This can be a phase of the BlockWorks Day by day E-newsletter. To learn the whole version, Subscribe.

“You don't must be a rocket scientist. Funding isn't a recreation the place a person with 160 IQ beats a person with 130 IQ.”

– Warren Buffett

Warren Buffett is probably the most cited particular person within the historical past of this article. The very best achievements of his seven-year profession should fulfill him with delight.

After all, he often quoted him as a result of he has so much to say about investments and markets.

However he's not making enjoyable of it for us.

It actually thinks about how he thinks about funding, so I can know. And there's a lesson: the best buyers of all time make investments primarily by means of widespread sense.

Funding is so widespread sense for him that anybody can do it:

“You don't must do extraordinary issues to attain extraordinary outcomes.”

“If you happen to can separate your self… From the group, you'll develop into very wealthy. You don't have to be very vibrant.”

“You don't have a mind. You want a temperament.”

All of this, like lots of his funding adages, is cumming as glorious life recommendation.

“It's good to be taught out of your errors. It's higher to be taught from different folks's errors.”

“The pond you dive into is extra vital than how effectively you swim.”

“Except you're doing too many issues fallacious, you could do only a few issues in your life.”

Buffett attributes his unbelievable return on funding to simply about 12 “actually good selections” he made – on common about each 5 years.

And he lived his life the identical approach. The sixth most considerable man on this planet nonetheless lives in the home he purchased in 1958 for $31,500.

Conversely, his funding course of was so simple as the life he led. For instance, he doesn’t construct a monetary mannequin. For instance, he reads so much.

“I most likely learn 5 to 6 hours a day. I learn 5 newspapers a day. I learn fairly a couple of magazines. I learn 10kk. I learn the annual report.”

He defined that the compound curiosity data gained from all of the readings he defined allowed him to assault when an uncommon alternative got here.

“If somebody calls me about funding… I normally know in a couple of minutes if I'm .”

For instance, in 2003, he purchased house builder Clayton Holmes (firm as an entire, not simply all the firm) for $1.7 billion after studying SEC filings and speaking to administration over the telephone.

In 2008, he declined a request to rescue the Lehman brothers just because their monetary statements had been too difficult (an enormous purple flag for him).

On the top of the following monetary disaster, he poured $5 billion into Goldman Sachs after a name with the CEO and hours of negotiation phrases.

After all, the outcomes converse for themselves. Berkshire Hathaway's shares rose by greater than 5,500,000% from 1965 to 2024. 59 yr.

By comparability, the full income from the S&P 500 Index over that interval was “simply” 39,000%.

“Buffett's returns appear neither luck nor magical,” educational analysis discovered “however slightly, “rewards for utilizing leverage centered on low-cost and protected top quality shares.”

Nevertheless, just lately, Buffett hasn't discovered many shares of low-cost, protected and high quality sufficient to make the most of for the primary time in 20 years. Berkshire Hathaway holds additional cash than listed shares.

That's not as a result of Buffett is frightened about what politics and tariffs imply for the inventory market. “I'm not making an attempt to make a revenue from the inventory market,” he stated.

However failing to discover a good enterprise at an reasonably priced value will most likely inform us one thing about his views available on the market as an entire.

Buffett Acolyte Chris Bloomstran estimates that S&P 500 buyers ought to count on revenues of “lower than 1.1% per yr over the subsequent decade” as valuations and revenue margins are at the moment rising.

If that’s the case, the “actually good selections” Warren Buffett made, and, in any approach useful, retired with a file amount of money, could possibly be a history-decreasing.

“Funding is the best enterprise on this planet since you don't must swing,” explains Buffett in typical Buffett style. “All day lengthy, you're ready for the pitch you want. Then when the fielder is asleep, you step up and hit it.”

With the market recovering over the previous month, regardless of seemingly unhealthy information about tariffs, he most likely doesn't see any extra fats pitch earlier than he retires on the finish of the yr.

Nevertheless, he informed younger buyers, “In the long run, inventory market information could be good.”

Let's examine the chart.

