International Market Investor Julien Bittel, head of the macro analysis officer, supplied fascinating insights to the Bitcoin market after the primary worth loss final week. With daring actions, monetary analysts have sponsored premiere cryptocurrencies to recoil the current costs to attach a wider macroeconomic situation.

Bitcoin might have proven the top of the sale of lower than $ 80,000.

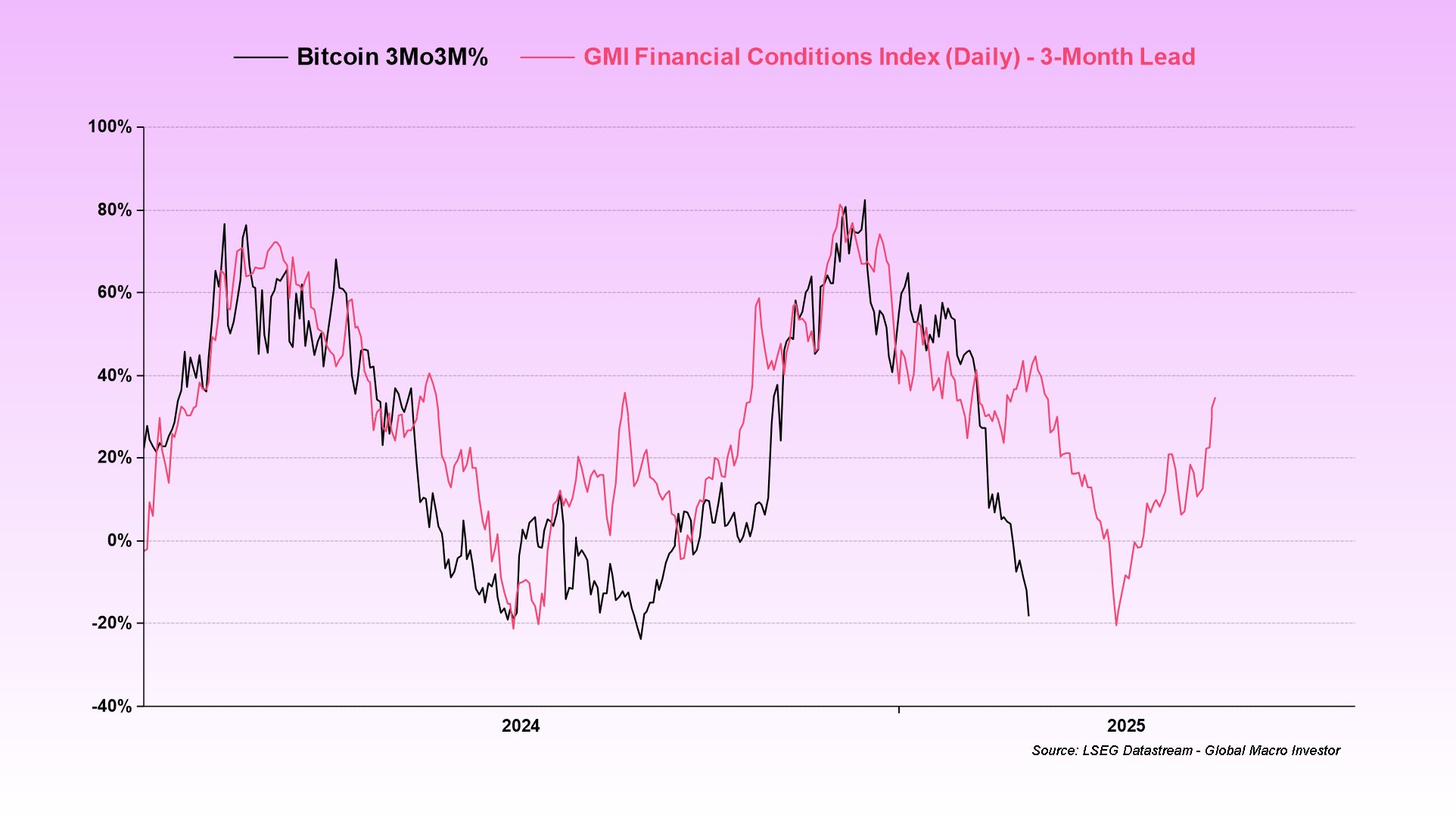

Final week, the BTC market registered a big weak worth habits.The value fell from $ 96,000 to lower than $ 80,000. On February 28, within the X Put up, BitTel thought that this worth fell on account of strengthening its monetary place within the fourth quarter of 2024, making it harder to take care of speculative belongings comparable to Bitcoin. Upward momentum.

If market liquidity decreases, financial shock is sluggish, inflicting issues about potential recession and in the end inflicting market uncertainty and harmful habits. However Bittel creates an instance for Bitcoin rebounds, anticipating that the feelings of those traders shall be reversed in March.

Analysts identified that the market situations prior to now two weeks have been quickly decreased as they identified on account of weak {dollars}, lower in bond yields and falling oil costs. This macroeconomic improvement means that liquidity returns to the monetary system and signifies potential rebound in market sentiment.

Specifically, as BITCON has just lately surged to lower than $ 80,000, Julien Bittel has utterly mirrored the impact of strengthening liquidity situations. And potential worth drops are nonetheless potential, however the emotional indicators have little area for a higher drop. For instance, Bitcoin's relative theft index (RSI) has touched 23, representing probably the most extreme stage since August 2023. These market situations return to the idea of the approaching worth rebound.

BTC Market: reverse alternative?

Within the final remarks of fascinating evaluation, Bittel pushed for a grasping mind-set in a variety of market fears, to not be too weak for traders.

Specifically, Santiment, a blockchain evaluation firm, identified that the “market crowd” predicts that the service provider predicts that Bitcoin is decrease, worth rises, and vice versa tends to be unsuitable primarily based on historic knowledge. Subsequently, the Bitcoin market can present a singular alternative of accumulation regardless of the overall expectations of steady costs.

On the time of writing, Bitcoin is buying and selling at $ 84,750 on a some worth improve on Friday at a optimistic pace. Whereas the market cap is $ 1.68 trillion, premiere cryptocurrency stays the biggest digital asset with an amazing market dominance of 60%.

The primary picture of the TradingView's The Impartial Chart