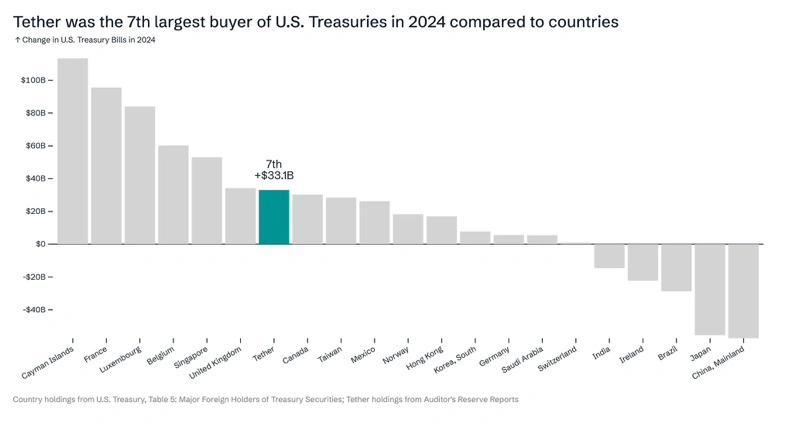

Tether CEO Paolo Ardoino shared a publish from X yesterday saying that Tether was the US Treasury's seventh largest purchaser in 2024. Final yr, the corporate amassed US Treasury securities price $33.1 billion, surpassing nations resembling Canada, Mexico and Germany.

Tether, the issuer of USDT, the world's largest stubcoin since 2023, has strategically invested in US Treasury securities to make sure stability and liquidity. The technique additionally advantages the US by rising demand for presidency debt, thereby supporting fiscal operations.

Tether is the seventh largest proprietor of the US Treasury Division. Supply: Tether

Different personal corporations are actively investing in US Treasury securities as a part of their monetary methods, together with personal pension funds, insurance coverage corporations, mutual funds, and business banks. Information from late 2024 reveals that US personal pension funds maintain about $1.1T in US Treasury securities, accounting for about 3.7% of the debt held by the general public.

Equally, US insurers maintain about $630 million, accounting for two.3% of publicly held liabilities.

Tether's technique to put money into the US Treasury has strengthened profitability and profitability, because it reported $13 billion in web revenue in 2024, pushed primarily by income from these Treasury investments.

Vivek locations emphasis on US debt points

Vivek Ramaswamy, a former Dodgehead, a widely known entrepreneur, and political determine advocate for the mixing of Bitcoin into company monetary methods. Ramaswamy expects after the “Early of Easy Cash,” company and state establishments will more and more undertake Bitcoin as an ordinary for inside capital funding and look at it as a way of maximizing long-term shareholder worth.

Our curiosity funds on authorities bonds already exceed the US army price range, and rising rates of interest are placing a pressure on on a regular basis Individuals who need to purchase a house and reside their lives. That is unsustainable. The right reply is to scale back reckless authorities spending. However… https://t.co/k0xm6rjnyn

– Vivek Ramaswamy (@vivekgramaswamy) March 20, 2025

In response to Aldoino's publish in regards to the acquisition of Tether's US Treasury securities, Ramaswamy stated the proper reply to scale back rate of interest will increase is to chop reckless authorities spending.

“Overhead funds on our nationwide debt are already past the US army price range, and rising rates of interest are placing a pressure on on a regular basis Individuals who need to purchase a house and reside their lives. That is unsustainable. The correct reply is to scale back reckless authorities spending.

Ardoino additional defined the influence of his technique thus far. “Tether brings US {dollars} to greater than 400 million folks, primarily rising markets and growing nations. Tether has constructed the most important distribution community, each the US greenback, bodily and digitally, in human historical past,” he stated.

Tether is presently one of many US Treasury's largest personal homeowners.

In response to information compilation from Tether's Reserve Studies and the US Treasury Division's Tether, the Crypto Firm, behind the most important Stablecoin USDT, bought $33.1 billion price of US Treasury securities in 2024.

Tether was the US Treasury's seventh largest purchaser in 2024.

-Paolo Ardoino🤖 (@paoloardoino) March 20, 2025

Compiled information posted by the corporate's CEO Paolo Ardoino reveals that the corporate was ranked within the rankings because the seventh largest web purchaser of US Treasury securities in 2024, forward of nations resembling Canada, Mexico and Germany. In the meantime, Japan and China are web sellers, lowering US Treasury holdings. Brazil, Eire and India additionally offered their holdings.

By the top of 2024, Tether's US Treasury holdings had reached a file $11.3 billion, making it one of many largest personal holders of US authorities debt.

Treasury Secretary Scott Bessent stated earlier this month that Crypto and Stablecoins are key to sustaining international domination of the US greenback. President Trump mirrored this sentiment by way of a pre-recorded message on the Digital Belongings Summit.

Tether has additionally been actively working to enhance transparency by partaking with Massive 4 accounting companies and conducting a full audit of their reserves.