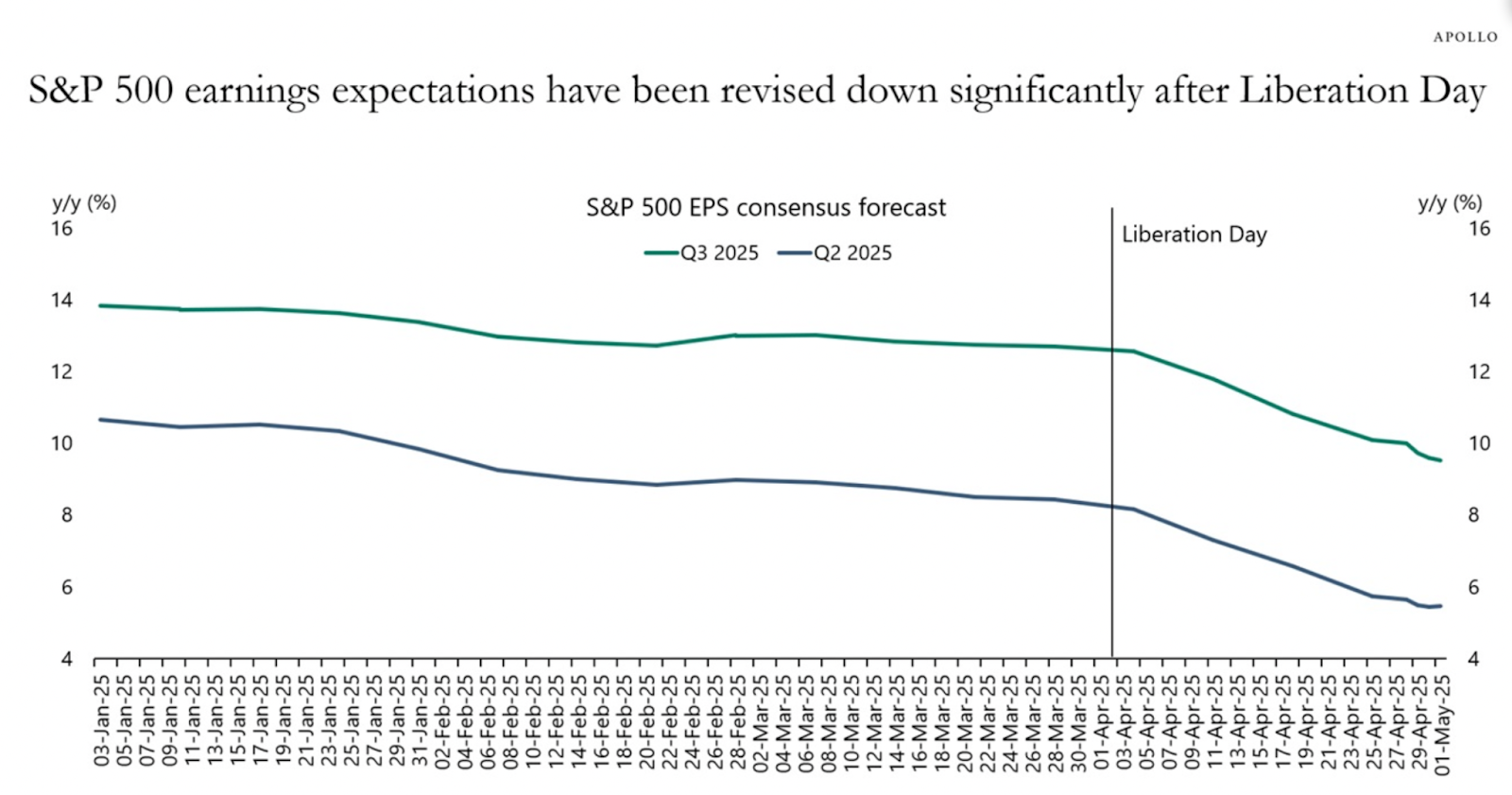

Stock is growing, however estimates are declining.

It's reassuring that the inventory has returned earlier than “liberation day,” however that doesn't imply that nothing occurred. In keeping with Torsten Slok, income estimates are considerably decrease and stock is considerably costlier.

