Galaxy Digital has withdrawn a considerable amount of Ethereum by an OTC transaction and forwarded it to addresses reportedly linked to whales and amenities.

It’s because Ethereum (ETH)'s worth consolidated at $2,626.51, reflecting a mere 0.64% enhance during the last 24 hours.

Based on LookonChain, Galaxy Digital's business (OTC) pockets has withdrawn 89,000 ETH from the change. The withdrawal value round $234 million has attracted market consideration. Nevertheless, the switch didn’t cease.

Apparently the whale/facility bought $108,278 ($283 million) by the OTC.

The Galaxy Digital OTC pockets has withdrawn $89,000 ETH ($233.5M) from the change for the previous 12 hours, then transferred $108,278 ETH (283mm) to Whale/Facility Pockets 0x0B26.

Pockets 0x0b26 at the moment holds …pic.twitter.com/bgqilh2xlh

– lookonchain (@lookonchain) June 4, 2025

Galaxy Digital has since facilitated a further OTC transaction of 108,278 ETH value round $283 million. This transaction occurred in a number of batches of 44,000, 50,000, and 14,278 ETH, and was then moved to a different handle.

Go to whale handle

Following the OTC transaction, these Ethereum possessions have been transferred to a brand new handle: 0x0B26. this handle It at the moment holds a complete of 139,476 ETH, value round $365 million. Based on Lookonchain, the handle might be owned by whales and amenities.

This switch illustrates a considerable accumulation of Ethereum, particularly given the substantial worth of the belongings concerned. Sometimes, whales and companies add massive portions of Ethereum, which often signifies a possible long-term holding technique. This may enhance rarity and enhance asset costs as a result of decrease gross sales pressures.

Over the previous few weeks, Galaxy Digital OTC addresses have been forwarding massive quantities of Ethereum (ETH) to exchanges comparable to Coinbase and Binance by a number of transactions. Specifically, these transfers occurred throughout April at a number of levels all through April, together with transactions comparable to 4.4K ETH ($7.86 million), 5K ETH ($893 million), and 5.5K ETH ($9.83 million) to the Coinbase Change. These occurred round April twenty eighth.

ETH costs fell in early April, adopted by a stagnation of round $1,800 when these transactions came about. Nevertheless, as transactions started to maneuver to particular person addresses, ETH costs started to realize momentum and finally spiked above $2,500 by mid-Could. However, this can be a coincidence.

Important leaks from exchanges

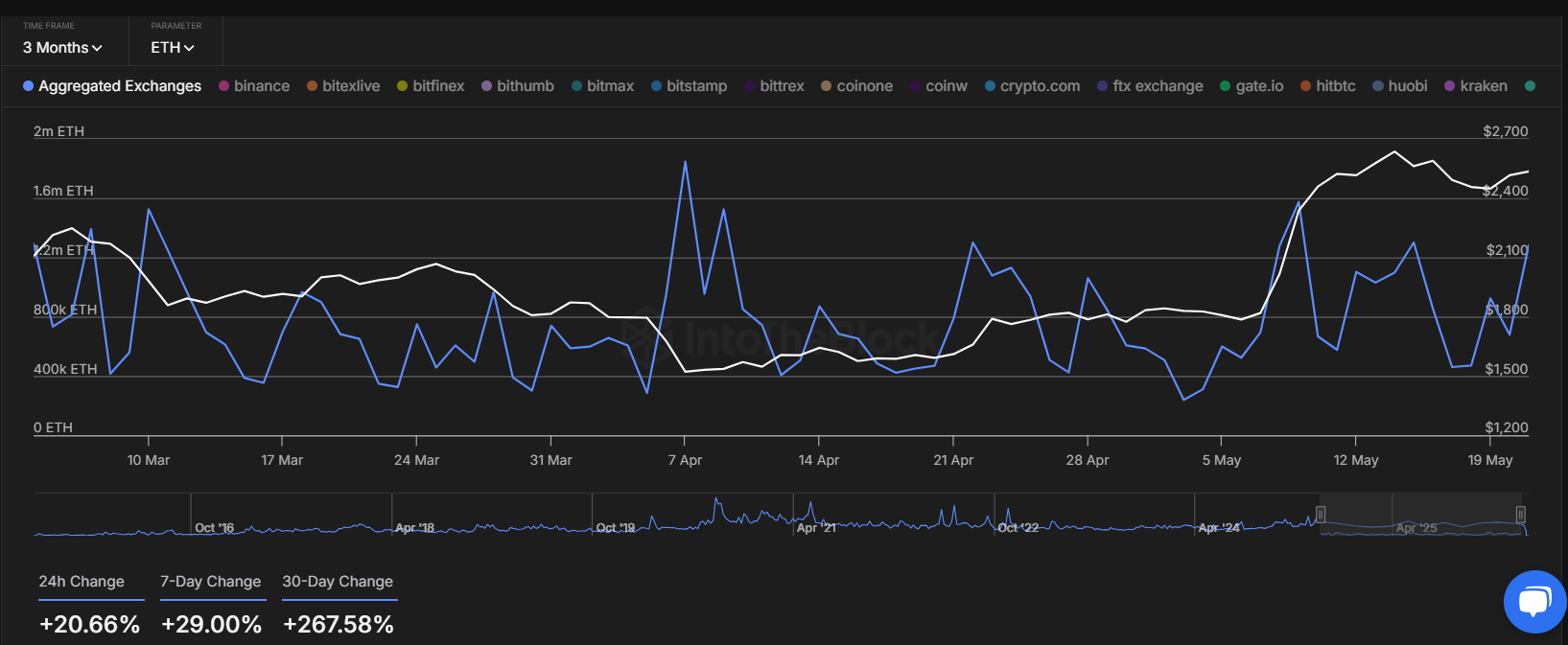

Intotheblock information additional confirms that the change has skilled a big outflow of Ethereum.

