Written by Omkar Godbole (all instances Jap Time except in any other case famous)

Transfer cryptocurrencies and USD pairs. as bitcoin BTC$92,864.00 And with the broader market consolidating on the current rally, it might be a really perfect time to give attention to cross-pairs, particularly the Ether to Bitcoin (ETH/BTC) ratio.

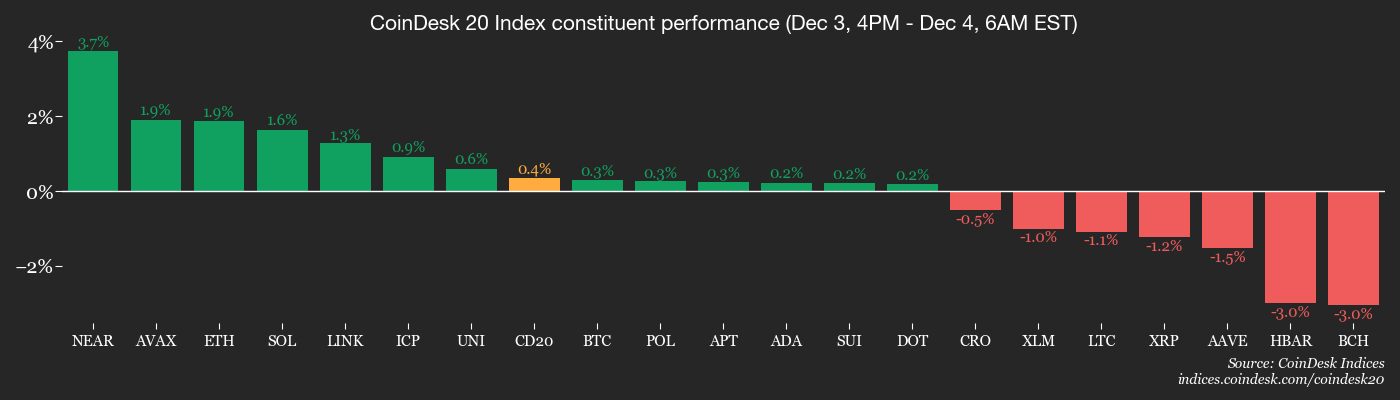

ether Ethereum$3,179.71 Though up greater than 4% previously 24 hours and approaching $3,200, Bitcoin BTC$92,864.00 There’s little change above $93,000. The CoinDesk 20 index and CoinDesk 80 index rose about 1%.

Ether momentum pushed the ETH/BTC ratio up 4%, confirming a bullish technical breakout above the downtrend line from the August excessive. This sample, which we mentioned within the technical evaluation part, signifies {that a} bull run in Ether towards BTC is imminent.

This outlook is strengthened by constructive elementary developments, together with the Fusaka improve that was rolled out on Wednesday. This improve will increase blob capability and makes it extra environment friendly.

The adjustments “enhance Ethereum's Layer 1 execution capabilities by means of EIP-7935, rising the protocol's default gasoline restrict to 60M,” Coinmetrics stated. “This immediately will increase the variety of transactions that match right into a block, rising throughput, lowering congestion, and reducing gasoline costs.”

It’s no marvel that analysts like BRN’s Timothy Misil are calling this improve a tailwind for Ether.

“Community development reached 190,000 new addresses in sooner or later, demonstrating true natural enlargement post-Fusaka,” Misir stated in an electronic mail, pointing to new energetic ETH accumulation by wallets holding between 1,000 and 10,000 ETH.

In different bullish information, the US-listed Spot Ether ETF attracted $140 million in investor funds on Wednesday. The XRP fund had inflows of $50 million, whereas BTC and SOL ETFs recorded outflows.

PayPal's stablecoin PYUSD has grown over 36% over the previous month, turning into the sixth largest stablecoin.

In conventional markets, debate raged over the potential influence of rising Japanese authorities bond yields on danger belongings. Dutch funding financial institution ING has warned that the yield on 10-year US authorities bonds may rise. Be alert!

Extra data: For an evaluation of at the moment's exercise in altcoins and derivatives, see Crypto Markets Immediately.

what to see

For a extra complete record of this week’s occasions, see CoinDesk’s “Crypto Week Forward.”

- cryptography

- macro

- December 4th, 7am: Brazil's third quarter GDP development fee. Anticipated 0.2% in comparison with the earlier quarter and 1.7% in comparison with the earlier yr.

- Dec. 4, 8:30 a.m.: Estimated variety of new U.S. unemployment insurance coverage claims for the week ending Nov. 29. The estimated variety of unemployment insurance coverage claims for the week ending Nov. 22 is 220,000. 1960K.

- December 4, 12:00 p.m.: Michelle W. Bowman, Vice Chair of the Board of Governors of the Federal Reserve System, will communicate on “Financial institution Supervision and Regulation.''

- December 4th, 2:00pm to 4:00pm: Panel dialogue on “Fairness Tokenization” at US SEC Investor Advisory Committee assembly.

- December 4-5: twenty third India-Russia Annual Summit. Russian President Vladimir Putin is visiting New Delhi to fulfill with Indian Prime Minister Narendra Modi.

- income (estimated based mostly on FactSet knowledge)

token occasion

For a extra complete record of this week’s occasions, see CoinDesk’s “Crypto Week Forward.”

- Governance votes and calls

- The Arbitrum DAO is voting to pick the ultimate three members of the AGV Council for 2026 from amongst six candidates. Voting ends on December 4th.

- The Rootstock Collective is voting to determine and develop the Rootstock (RSK) neighborhood in Ghana. The initiative focuses on accelerating the adoption of Bitcoin sidechains by onboarding new customers and coaching native builders. Voting ends on December 4th.

