Gold can hit highs and burn hypothesis that fuels Bitcoin within the explosive This fall rally.

Markus Thielen suggests Bitcoin Mirrors Gold and will quickly put together for the strongest breakout.

Bitcoin choices present stability advantages over Ethereum, sparking new buyers' curiosity in BTC.

Crypto merchants are trying intently at $3,475 this August 2025, near a report excessive. The world's oldest protected seafarer property are surged once more, and that rise may set the tone of Bitcoin's subsequent huge transfer.

The present query is whether or not this Gold Rally is only a protected play or a quiet sign that marks the beginning of Bitcoin's strongest quarter.

Gold breakout and bitcoin connection

Gold lately touched on an all-time excessive of $3,475 per ounce, spurring sticky inflation, anticipated fee reductions and international tensions. The metallic has seen brief pullbacks, however is properly supported close to the $3,416 report stage.

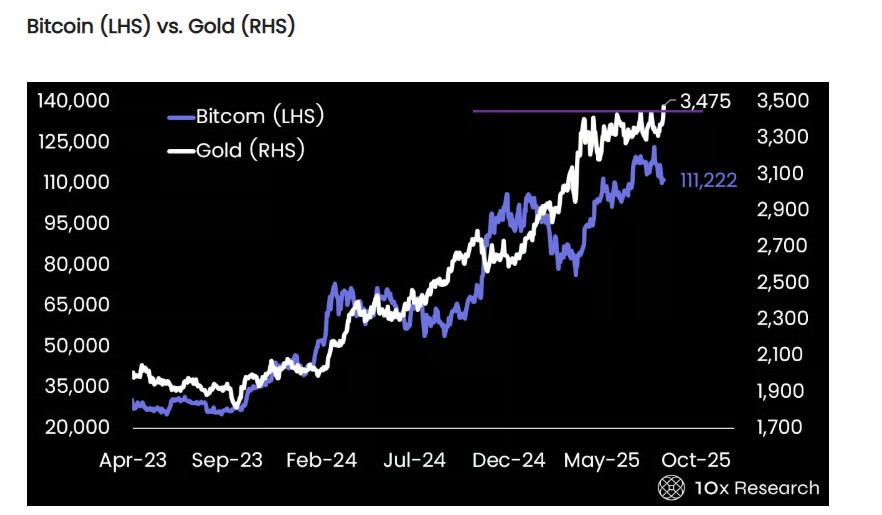

10x analysis head Markus Thielen reveals how this steady breakout will develop into a mirror for Bitcoin. Each property are sometimes thought-about protected shelters throughout unsure instances, and when gold strikes first, Bitcoin can final with extra pressure.

His chart evaluating the 2 means that if macro circumstances proceed to accentuate, Bitcoin could also be making ready for the same breakout.

Bitcoin displays the motion of gold

Bitcoin, sometimes called “digital gold,” has a transparent correlation with bodily gold in 2025. Each property rose in parallel, with Bitcoin reaching $124,000 in July, then round $111,000.

Analysts like Markus Thielen of 10x Analysis have argued that Gold's quiet breakout may shortly echo Bitcoin, given the way it responds to macroeconomic adjustments equivalent to US debt issuance and financial easing.

Crypto-rotation returns to Bitcoin

On the identical time, the choices market is flashing extraordinary indicators. The hole between Ethereum's volatility pricing and Bitcoin is presently one of many widest ranges seen in just a few years.

Such excessive spreads usually mark turning factors, suggesting that merchants anticipate Bitcoin stability in comparison with Ethereum.

Because the macro circumstances tighten and merchants spin into a brand new story, This fall may mark the start of Bitcoin's subsequent highly effective rally.