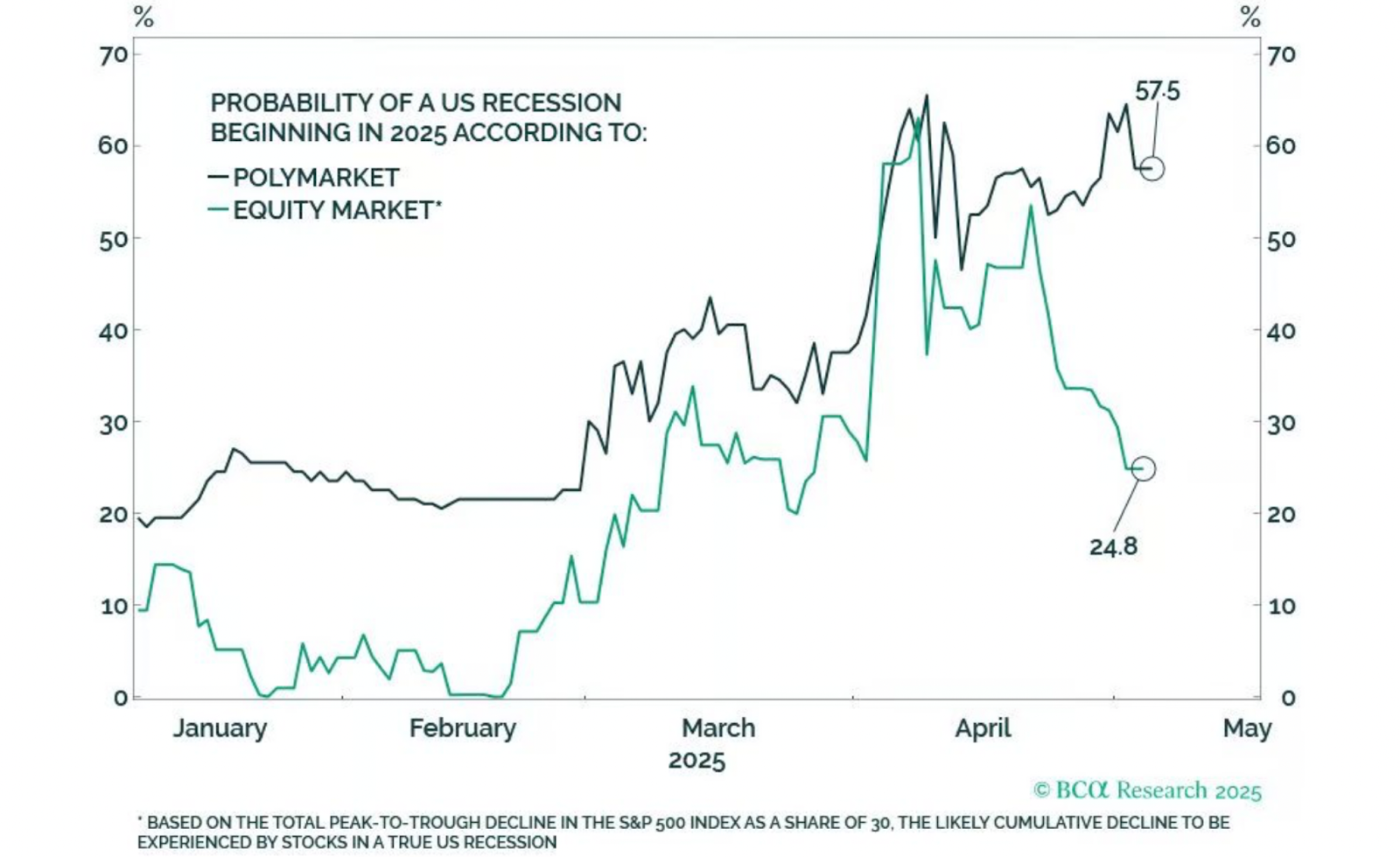

Inventory markets and betting markets:

The percentages of multi-tier markets counsel {that a} US recession continues to be barely probably, however BCA analysis estimates that the inventory market is at the moment priced 25%.