- unlock

- Activate token

- December 4: Alpha Companions' cross-chain bridge and decentralized alternate goes dwell.

convention

For a extra complete record of this week’s occasions, see CoinDesk’s “Crypto Week Forward.”

- Day 3 of three: FT's World Banking Summit (London)

- Day 2: Binance Blockchain Week 2025 (Dubai)

- Day 1 of two: Milken Institute Center East and Africa Summit 2025 (Abu Dhabi)

market actions

- BTC has fallen -0.44% to $93,325.36 as of 4:00 PM ET on Wednesday (24h: +0.24%).

- ETH rose 0.93% to $3,194.78 (24 hours: +3.84%)

- CoinDesk 20 fell 0.55% to three,017.58 (24h: +0.95%)

- Ether CESR general staking fee elevated by 1bps to 2.85%

- BTC funding fee is 0.0078% (8.5728% p.a.) on Binance.

- DXY stays unchanged at 98.86

- Gold futures unchanged at $4,231.00

- Silver futures fell 1.16% to $57.94.

- The Nikkei 225 rose 2.33% to shut at 51,028.42.

- The Dangle Seng rose 0.68% to shut at 25,935.90.

- FTSE unchanged at 9,692.43

- The Euro Stoxx 50 rose 0.39% to five,717.01.

- The DJIA rose 0.86% to shut at 47,882.90 on Wednesday.

- The S&P 500 rose 0.30% to shut at 6,849.72.

- The Nasdaq Composite Index rose 0.17% to finish at 23,454.09.

- The S&P/TSX Composite rose 0.36% to finish at 31,160.54.

- The S&P 40 Latin America index rose 0.2% to finish at 3,216.12.

- US 10-year authorities bond rate of interest rose 2.1bps to 4.079%

- E-mini S&P 500 futures unchanged at 6,864.75

- E-mini Nasdaq 100 futures unchanged 2% at 25,662.25

- E-mini Dow Jones Industrial Common futures unchanged at 47,994.00

bitcoin statistics

- BTC Dominance: 59.33% (+0.09%)

- Ether to Bitcoin ratio: 0.03419 (0.18%)

- Hashrate (7-day transferring common): 1,047 EH/s

- Hash Value (Spot): $39.66

- Whole charges: 3.56 BTC / $331,173

- CME futures open curiosity: 122,040 BTC

- BTC Gold Value: 22.2oz

- BTC vs. Gold Market Cap: 6.24%

technical evaluation

Each day chart of ETH/BTC in candlestick format. (Buying and selling View)

- The chart exhibits the each day fluctuations of the Ether to Bitcoin (ETH/BTC) ratio in candlestick format.

- This ratio signifies that Ether has damaged out of the descending channel and can outperform going ahead.

crypto belongings

- Coinbase World (COIN): Wednesday's closing value was $276.92 (+5.19%), pre-market was $277.56, +0.23%.

- Circle (CRCL): $86.29 (+11.43%), +0.15% to finish at $130.04

- Galaxy Digital (GLXY): $27.05 (+6.66%), +0.37% to finish at $27.15

- Bullish (BLSH): $46.37 (+7.69%), -0.15% to shut at $46.30

- MARA Holdings (MARA): $12.47 (+4.7%), +0.24% to shut at $12.50

- Riot Platform (RIOT): $15.64 (+2.76%), +0.32% to shut at $15.69.

- Core Scientific (CORZ): $16.55 (+4.61%), -0.36% to shut at $16.49.

- CleanSpark (CLSK): Closed at $14.49 (+5.69%), -0.14% at $14.47

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): $45.47 (+4.10%), -0.99% ending at $45.02

- Exodus Motion (EXOD): Ended unchanged pre-market at $14.33 (-1.04%)

crypto asset firm

- Technique (MSTR): $188.39 (+3.89%), +0.21% to finish at $188.78

- Semler Scientific (SMLR): Closed at $20.44 (+2.3%)

- SharpLink Gaming (SBET): $10.59 (+6.22%), +0.94% to finish at $10.69

- Upexi (UPXI): $2.91 (+0.52%), -5.32% to shut at $7.66

- Mild Technique (LITS: Closed at $1.76 (-2.22%), -2.27% at $1.72

ETF circulation

Spot BTC ETF

- Each day internet circulation: -$14.9 million

- Cumulative internet circulation: $57.74 billion

- Whole BTC holdings ~1.31 million

Spot ETH ETF

- Each day internet circulation: $140.2 million

- Cumulative internet circulation: $13.02 billion

- Whole ETH holdings ~6.24 million

Supply: Farside Traders

whilst you have been sleeping

- Citadel challenges DeFi framework in letter to SEC, stokes trade anger (CoinDesk): Citadel Securities says some DeFi platforms are just like broker-dealers, urges formal rulemaking, and warns that unequal regulation of tokenized and conventional markets may weaken investor protections.

- Putin and Modi deepen ties that drew Trump's ire (Wall Road Journal): Russian President Vladimir Putin's go to to New Delhi for talks on oil and arms is prone to enhance tensions with the USA as President Donald Trump pushes again towards nearer ties between Russia and India.

- Ether bulls develop bolder as Bitcoin returns to $100,000 stage as volatility breaks uptrend (CoinDesk): Bitcoin's plummeting volatility and return to $93,000 have bulls eyeing $100,000, whereas Ether's restoration from the collapse has elevated requires $3,500.

- CZ Teases New BNB Chain Native Prediction Market Predict.Enjoyable (CoinDesk): The platform pays yield for energetic bets, however the restricted provide of BNB Chain stablecoins may hinder development because it competes with smaller rivals like Limitless.