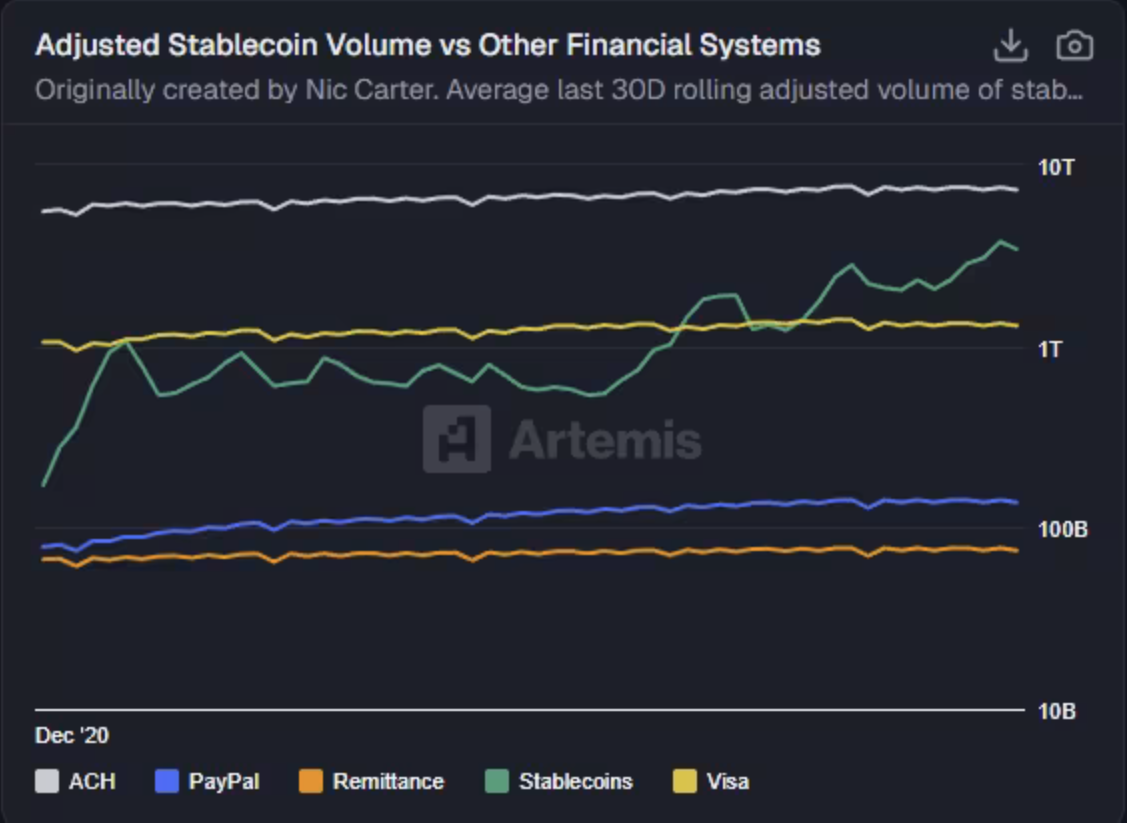

With regulatory readability and elevated adoption, stablecoins may deal with extra transaction volumes than the U.S. automated clearinghouse system in 2026, in line with a brand new forecast.

Galaxy Analysis, the analysis arm of digital asset agency Galaxy Digital, factors to present transaction information and regulatory traits that assist its predictions.

Vice President of Analysis Thad Pinakiwicz stated stablecoin provide continues to extend at a compound annual progress charge of 30% to 40%, and buying and selling volumes are rising in addition to issuance. Galaxy additionally cited the anticipated implementation of the definition underneath the GENIUS Act in early 2026 as an element supporting additional progress in stablecoin utilization.

Comparability of stablecoin volumes and different monetary techniques. sauce: galaxy digital

The paper additionally supplies predictions for the value of Bitcoin (BTC), stating that it may attain $250,000 by the top of 2027. 2026 is “too chaotic and unpredictable, nevertheless it's nonetheless doable that Bitcoin will hit a brand new all-time excessive in 2026,” stated Alex Thorne, director of company analysis at Galaxy Analysis.

