Farmway Applied sciences, a US-based fintech firm specializing in tokenizing agricultural produce, has a $100 million contract with the Republic of Georgia and has the nation's almond orchard on its blockchain.

Farmway invests funds in agricultural infrastructure, processing, logistics and irrigation programs throughout the nation. The deal spans 500 hectares (1,236 acres) and contains services that course of almond milk powder, oils and extracts.

“Almonds signify one in every of Georgia's quickest rising agricultural sectors. It rose from 2,500 tonnes in 2023 to a forecast output of 14,000 tonnes by 2027, putting the nation among the many high 20 producers on this planet.”

The nation reportedly had 6,000 hectares devoted to almond cultivation in August 2023. High almond producers within the nation included Udavno, nut firms and nut cultivators. Regionally grown almonds fell 49% in 2024, however are more and more being changed by imports that proceed to develop in exports, based on the Georgia Instances.

The deal was primarily based on a earlier $20 million funding in Georgia's almond business, based on the farm, which served as a proof of idea.

The corporate tokenizes agricultural infrastructure, together with orchards, irrigation programs and processing services. Every token represents a fractional share of an asset, and the blockchain information all exercise.

https://www.youtube.com/watch?v=owvy6lp9w2a

“Conventional local weather finance is commonly gradual and bottlenecked by multilateral establishments and donor cycles,” Misra stated. “Tokenization transforms this dynamic change by making a direct, cost-effective, investor-led pathway in agriculture and turning huge areas of land into investable, auditable local weather belongings.”

Based on MISRA, utility tokens representing belongings are primarily based on the ERC-20 commonplace, which governs the creation of dependable tokens on Ethereum networks. Actual-World Property (RWA) Digital Securities are made up of the ERC-1155 commonplace. This permits for the creation and switch of dependencies and unequipped tokens in a single transaction.

Based in 2020, Farmway is claimed to be holding lively RWA tokenization initiatives in seven international locations, masking merchandise starting from espresso and cinnamon to lavender and ashwagandha. The corporate is changing its illiquid conventional asset courses into programmable, globally investable models.

RWA Commodity Token Market

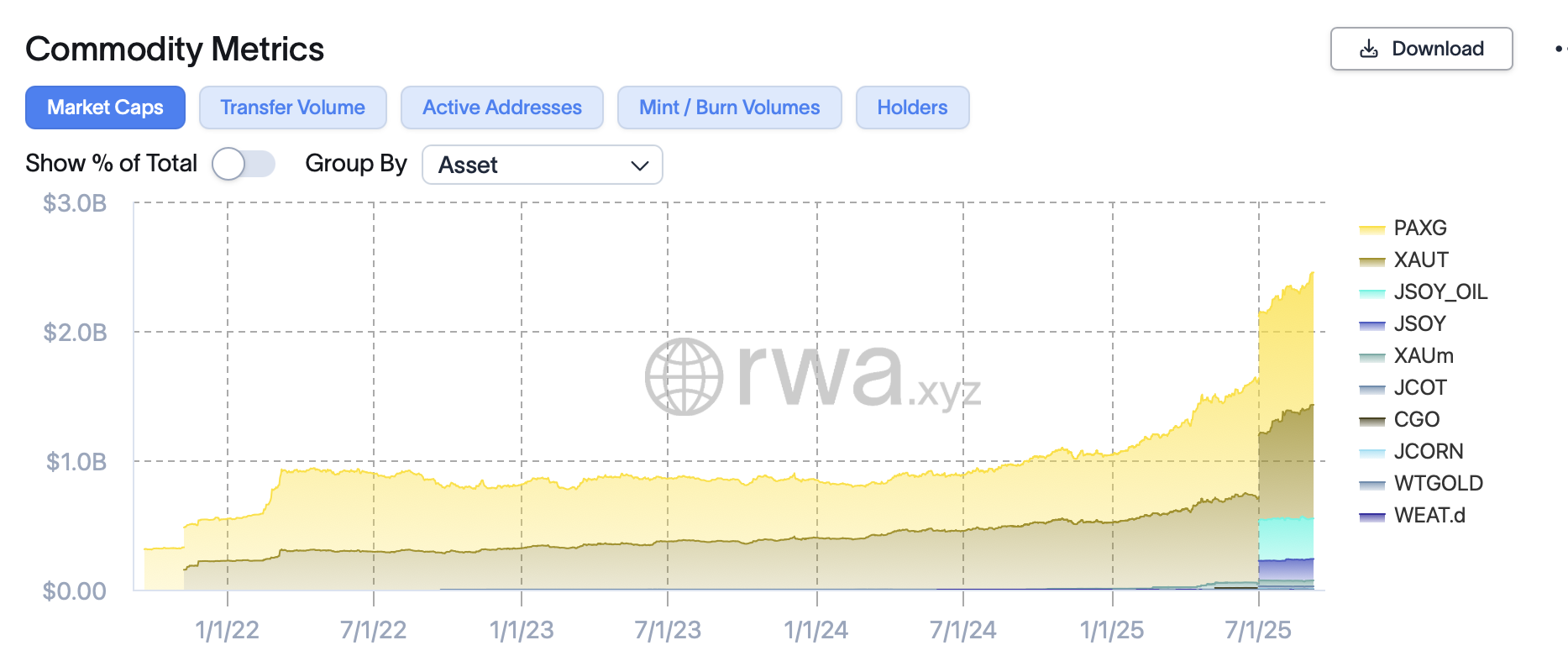

Based on RWA tokenization platform RWA.xyz, tokenization of merchandise represents a small, rising portion of the RWA tokenization market.

The tokenized commodity market is presently valued at $2.5 billion, accounting for round 9% of the $27.8 billion RWA tokenization sector. It has expanded by 5.6% over the previous 30 days.

Based on Onchain information, the market is led by Paxos Gold (Paxg) and Tether Gold (Xaut).

A tokenized product market. sauce: rwa.xyz

Justedeen, a farm competitor primarily based in Buenos Aires, has created tokenized funds, together with soybean oil, soy bushels, cotton and corn. The 4 funds accounted for greater than $500 million in market capitalization on the time of writing.

RWA tokenization is the method of buying real-world belongings reminiscent of items, shares, and credit, expressed as blockchain tokens.

Advocates of RWA tokenization say the know-how will improve accessibility and liquidity to conventional asset courses. As of June, the market had grown 260% in 2025, affecting a variety of sectors like Defi.