Bitcoin (BTC) continues to commerce inside its current consolidation, hovering round $90,000 on the time of writing on Friday, as buyers digest the Federal Reserve's cautious December rate of interest minimize and its affect on danger belongings.

BTC worth motion approaches an vital downtrend line that would decide its subsequent path. In the meantime, institutional inflows into Spot Bitcoin ETFs confirmed modest inflows, with Technique Inc. including extra BTC to its treasury reserves.

Fed Coverage Path Will Trigger Bitcoin Consolidation

Bitcoin worth began the week sturdy, extending its weekend restoration within the first half of the week, topping $92,600 on Tuesday.

Nevertheless, momentum weakened on Wednesday, with Bitcoin closing at $92,015 after the Federal Open Market Committee (FOMC) assembly.

In a extensively anticipated transfer, the Fed minimize rates of interest by 25 foundation factors. Nevertheless, there was a touch that the FOMC assembly could possibly be adjourned in January.

Policymakers anticipated a discount within the general outlook for 2026 by only a quarter of a proportion level, including to the cautious tone. This was the identical outlook as in September, however market expectations of two rate of interest cuts have subsided, contributing to short-term strain on danger belongings.

The Fed's cautious stance, coupled with Oracle's disappointing efficiency, led to a short lived risk-off transfer.

All these elements weighed on riskier belongings, inflicting the biggest cryptocurrency by market cap to drop to a low of $89,260, earlier than rebounding to shut above $92,500 on Thursday.

Within the absence of any main US financial information popping out, the crypto market will look to FOMC members' speeches and broader danger sentiment for path.

On the finish of the week.

BTC is prone to be steady within the quick time period Until a big catalyst emerges.

Russia and Ukraine uncertainties restrict risk-on momentum

On the geopolitical entrance, US President Donald Trump is “extraordinarily pissed off” with Russia and Ukraine and doesn’t need additional dialogue, his spokesman mentioned on Thursday.

Earlier, Ukrainian President Volodymyr Zelenskiy mentioned the USA was pressuring his nation to cede land to Russia as a part of a deal to finish almost 4 years of warfare.

These extended geopolitical tensions and stalled peace talks proceed to weigh on world danger sentiment, limiting risk-on urge for food and contributing to Bitcoin's consolidation to this point this week.

There are indicators of gradual enchancment in demand from institutional buyers.

Institutional demand for Bitcoin is exhibiting indicators of modest enchancment.

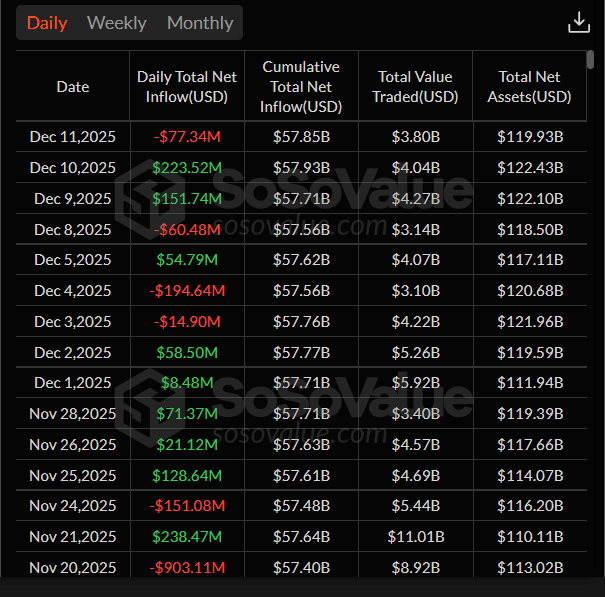

The U.S.-listed Spot Bitcoin ETF recorded complete inflows of $237.44 million by means of Thursday, following modest outflows of $87.77 million per week in the past, in accordance with SoSoValue information, indicating a slight enchancment in institutional investor curiosity.

Nevertheless, these weekly inflows are nonetheless small in comparison with the inflows noticed in mid-September. For BTC to proceed its restoration, ETF inflows have to strengthen.

Whole Bitcoin Spot ETF Web Inflows Chart. Supply: SoSoValue

On the company facet, Technique Inc. (MSTR) introduced on Monday that it purchased 10,624 Bitcoins between December 1st and seventh for $962.7 million, at a median worth of $90,615.