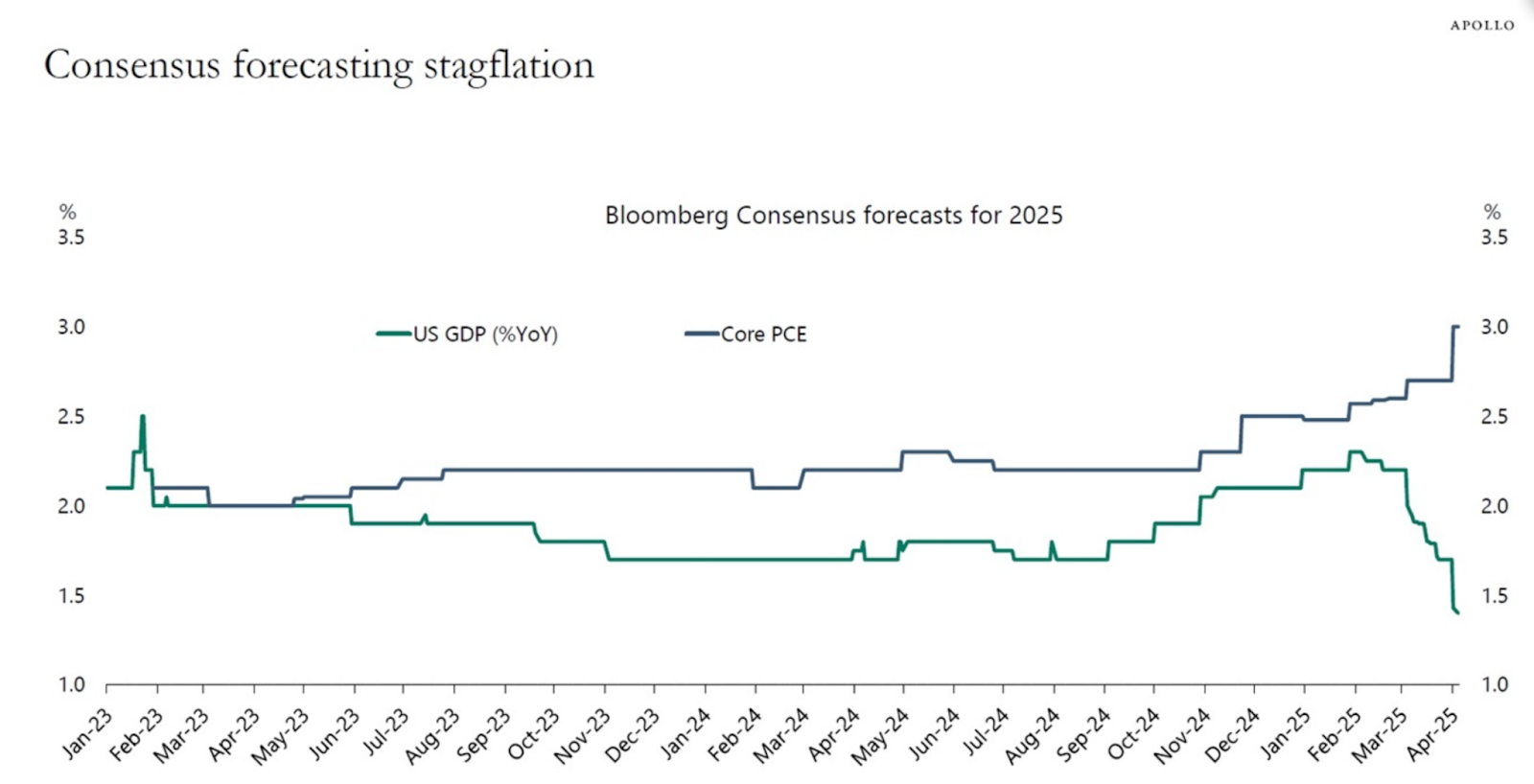

Economists value stagflation:

Torsten Slok factors out that rising inflation and growing GDP estimates point out that STAGFLATION is coming. At FOMC Press this week, Federal Reserve Chairman Jerome Powell seems to have agreed that “if the large enhance in tariffs introduced is maintained, it’s more likely to generate elevated inflation, slower financial development and elevated unemployment.” ”

It could worsen than that:

