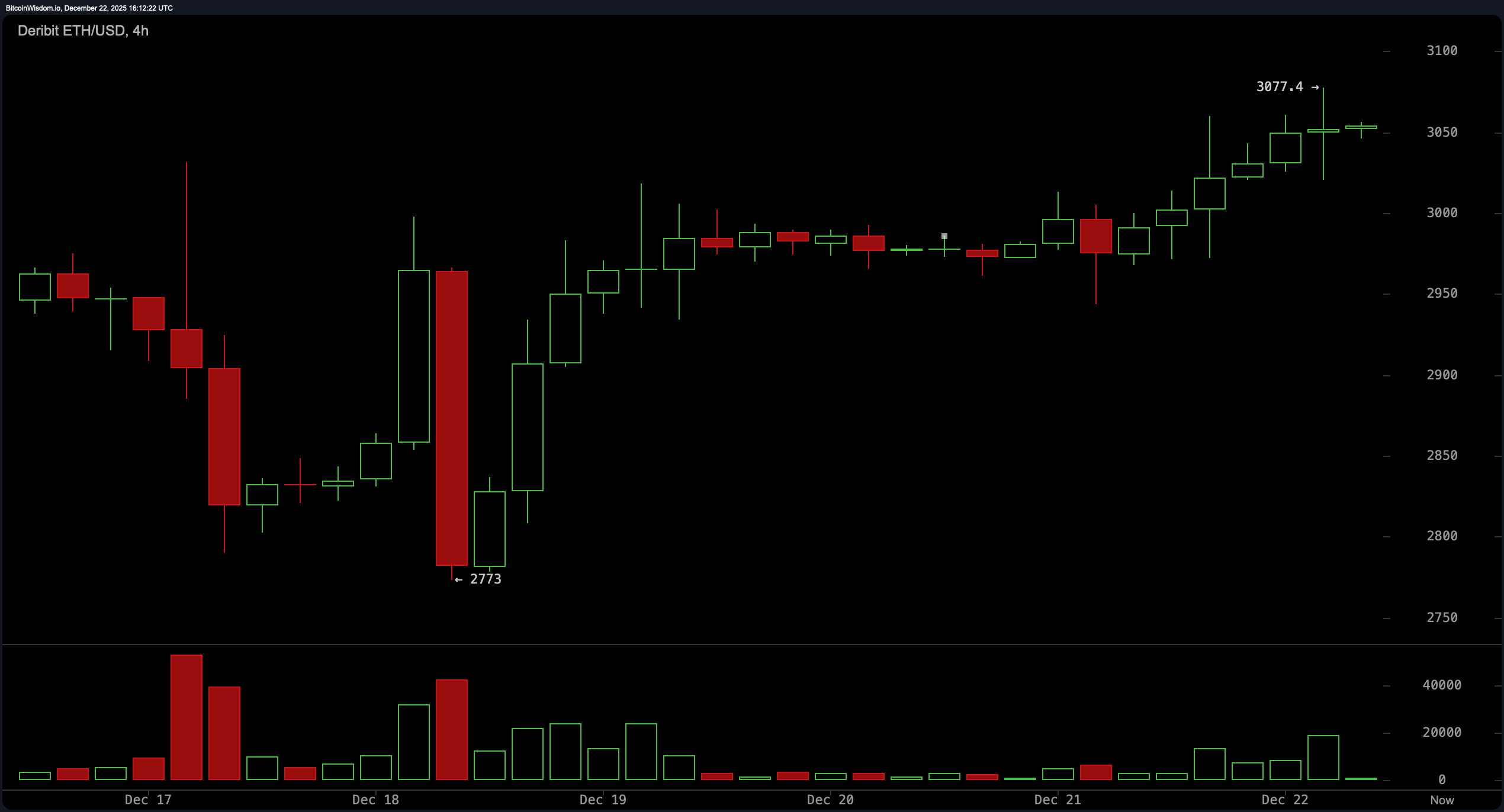

Shifting to the 4-hour chart, Ethereum has managed to regain management above the $3,000 degree, creating an enormous psychological and technical rally. This chart reveals a sequence of constructive lows from the rebound from $2,773, indicating a managed rally reasonably than a euphoric spike. That stated, momentum is clearly slowing down round $3,075-$3,100, an space that acts as a short-term provide zone. A value transfer above $3,000 nonetheless helps continued upside, however market love is fickle. A sustained decline under $2,980 would elevate much more eyebrows amongst bulls this week and immediate a structural reassessment.

ETH/USD 4-hour chart by way of Deribit on December 22, 2025.