The corporate at present holds 660,624 BTC value $49.35 billion. This technique nonetheless has ample capability to lift extra funds, doubtlessly permitting for even bigger Bitcoin accumulations.

On-chain information reveals promoting strain easing

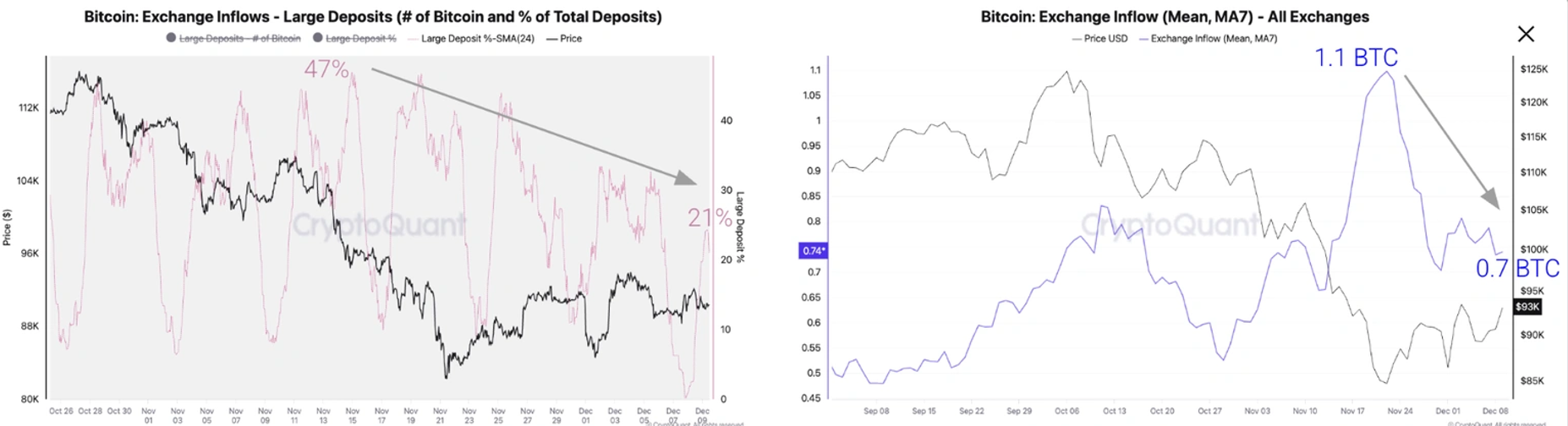

CryptoQuant’s weekly report on Wednesday highlights that promoting strain on Bitcoin is beginning to ease.

The report notes that international change deposits eased as main firms decreased remittances to exchanges.

The graph beneath reveals that the share of complete deposits from main gamers has fallen from a 24-hour common excessive of 47% in mid-November to 21% as of Wednesday.

On the identical time, the common deposit quantity decreased by 36% from 1.1 BTC on November twenty second to 0.7 BTC.