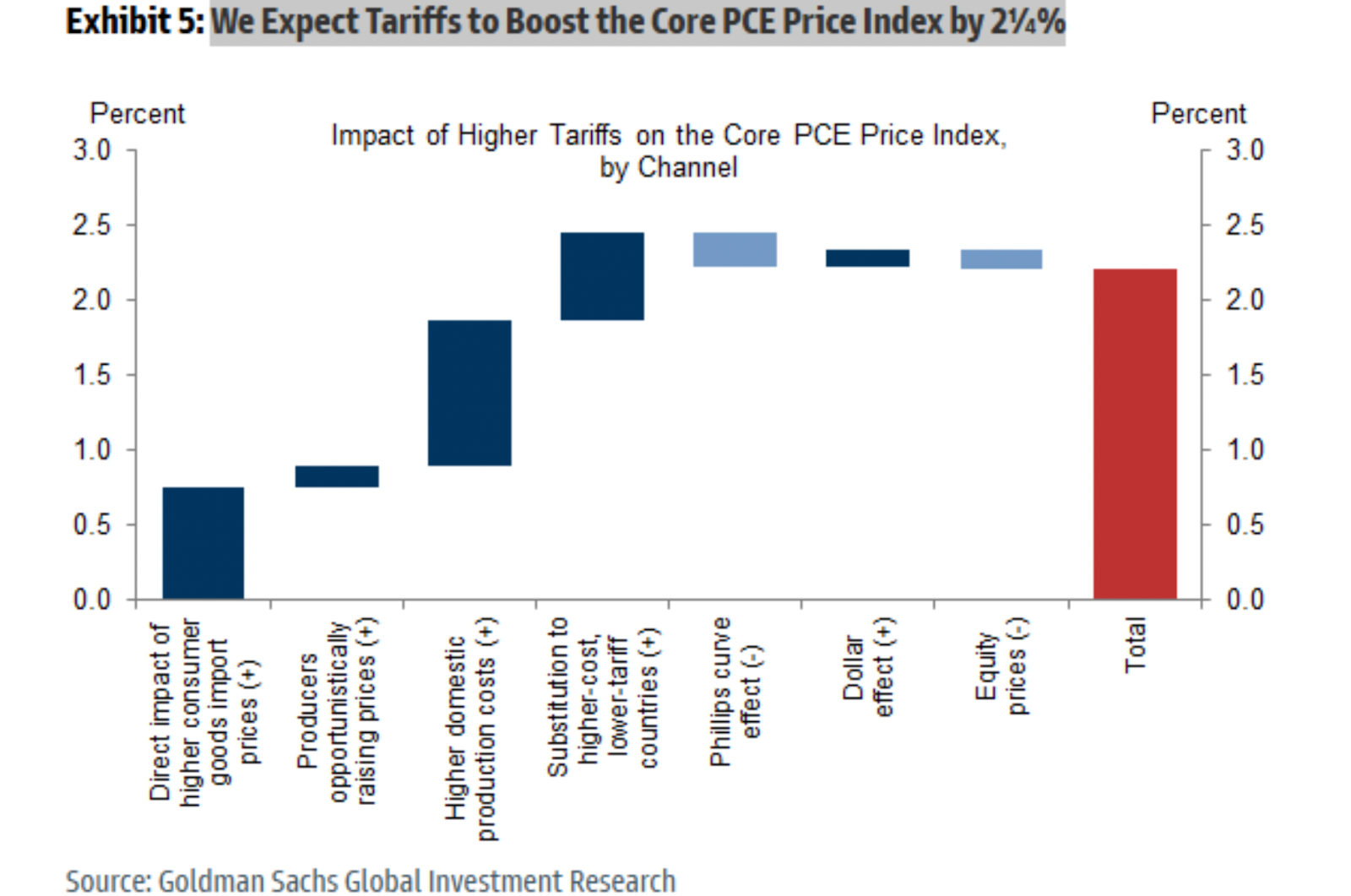

Analysts at Goldman Sachs estimate tariffs will enhance by a whopping 2.25%.

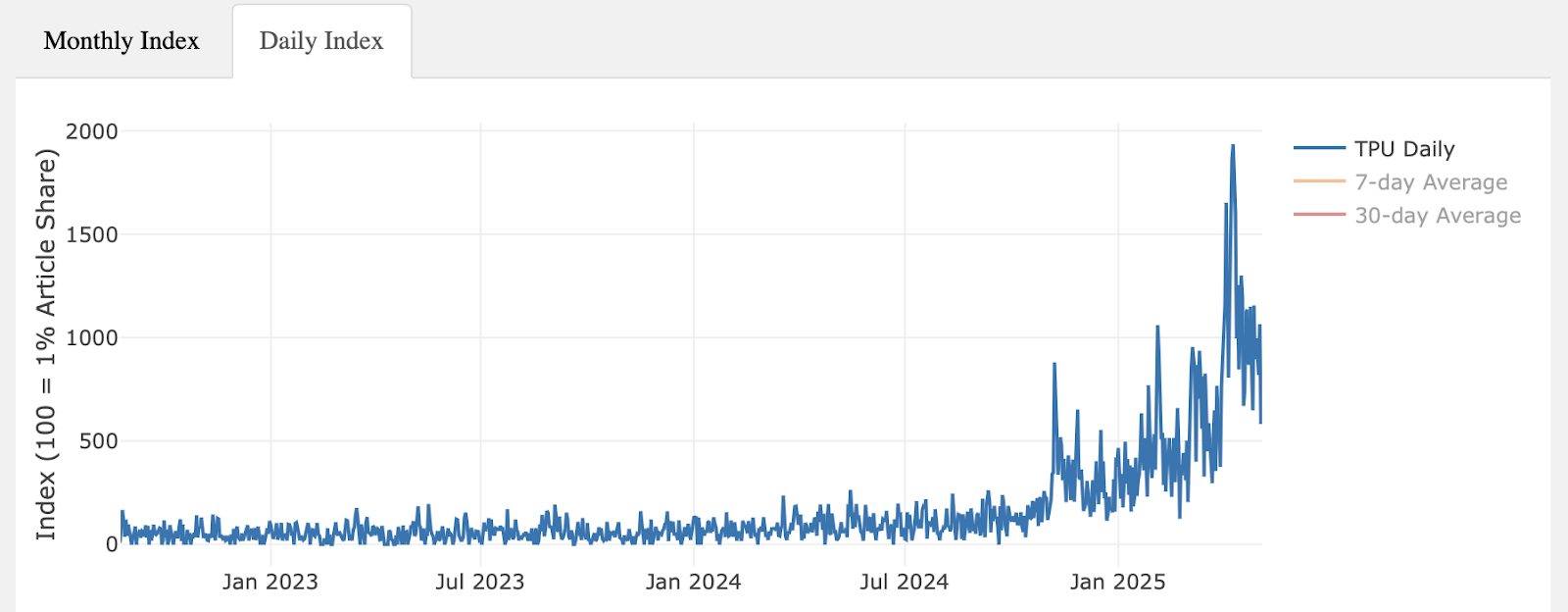

I don't suppose commerce coverage is that unsure:

Markets are stated to avers to uncertainty, and regardless of all contradictory headlines, the commerce coverage uncertainty index has declined.

Precise buying and selling has additionally declined:

Container reservations from China to the US fell 49% year-on-year. President Trump stated it's a great factor as a result of it doesn't imply “now we have little cash.” However he appears to need it Some The extent of commerce with China – he posted this morning that the present 145% tariff price may fall to 80%, suggesting that it’s left to Treasury Secretary Bescent.