Associated: Coinbase is 'cautiously optimistic' about 2026 as crypto approaches institutional inflection level

Greenback-pegged stablecoin market expands

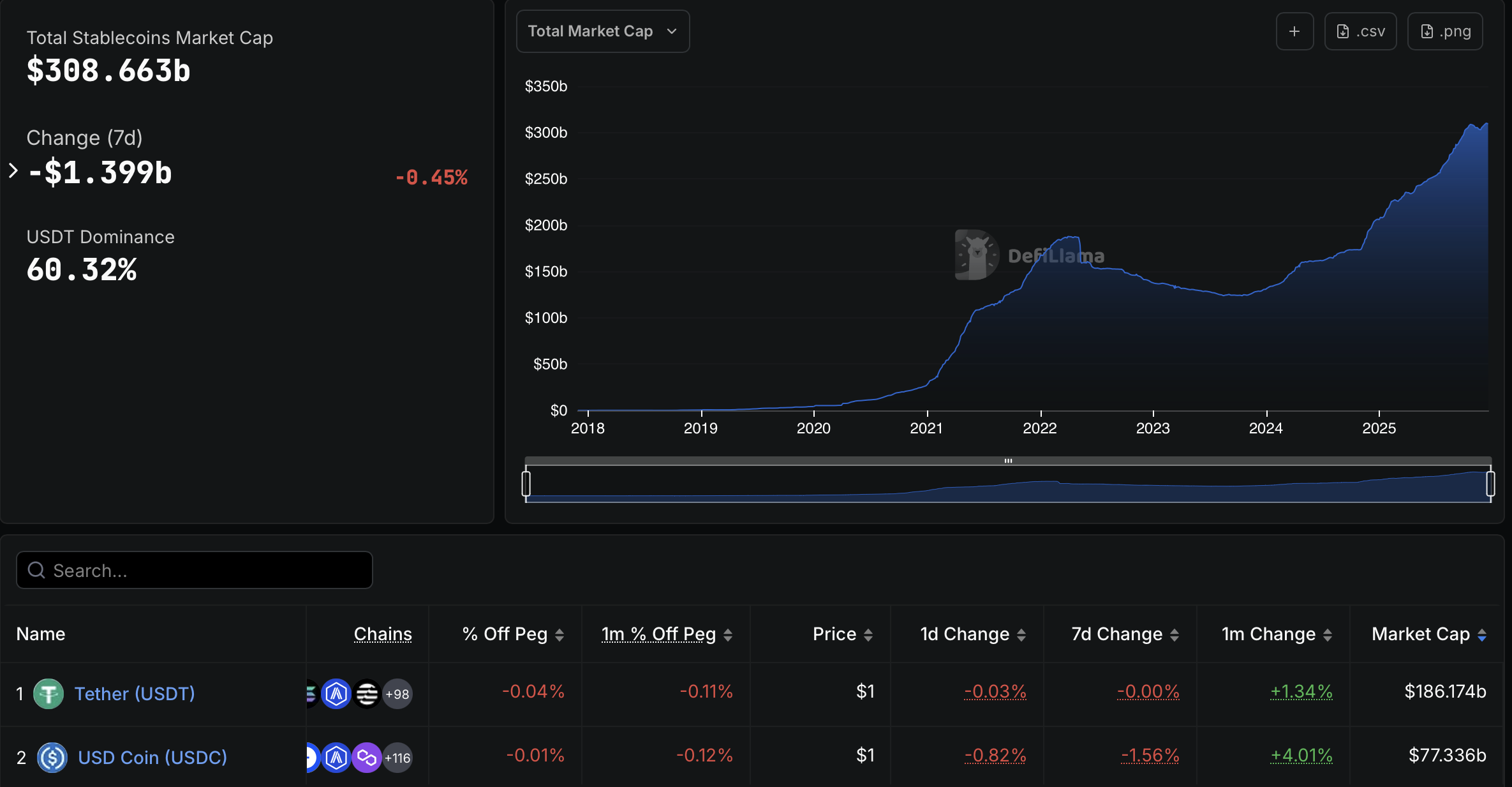

In keeping with information from DefiLlama, the market capitalization of stablecoins is at present round $309 billion. Whereas Tether Inc.’s USDt (USDT) and Circle Inc.’s USDC (USDC) stay dominant, an increasing number of monetary establishments and cost corporations have entered the stablecoin race in current months.

Stablecoin market capitalization. sauce: Defilama

In October, Western Union introduced plans to launch its personal USD-pegged stablecoin, the USD Fee Token. The token is constructed on the Solana blockchain and issued by Anchorage Digital Financial institution as a part of the broader digital asset funds community.

Sony Financial institution is reportedly getting ready a stablecoin pegged to the US greenback to be used throughout Sony's US ecosystem, together with PlayStation video games, subscriptions, and anime content material. The stablecoin is scheduled to be issued in 2026.

On Thursday, SoFi Applied sciences launched SoFiUSD, a completely reserved USD stablecoin issued by its banking subsidiary SoFi Financial institution. The corporate stated the token debuted on Ethereum and is designed to assist low-cost funds for banks, fintechs, and enterprise platforms.

Janine Wu, an affiliate at Galaxy Analysis, stated she expects stablecoins affiliated with TradFi to consolidate in 2026, as customers and retailers are unlikely to undertake a protracted listing of digital {dollars}, preferring as a substitute the one or two which can be “most generally accepted.”

journal: Quantum Bitcoin assaults are a waste of time: Kevin O'Leary