Simply over six months after Shopify partnered with Coinbase, funds $USDC The mixed actions at Base signify solely a small portion of the e-commerce big's actions.

Introduced final June and involving Shopify, Coinbase, and Stripe, this integration permits Shopify retailers to: $USDC Funds are settled at Base. Funds are settled via the Commerce Funds Protocol, an open supply protocol developed by Shopify and Coinbase and launched on the time of their integration.

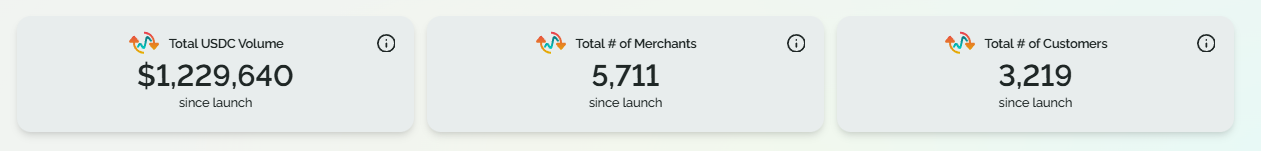

However to date, adoption charges look like comparatively low. In keeping with information from blockchain analytics platform Growthhiepie, since June, blockchain analytics platforms have grown by simply $1.2 million. $USDC Funds at Base are processed via the Commerce Funds Protocol from 5,700 retailers and roughly 3,200 clients.

Growthepie additionally famous that these numbers replicate exercise throughout “a number of firms” that use the Commerce Funds Protocol, not simply Shopify.

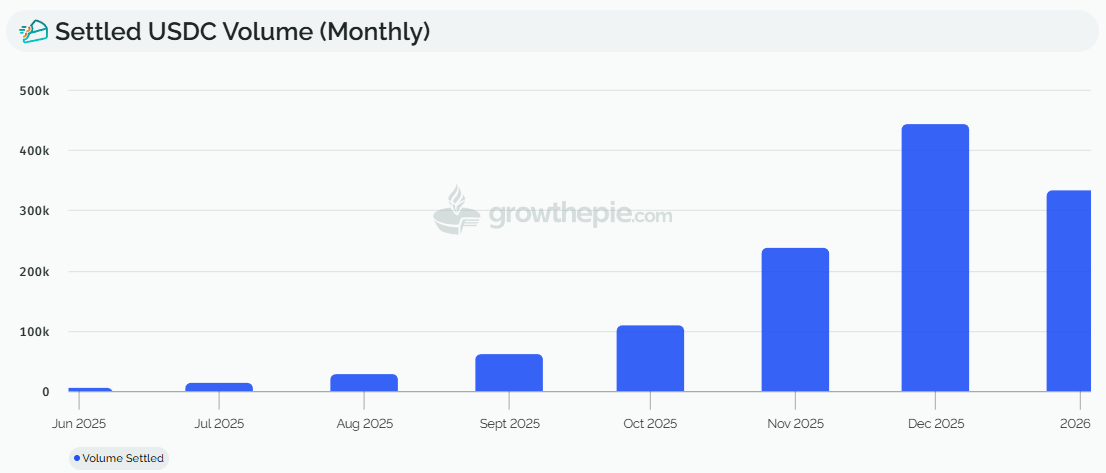

$USDC Commerce Funds Protocol buying and selling quantity since June 2025. Supply: Grooveepie

A Coinbase spokesperson confirmed to The Defiant that the Growthpie information “represents a bit of the puzzle,” including that the Shopify rollout is underway and early indicators are stable.

“Commerce volumes are on the rise and we’re seeing retailers more and more leaning in the direction of cryptocurrencies, particularly in terms of cross-border funds,” a Coinbase spokesperson stated, including that a number of different operators are additionally collaborating within the plan.

When the partnership was first introduced in June, Shopify described the transfer as an effort to “present easy and safe stablecoin funds to retailers world wide.”

however, $USDC That quantity is only a small a part of Shopify's intensive footprint. In 2024, the e-commerce big reported greater than 5.5 million retailers, 875 million clients, and annual gross merchandise quantity (GMV) of roughly $300 billion.

progress trajectory

In an interview with The Defiant, Lorenz Lehmann, head of analysis at GrowthEpi, stated {that a} small absolute quantity shouldn’t be taken as a failure.

“Though absolutely the quantity ($1.2 million) is small in comparison with Shopify's international GMV, in our opinion, progress trajectory is what issues in early-stage applied sciences,” Lehman advised The Defiant.

month-to-month quantity $USDC Funds are made by way of Commerce Funds Protocol. Supply: GrowthPy

Of the $1.2 million that has been settled since Shopify went reside, he stated, $USDCwhich has generated roughly $750,000 up to now two months alone, describes its progress as “the basic 'slow-then-fast' compound progress curve frequent in cryptocurrencies.” Mr. Lehman elaborated as follows.

“We see this as typical of the pilot section, the place we see excessive ‘novelty’ utilization (folks attempting it as soon as to see if it really works) within the early days of a brand new cost rail. The truth that volumes have accelerated considerably over the previous 60 days means that we’re transferring past the “curiosity” stage and into extra constant utility.

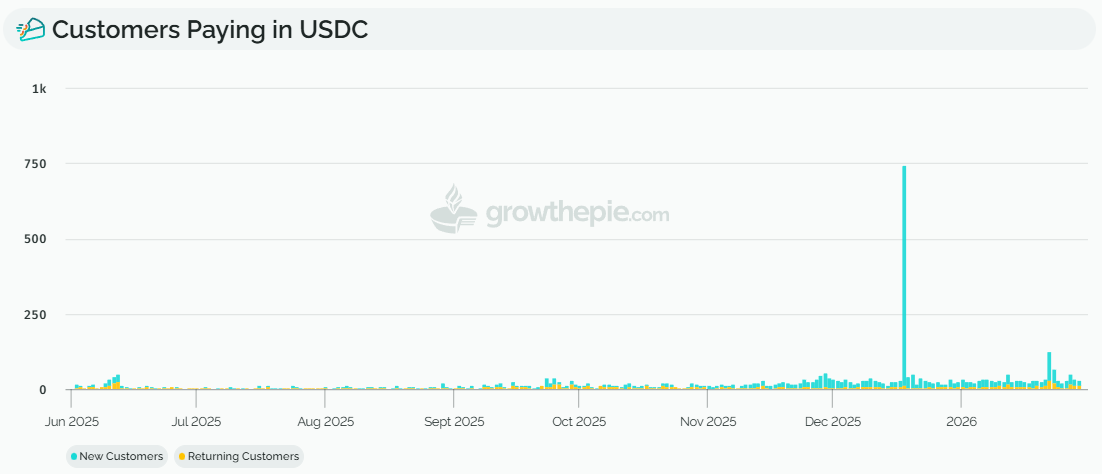

Fee strategies for brand new and repeat clients $USDC Based mostly on Commerce Fee Protocol. Supply: GrowthPy

Nonetheless, the Growthpie dashboard exhibits that almost all wallets are solely transacted as soon as, with restricted repeat utilization. As Lehman defined, a “repeat buyer” is outlined as a pockets that makes a cost on one other day after the primary transaction, and the pockets handle represents a decrease sure for precise customers.

As Lehman famous, the danger of “ghost cities” is “actual with any new expertise,” however as progress accelerates, each vendor curiosity and buyer behavior formation are “on the right track.”

The Defiant reached out to Shopify for touch upon this initiative, however didn’t obtain a response as of press time.

In keeping with a current report from S&P World Scores, the full provide of USD-pegged stablecoins is simply over $300 billion, however solely 5% are at present used for personal sector funds.