Gold's market capitalization rose to an all-time excessive of $4,357 an oz. on Thursday, reaching an all-time excessive of $30 trillion.

The milestone market cap peak signifies that gold is now 14.5 instances the market cap of Bitcoin (roughly $2.1 trillion).

It's additionally 1.5 instances the market capitalization of the “Magnificent Seven” of the most important expertise corporations on the planet: Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta, and Tesla, whose mixed market capitalization is simply about $20 trillion.

In contrast to an organization's inventory market capitalization, which is predicated on excellent shares, gold market capitalization is a calculation of the full worth of all gold ever mined. Nonetheless, it’s not possible to know the precise quantity.

Bitcoin may benefit as gold soars this yr

Gold costs have risen 64% since Jan. 1 as traders flocked to retailer worthwhile property amid a weakening greenback, geopolitical tensions and commerce tariff points.

Gold has greater than doubled for the reason that starting of 2024. supply: TradingView

Many analysts imagine that when the gold market cools, capital will flow into into Bitcoin, also known as digital gold.

Associated: Bitcoin-Gold Correlation Will increase as BTC Follows Gold’s Path to Retailer of Worth

“Gold added greater than $300 billion to its market cap right this moment,” crypto analyst Sycoderick mentioned Thursday. “Bitcoin market cap is growing by one in every week,” he continued.

“I don’t perceive why most individuals can’t perceive that as quickly as gold stalls, BTC will collapse.”

“In a tense geopolitical context, particularly if gold flows decelerate, if Bitcoin can de-correlate with U.S. shares, this can in all probability be a post-trade deal,” enterprise investor Joe Consorti mentioned.

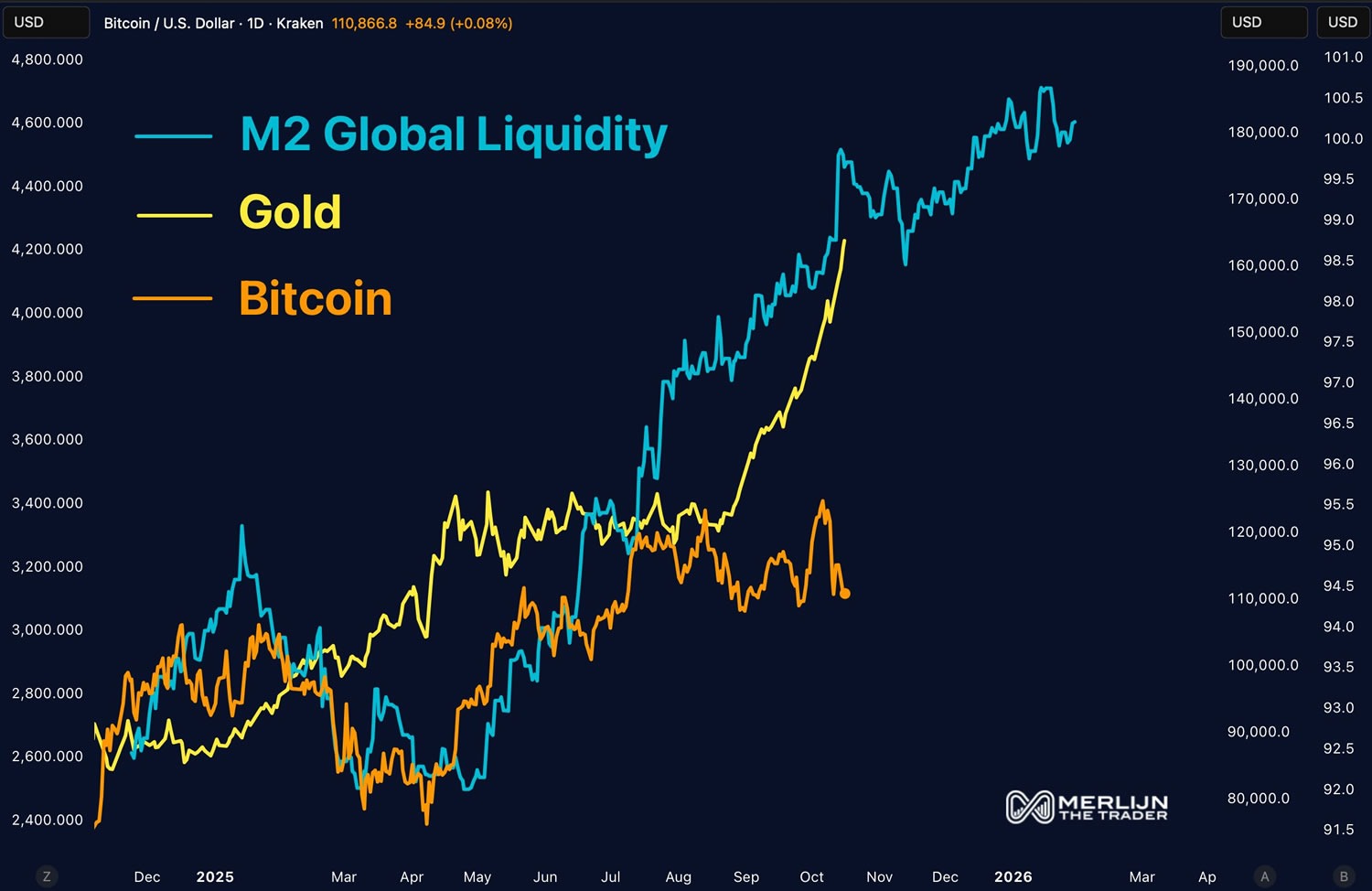

In the meantime, analyst “Merlin the Dealer” noticed that M2 international cash provide is surging, gold is working wild, however Bitcoin is sleeping.

“This divergence won’t ever final, liquidity will at all times be in danger (and) the comeback can be brutal,” he mentioned.

Bitcoin value lags behind gold and M2, however normally catches up. sauce: Dealer Merlin

Bitcoin (BTC) is presently up 16% from January 1st ranges and practically 14% from its all-time excessive.

journal: Binance shakes up Morgan Stanley’s safety tokens in South Korea, Japan: Asia Specific