Commerce with China was a great factor for us:

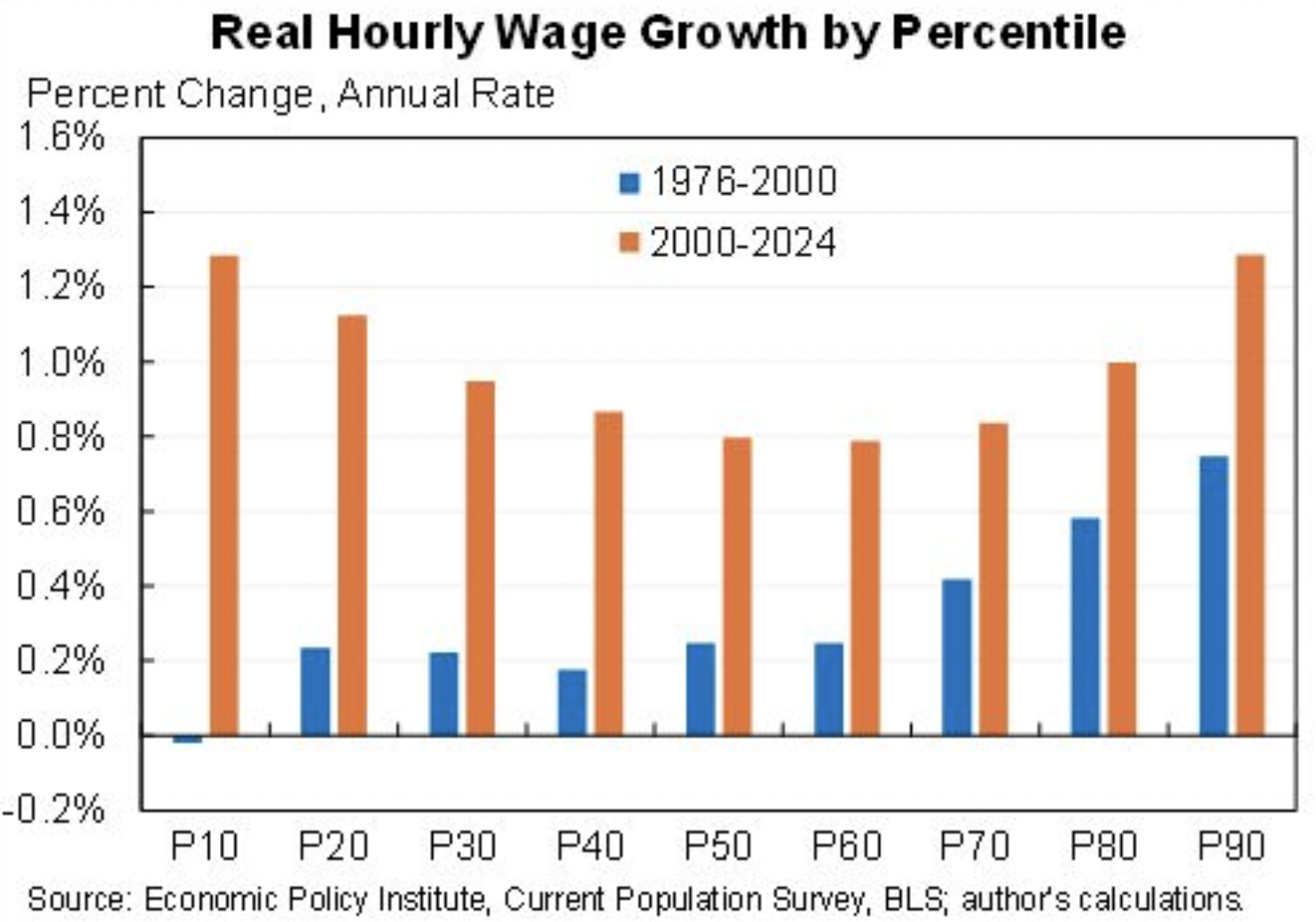

Jason Ferman says US wages have grown sooner over 24 years rear China has joined the WTO (orange bar) greater than 24 years in the past (blue line). Most stunning, wage development has been way more honest than earlier than in these 20 years of globalization.

Commerce with China was a great factor for us (2):

