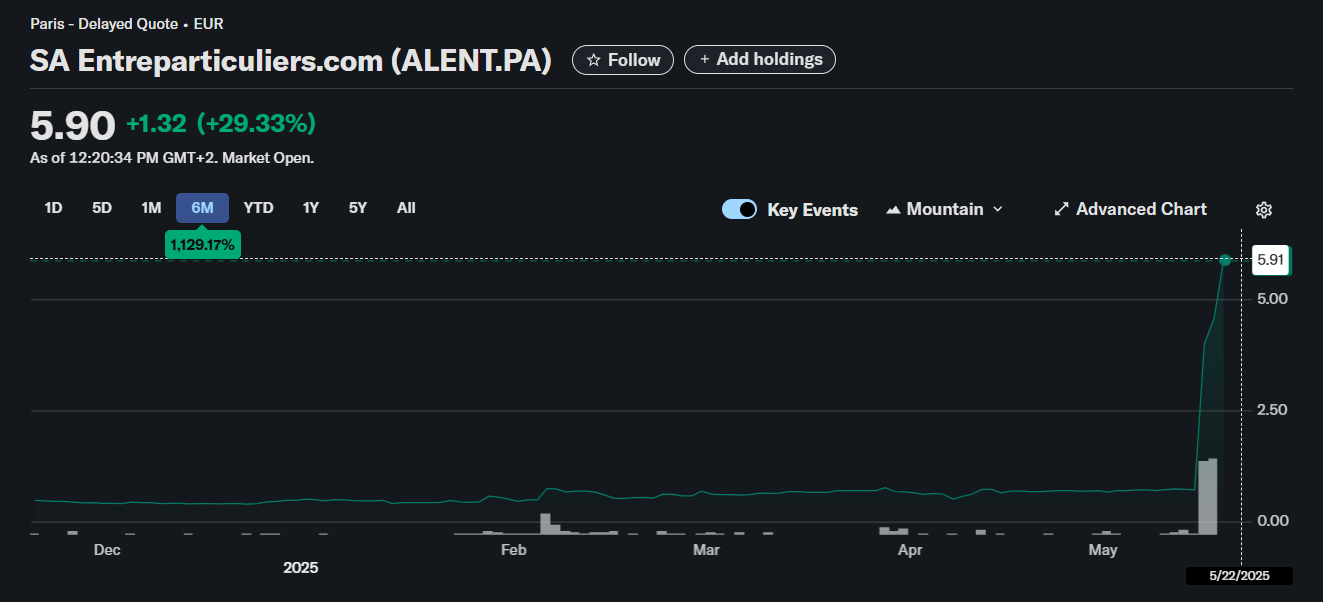

The French actual property firm entrepreneur noticed its inventory rise 800% amid information of a strategic transfer to build up Ethereum.

Shares on the French public actual property platform have exceeded 800% up to now week after it revealed that the corporate has been remodeled into an Ethereum financing firm. Within the announcement, the inventory has skyrocketed by over 800% in simply 5 days, rising the corporate's market worth to round 23.44 million euros (roughly $25.78 million) from round $1.35 million in January and a rise of greater than 1,800% per knowledge from Google Finance.

In a press launch Monday, the corporate knowledgeable the market that it has launched a programme for buying the primary tranches of Ethereum (ETH), price 1 million euros price of Ethereum (ETH), a program funded by majority shareholder Stéphane Romanyszyn.

Streparticuliers Share|Supply: Yahoo Finance

To help the continued progress of this strategic Ethereum Reserve, the entrepreneurs stated they comprise a wide range of monetary merchandise focused at skilled buyers and monetary companions. Nevertheless, the corporate and Romanissin dominated out “using excessively diluting measures resembling fairness strains.”

The entrepreneur stated its additional capital contributions can be topic to approval on the normal assembly on June 18th, with the decision protecting funding of as much as 150 million euros.

You would possibly prefer it too: Méliuz will develop into Brazil's first publicly listed firm to undertake the Bitcoin Treasury mannequin

Based in 2000 by Stéphane Romanyszyn, Antreparticuliers has traditionally been an actual property search platform for the reason that 2007 itemizing on EuroNext Progress. The platform connects people to purchasing or promoting actual property with out an middleman.

This motion is a part of a broader transformation. It has shifted from an actual property platform to a pioneering digital finance, actual property tokenization and asset administration, in response to the corporate's impartial, crypto-centric web site. It’s offered as a approach to achieve “a easy, regulated publicity to Ethereum by way of publicly accessible stock on Euronext's progress.”

The corporate's new route seems to concentrate on constructing tokenization instruments for real-world property resembling ETH investments and real-world property resembling actual property and bonds.

learn extra: Crypto Scams prices French casualties 500 million euros a yr, the AMF says