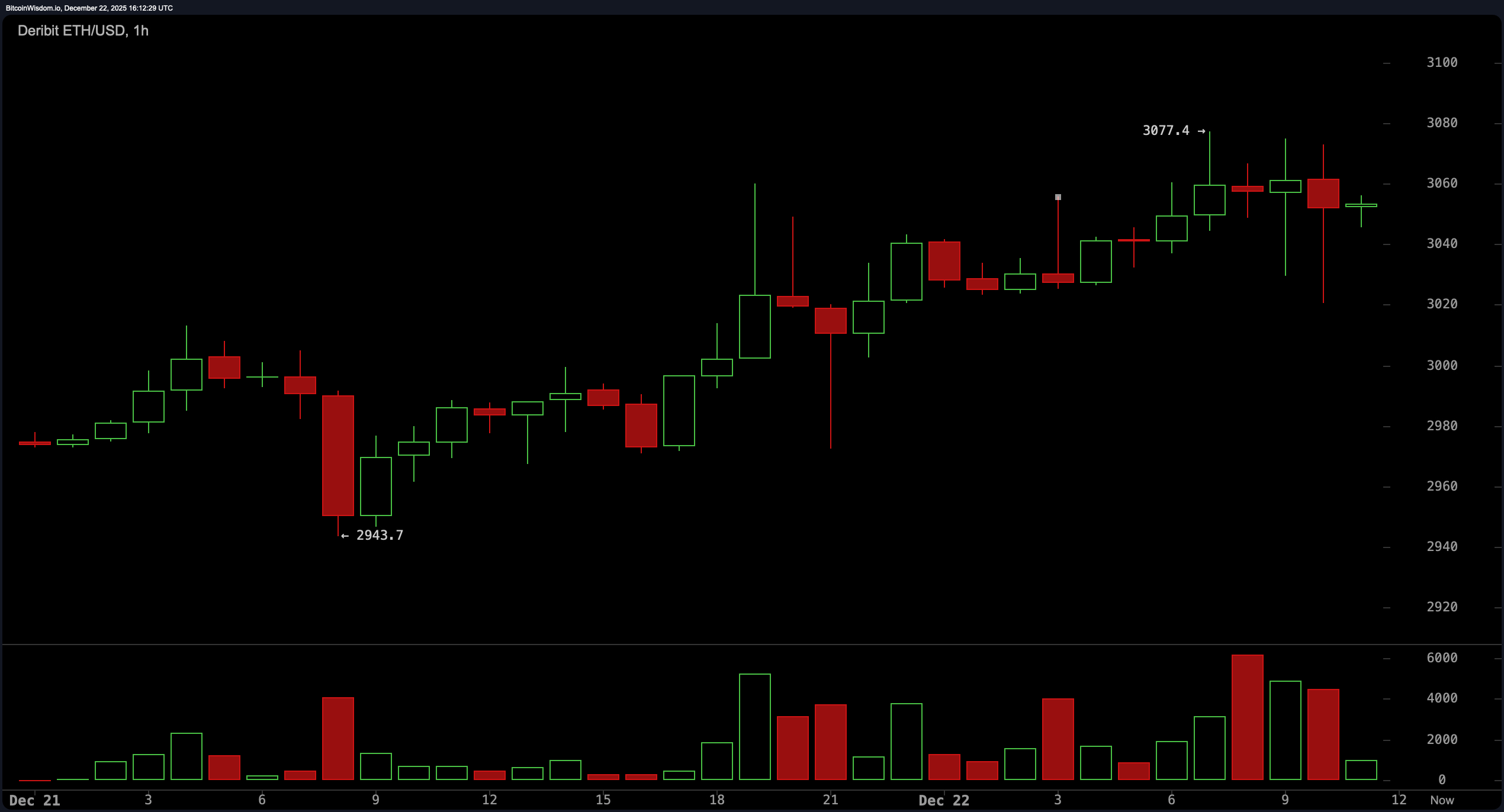

The hourly chart tells the story of a consolidation slightly below $3,077, with Ethereum candlesticks growing an upward core, a traditional calling card of vendor aggressiveness. The surge in quantity throughout the pullback means that bullish consumers are aggressive, however they’re extra targeted on defending territory than exploring new territory. The market seems to be gaining floor, however has but to make a decisive push that conjures up confidence to interrupt out. Till Ethereum definitively clears the $3,100 threshold, vary motion will proceed to dominate, requiring strategic persistence reasonably than impulsive positioning.

ETH/USD 1-hour chart by way of Deribit on December 22, 2025.

By way of indicators, the ETH oscillator stays inconclusive. The Relative Power Index (RSI) is hovering at 49.6, the Stochastic Oscillator is clocking in at 34.9, and the Commodity Channel Index (CCI) is -23.2, all firmly in impartial territory. The Common Directionality Index (ADX) is 28.9, confirming the absence of a dominant pattern, whereas the Superior Oscillator is hovering at -50.6, indicating extra turmoil than momentum. The momentum indicator reveals a slight slope, studying -34.2, and the shifting common convergence divergence (MACD) degree is -47.2, each suggesting a possible optimistic bias regardless of the neutrality overhead.

Trying on the shifting averages (MA), Ethereum's MA reveals a blended bag with a refined bullish undertone within the quick time period and outright resistance in the long run. The ten- and 20-period exponential and easy shifting averages (EMA and SMA) are constructive, with a 10-period EMA of $3,000.6 and a 10-period SMA of $2,976.8, each indicating upside potential. Nevertheless, the 30-period EMA and 50-200 interval shifting common on either side of the EMA and SMA are constantly above the present value, indicating structural headwinds. These larger interval shifting averages counsel that it’ll take greater than wishful pondering for Ethereum to interrupt via resistance and regain the highs seen earlier this quarter.

Bullish verdict:

Ethereum’s resilience above $3,000 and the construction of rising lows throughout the timeframe means that the bulls will not be retreating, however are merely circling and ready for the precise second to strike. If the quantity is confirmed and momentum can decisively break above $3,100, this consolidation may very well be a prelude to additional highs, doubtlessly testing the $3,300 zone by the tip of the 12 months. Till then, disciplined optimism is the secret.

Bear verdict:

Ethereum could also be hovering simply above $3,000, however a mix of slowing momentum indicators and cussed resistance overhead paint an image of an uptrend shedding momentum. If the asset can’t convincingly break via and maintain $3,100, the trail of least resistance might be to the draw back. For now, Tape favors fade-the-rip techniques over power pursuits.

Steadily requested questions ❓

- What’s the present value of Ethereum?Ethereum is buying and selling at $3,049 as of December 22, 2025.

- Is Ethereum exhibiting a bullish or bearish sign?Ethereum is firming above $3,000 with blended short-term technical alerts.

- What are Ethereum's main assist and resistance ranges?Assist is close to $2,900 and resistance is between $3,300 and $3,450.

- What do shifting averages point out about Ethereum's pattern?Brief-term shifting averages counsel power, whereas long-term averages counsel resistance.