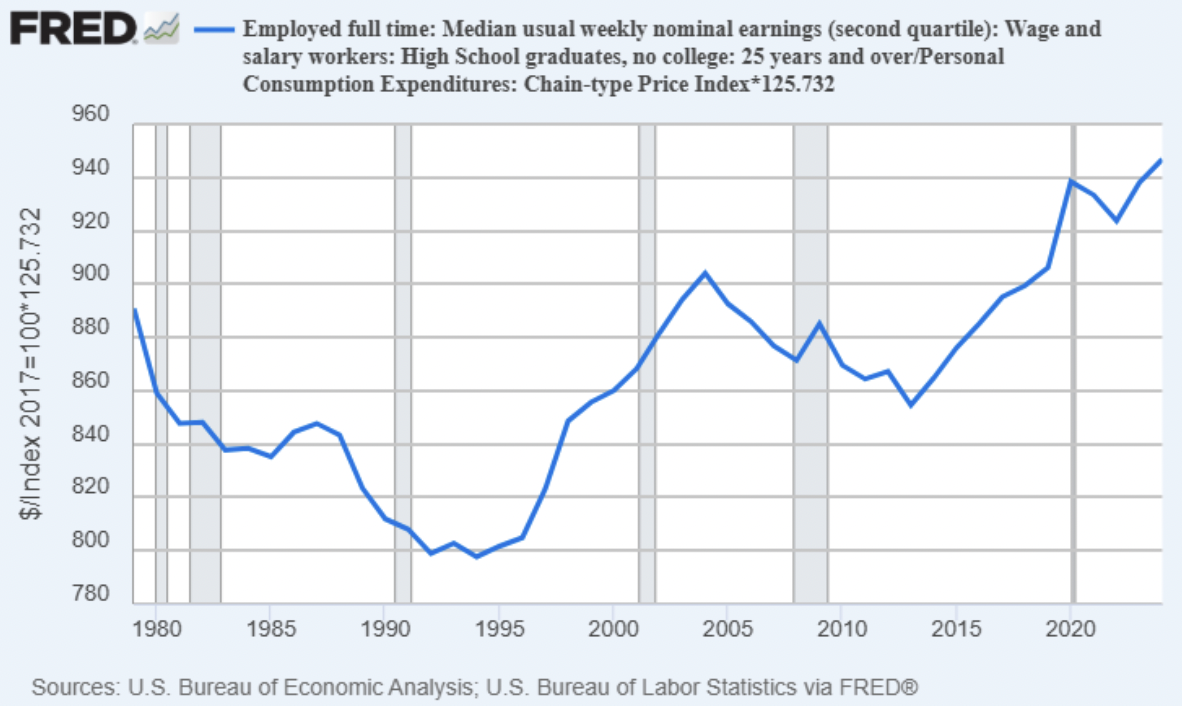

Jeremy Holepodal digs a little bit deeper and discovers that the precise (i.e., inflation-adjusted) revenues of highschool graduates and not using a school diploma are greater than no less than 50 years (and, he speculates that it hasn't been earlier than, however hasn't gone again any additional). That appears to be getting even higher too. This week's Wall Road Journal reported on highschool juniors who acquired a job supply of $70,000 a yr as his college provides welding courses.