Bitcoin change move. Supply: CryptoQuant

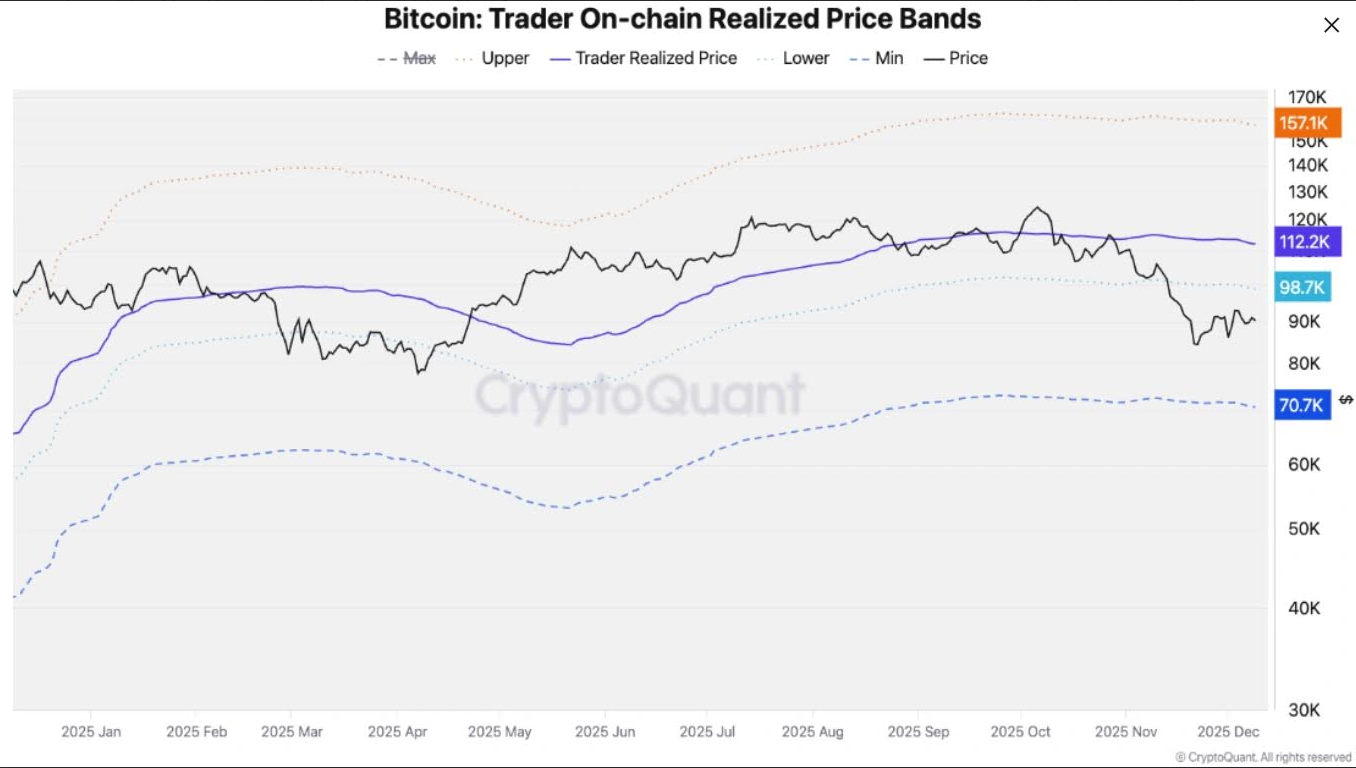

CryptoQuant concludes that if promoting strain stays low, a bailout rebound may push Bitcoin again to $99,000. This degree is the decrease certain of the dealer's on-chain realized worth band and represents worth resistance in a bear market.

Above this degree, the important thing worth resistances are $102,000 (1-year transferring common) and $112,000 (merchants’ on-chain realized worth).

Bitcoin dealer’s realized worth vary

The Copper Analysis report additionally prompt optimism about Bitcoin. This report means that BTC's four-year cycle will not be over but. Changed.

For the reason that launch of spot ETFs, Bitcoin has demonstrated a repeatable cost-based return cycle, as proven within the graph beneath.

Bitcoin USD worth and ETF value base

“For the reason that launch of the spot ETF, Bitcoin has been on a repeatable mini-cycle of returning to its value base after which rebounding by about 70%,” Fadi Abu-Alfa, head of analysis at Copper, informed FXStreet.

BTC is at present buying and selling round $84,000 in value phrases, and this sample suggests it may cross $140,000 within the subsequent 180 days.

If the associated fee foundation will increase by 10-15%, much like earlier cycles, the ensuing premium seen throughout historic peaks would yield a goal vary of $138,000 to $148,000.

Will the Bitcoin Santa Rally start?