Ethereum Change leak

The circulation of funds from the change has elevated considerably, with 20.66% of the 24-hour change, 29.00% for the 7-day change, and 267.58% for the 30-day change. This rise within the outflow suggests a serious change as buyers look like shifting their belongings off the centralized platform.

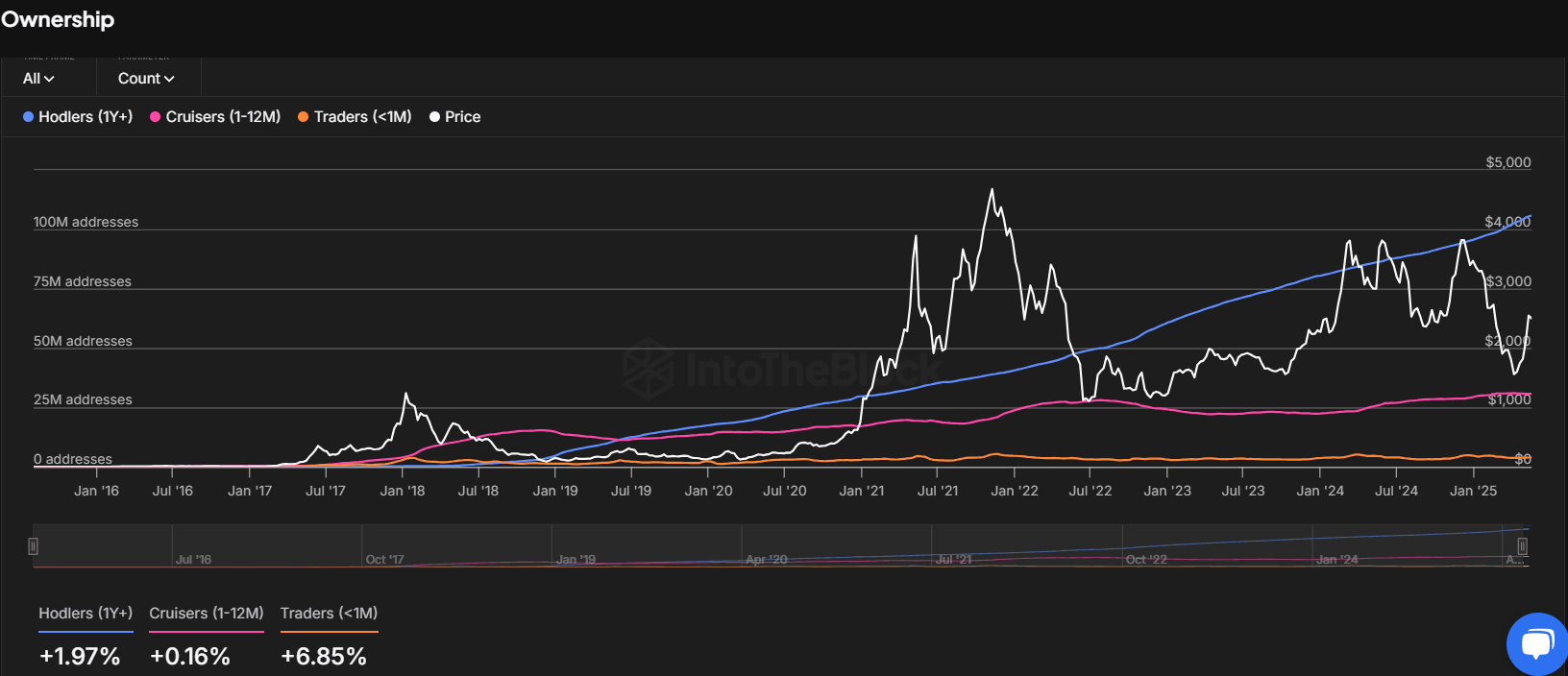

Adjustments in Ethereum possession throughout the pockets

The info additionally reveals a big change in Ethereum possession amongst various kinds of buyers. Proportion of Ethereum Addresses which have held ETH for greater than a 12 months have elevated by 1.97%.

Ethereum handle at every time of the occasion

In the meantime, medium-term buyers who held ETH between one month and one 12 months noticed a slight enhance of 0.16%. In distinction, short-term speculators who held ETH in lower than one month skilled a extra vital 6.85%. These strikes mirror a wider change in investor habits, particularly as they deal with long-term holdings.

Massive establishments are additionally accumulating ETH

Along with these pockets developments, outstanding establishments have shifted their focus from Bitcoin to Ethereum. For instance, Black Rock is regularly Liquidation That Bitcoin helps Ethereum.

This shift has been noticed over the previous few days, with BlackRock shifting 5,362 BTC, value $561 million, incomes 27,241 ETH concurrently, valued at $69.25 million.