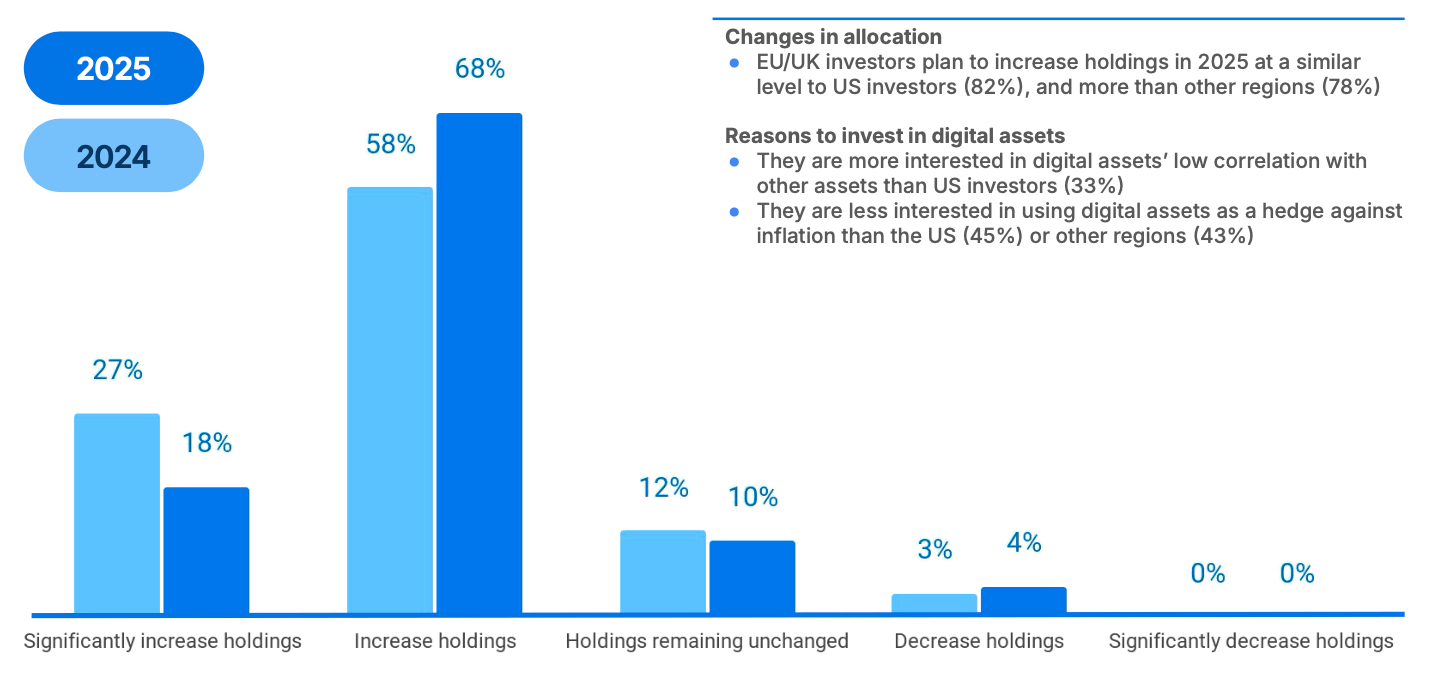

In accordance with a survey of 97 Coinbase and Ey-Parthenon establishments, EU and UK institutional buyers have considerably elevated their cryptocurrency allocations, with 86% planning to extend their holdings or enter the market in 2025.

Defi Engagement set to leap 2.5 instances in European establishments

Half of respondents plan to allocate managed belongings (AUM) to digital belongings, ranging from 46% in 2024, indicating a rising dedication regardless of volatility considerations.

Regulation readability emerged as the largest catalyst for development (58%), with licensing frameworks, custody guidelines and tax remedy being cited as vital wants. Volatility (51%) and market manipulation threat (42%) stay vital considerations, however 71% of establishments already maintain Altcoin past Bitcoin and Ethereum.

“Regulation readability was cited as the largest concern for digital asset managers. Respondents stated that rising readability in laws is the largest catalyst for transferring the business ahead,” says the Coinbase and Ey-Parthenon Report.

The examine writer added:

“European asset managers are centered on hoping for shopper recruitment and rising data of digital belongings that help recruitment.”

Precedence funding routes embody registered automobiles equivalent to Change-Traded merchandise (ETP), supported by 57% of respondents. Tokenization attracted robust curiosity, with 58% being “very ” in belongings equivalent to tokenized merchandise (56%) and actual property (42%). Nearly 70% of those buyers plan their allocations by 2026, primarily attributable to portfolio diversification.

Defi Engagement is projected to surge from 2.5 instances to 68% inside two years, however 66% of non-participants cited data gaps as a barrier. Stablecoins seems at sturdy utilities, with 81% of establishments utilizing or exploring overseas trade (75%) and buying and selling effectivity (67%).

Regardless of optimism, the Coinbase and Ey-Parthenon report stated 66% flagged an inside experience scarcity as a hurdle to Defi's adoption, whereas 62% emphasised regulatory compliance dangers. The findings level to a mature European market the place rising quotas are per a clearer framework and training calls for.

Coinbase and Ey-Parthenon carried out a world survey in January 2025, with European information reflecting establishments managing greater than $1 billion in belongings.