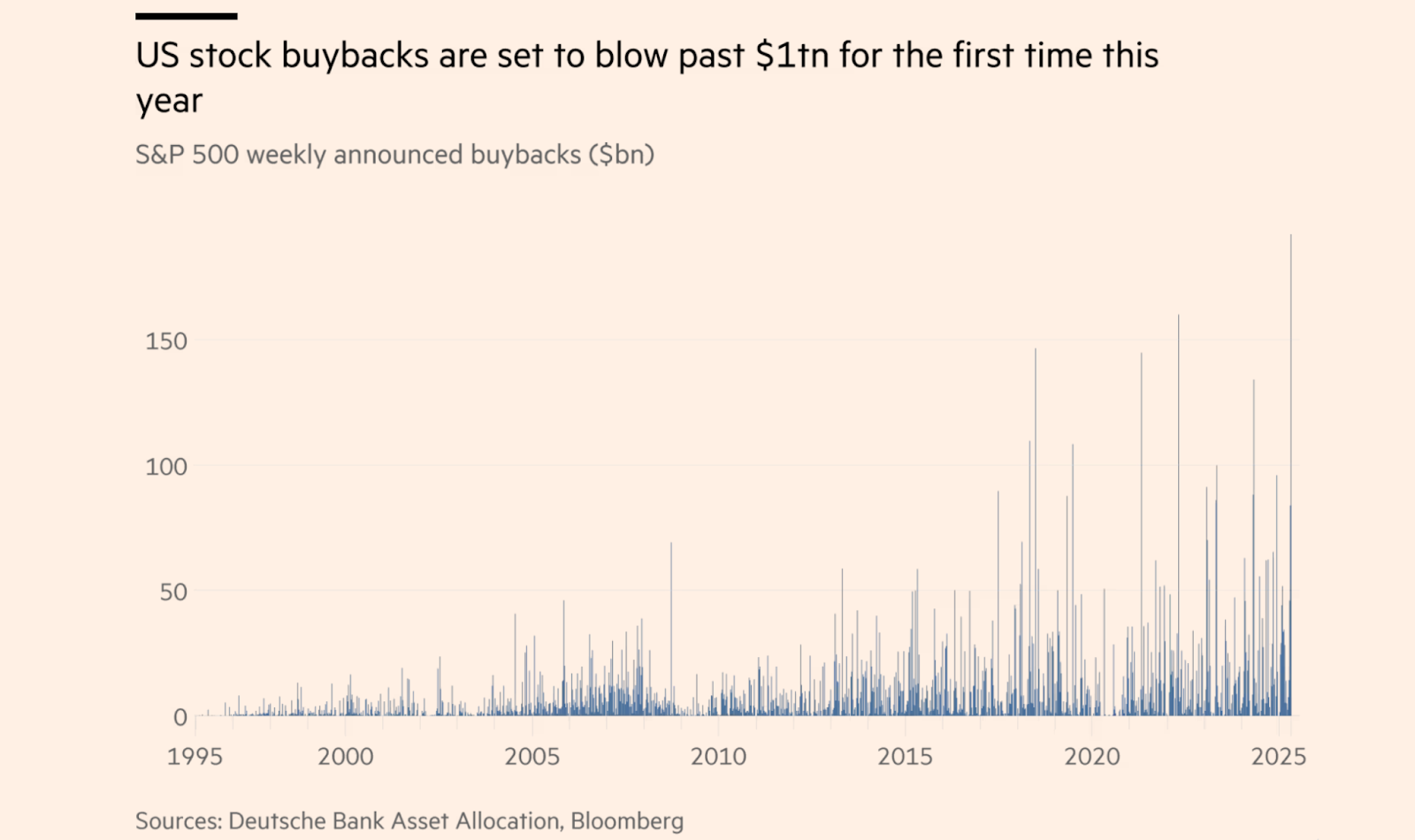

Corporations are nonetheless shopping for:

FT reviews that US corporations are on monitor to purchase greater than $1 trillion in inventory this yr.

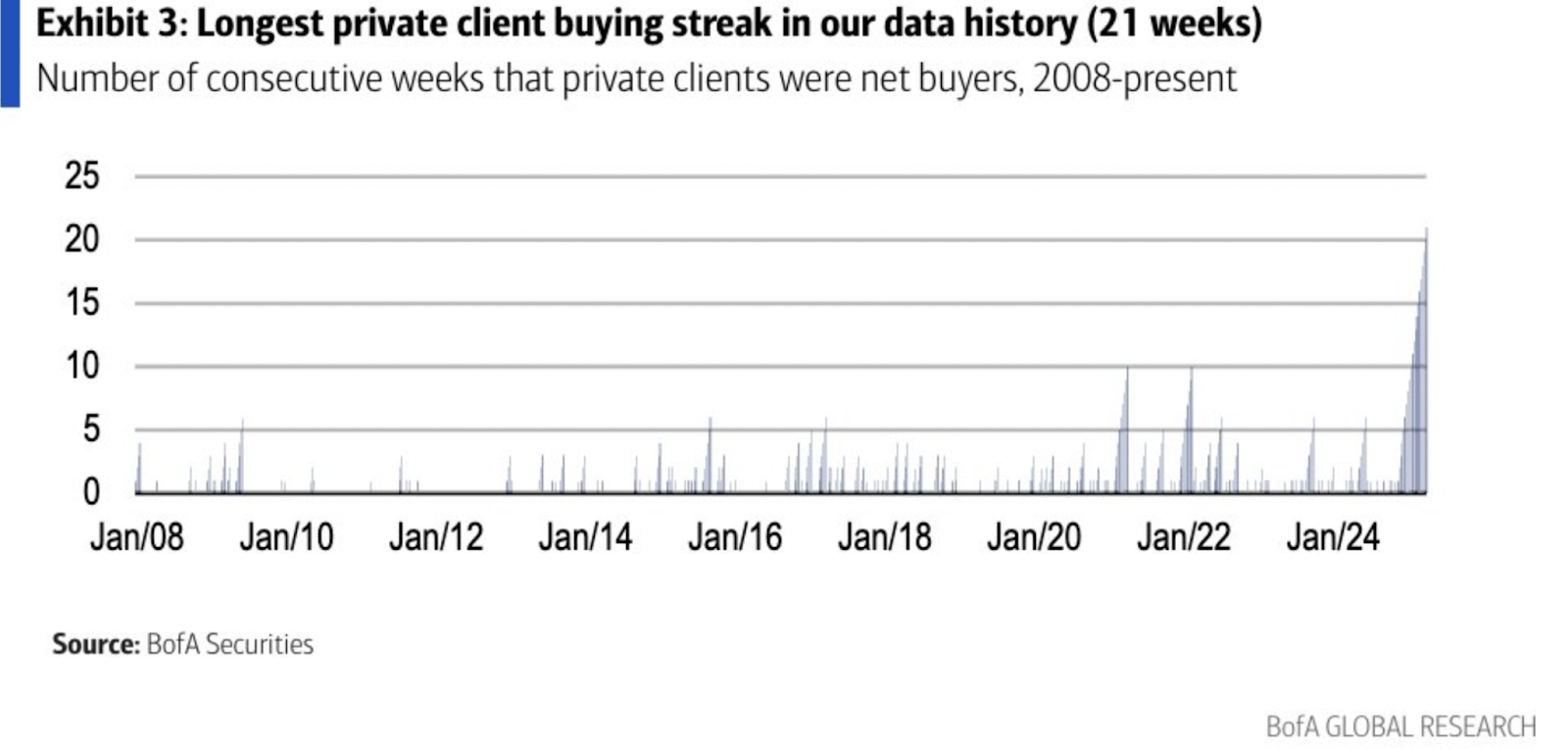

Retail buyers are nonetheless shopping for: