The Fed minimize rates of interest by 25 foundation factors to its goal vary of three.50% to three.75%, a minimize that markets had overwhelmingly anticipated, however confirmed no clear momentum towards additional easing.

At present's determination is mismatchadditional intensifying the uncertainty that has dominated investor sentiment over the previous week.

Steering is a market focus, not a minimize.

The FOMC additionally acknowledged Slower employment developmentthe unemployment fee was on an upward development till the third quarter, and inflation was marked excessive From early 2025 onwards.

Whereas policymakers have famous rising draw back dangers to employment, they’ve stopped in need of committing to a sustained cycle of cuts. As an alternative, right now's assertion firmly units future coverage. knowledge dependent observe.

The committee reiterated that it will consider “.Incoming knowledge, evolving prospects, and the stability of dangers” earlier than deciding on additional adjustments.

Cryptocurrency merchants will doubtless interpret this stance as impartial or considerably cautious. Except there’s an specific ahead dedication, January and March at the moment are key pivot factors for fee path forecasts.

The minimize everybody expects. However perhaps you shouldn't??

The market sees an 87% likelihood of a 25bp fee minimize on Wednesday (market prediction: 97%).

Nevertheless, Credit score Websites says the choice is “hotly debated.”

The typical policymaker's insurance policies are extra hawkish than the median, and the chance of shock is actual. 🧵👇

— Schaeffers Funding Analysis (@schaeffers) December 9, 2025

That is in line with pre-meeting discussions the place analysts warned: hawkish minimize There was a risk of easing right now, however there was no dovish roadmap.

The omission of forward-looking language suggests the Fed is looking for flexibility, particularly at a time when inflation is claimed to be “reasonably rising” and uncertainty round development stays excessive.

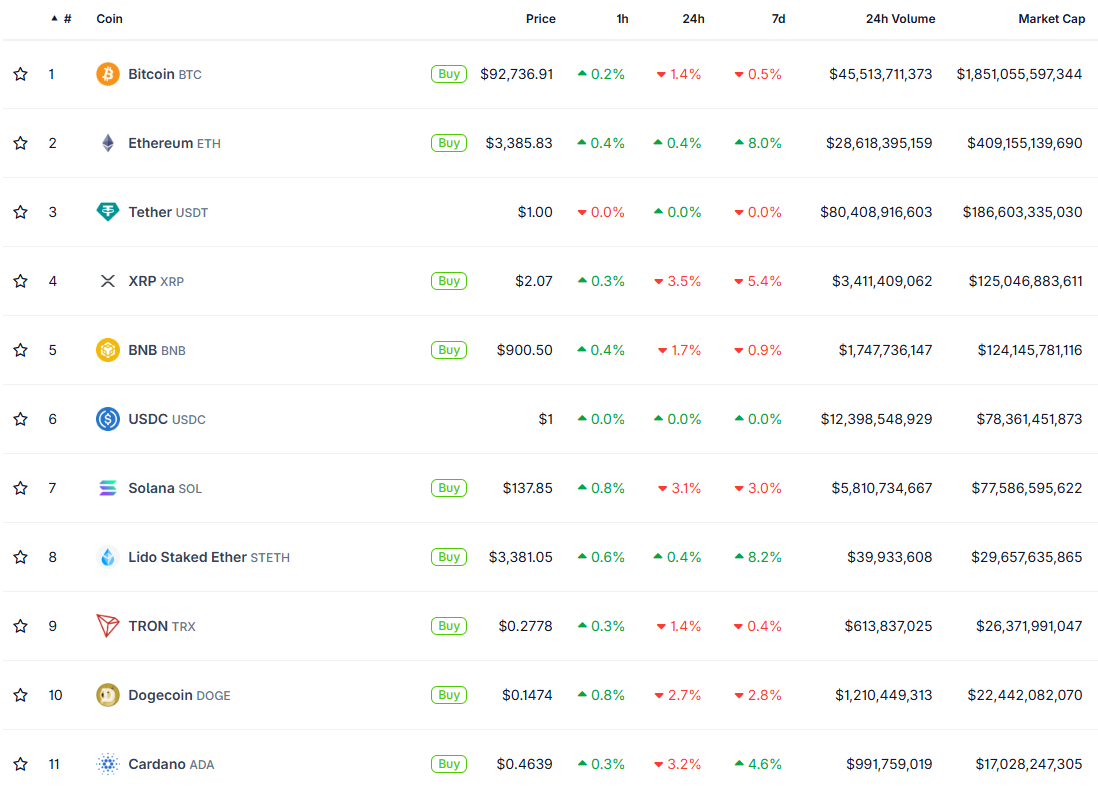

The digital foreign money market stays unresponsive to the Fed's rate of interest cuts. Supply: CoinGecko

Uncommon break up vote highlights inside tensions

The breakdown of the vote highlights the committee's divisions. Stephen Millan wished a deep 50 foundation level (bp) minimize, however Austan Goolsby and Jeffrey Schmidt didn't need to change coverage.

This three-party division displays the uncertainty of the long run. The labor pressure is changing into more and more delicate, inflation is now not trending steadily downward, and views seem more and more divided on how a lot reduction the financial system wants.

This three-way break up is noteworthy. This factors to disagreements over how a lot slack there’s within the financial system and whether or not easing ought to proceed extra shortly or cease altogether. The market will interpret this as affirmation that: This cycle is now not utterly dovish.

Steadiness sheet notes value flagging

The Fed additionally purchase short-term authorities bonds The necessity to preserve reserve adequacy is refined however crucial to liquidity circumstances. This might act as a stabilizer if volatility will increase heading into 2026.

At present's transfer landed precisely because the market anticipated, however and not using a roadmap. The tone is cautious and cautious, and > Fed cuts rates of interest by 25bps, however the true shock is what comes subsequent The put up appeared first on BeInCrypto.