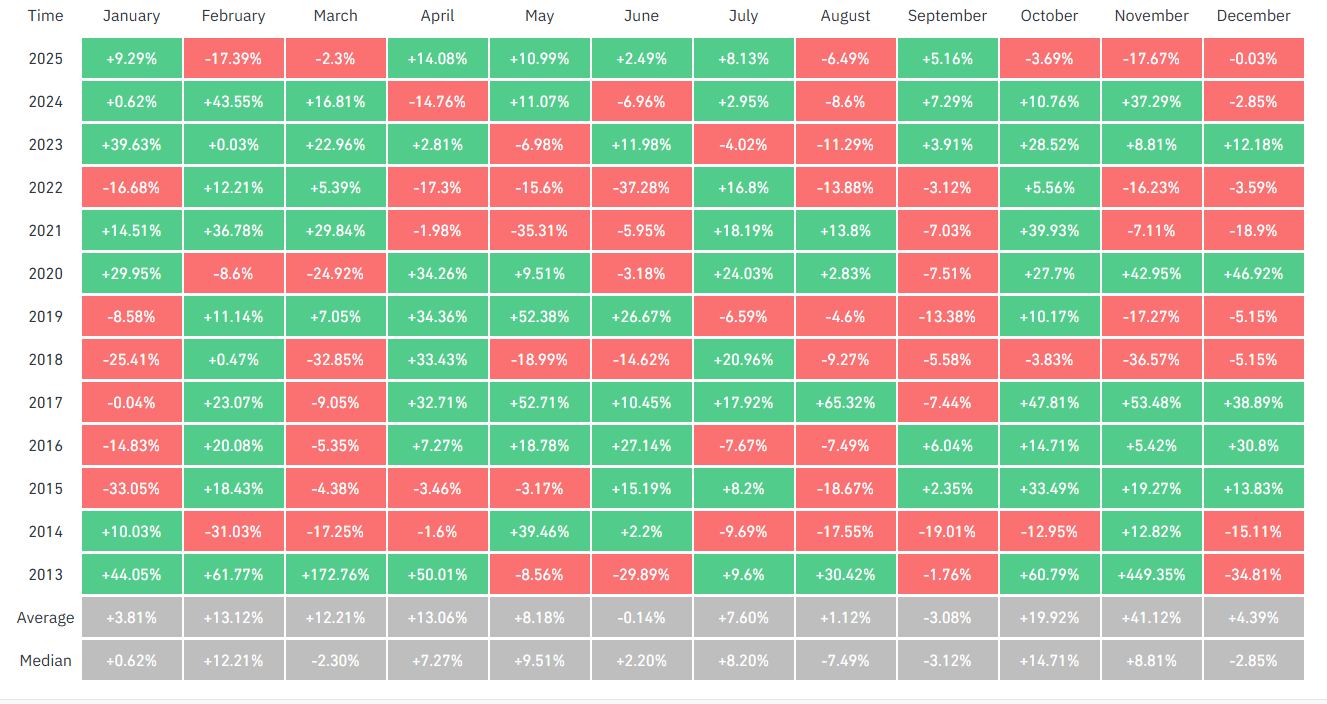

Bitcoin fell 17.67% in November, disappointing merchants who have been hoping for a rally based mostly on the month's traditionally sturdy returns (see CoinGlass information beneath).

December has traditionally been a constructive month for King Cryptocurrency, with a median return of 4.55%.

Bitcoin month-to-month returns. Supply: Coinglass

Taking a look at quarterly information, the fourth quarter (This fall) was the most effective quarter general for BTC with a median return of 77.38%.

Nonetheless, its efficiency within the final three months of 2025 has been by far the worst to this point, with a lack of 19% to this point.

Has BTC hit the underside?

Bitcoin’s weekly chart reveals worth help close to the 100-week exponential transferring common (EMA) at $85,809, marking the second consecutive inexperienced candlestick following a four-week correction that started in late October.

As of this week, BTC is up barely and buying and selling above $92,400.

If BTC continues its restoration, the rally may prolong in the direction of the 50-week EMA of $99,182.

The Relative Power Index (RSI) on the weekly chart is studying 40, indicating an upward development and weakening bearish momentum. For the restoration rally to maintain, the RSI must rise above the impartial degree of fifty.

BTC/USDT weekly chart

On the day by day chart, Bitcoin worth was rejected on Wednesday on the 61.8% Fibonacci retracement degree of $94,253 (from the April low of $74,508 to the all-time excessive of $126,199 set in October).

Nevertheless, on Thursday, BTC rebounded after retesting the $90,000 psychological degree.

If BTC breaks above the downtrend line (drawn by connecting a number of highs since early October) and closes above $94,253.

As soon as the resistance degree is reached, the rally may prolong in the direction of the psychological degree of $100,000.

The Relative Power Index (RSI) on the day by day chart has stabilized across the impartial 50 degree, suggesting an absence of near-term momentum on both facet.

To take care of bullish momentum, the RSI should rise above the impartial degree.

Alternatively, the Transferring Common Convergence Divergence (MACD) confirmed a bullish crossover on the finish of November and it stays intact, confirming the bullish concept.

BTC/USDT day by day chart

If BTC resumes downward correction, First main help is $85,569which coincides with the 78.6% Fibonacci retracement degree.

The publish “Bitcoin weekly forecast: Fed delivers outcomes however fails to impress BTC merchants” was first printed on BeInCrypto.