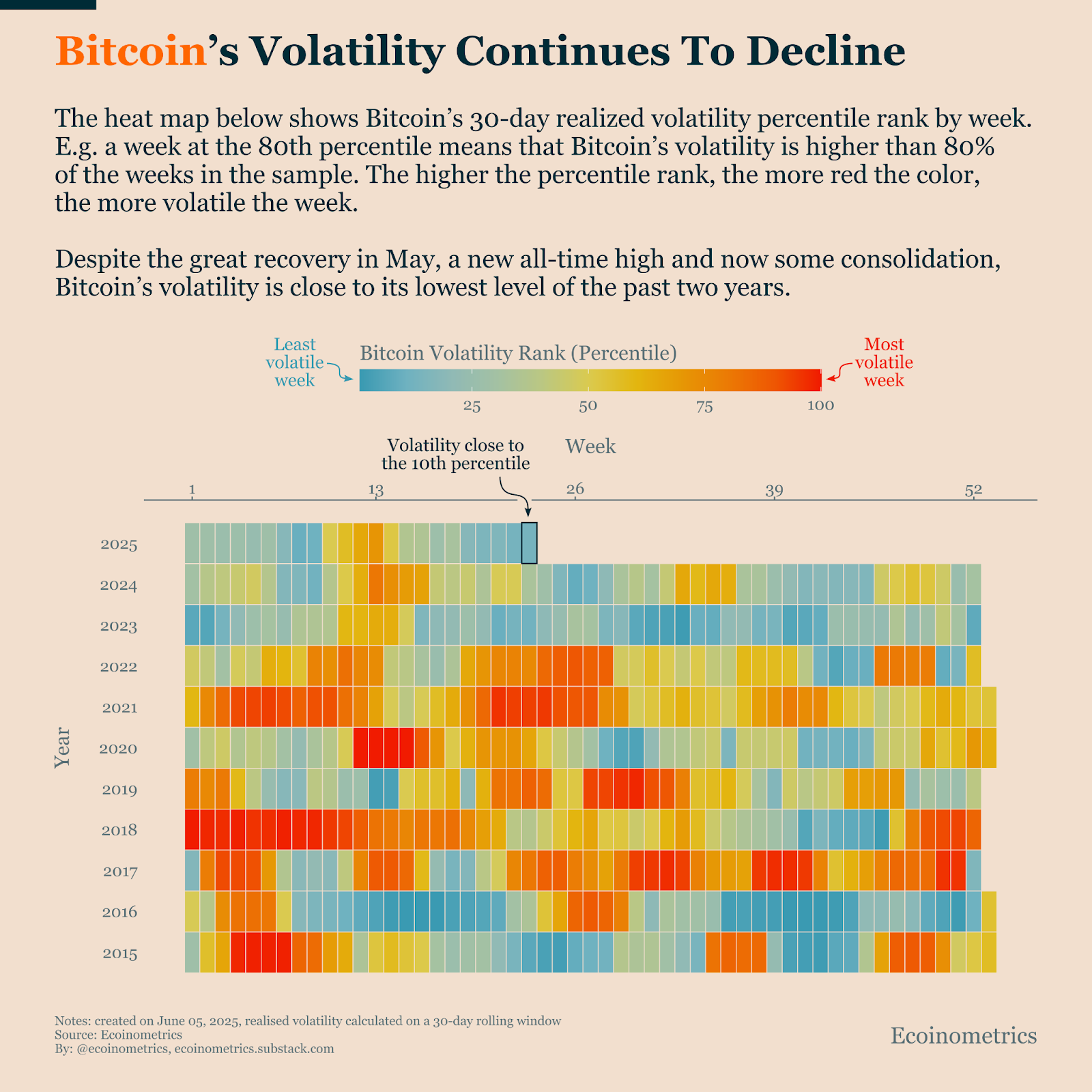

Bitcoin volatility has dropped to its lowest stage in almost a decade. This can be a signal of a serious structural change in market conduct. In response to new information visualized by Eco-Inometrics, Bitcoin's 30-day realized volatility is close to the tenth percentile. Because of this present market fluctuations have remained extra calm than 90% of all weekly durations since 2015, suggesting that Bitcoin is matured to a extra secure asset, even because it continues its robust upward development.

Regardless of the fast gatherings and property hit an all-time excessive in Might, this dramatic volatility decline might mark a serious shift in Bitcoin's threat profile, making it far more enticing to a brand new class of institutional buyers.

New Period of Stability: Bitcoin's Danger Profile is Altering

A warmth map based mostly on the percentile rankings of weekly volatility for Bitcoin past the 30-day rolling window exhibits this clear development in the direction of this delicate market state of affairs.

The chart exhibits deep purple zones and lots of weeks of extremely unstable, particularly between the previous few years, particularly between 2016 and 2021. In distinction, the charts for the second half of 2024 and 2025 are dominated by blue and inexperienced zones, representing durations of much less unstable.

Bitcoin volatility continues to say no. Supply: x

This shift means that Bitcoin is starting to behave like a mature monetary asset.

Associated: Bitcoin Asia will roll out free public admission to develop entry to the 2025 convention

This development is vital for portfolio managers who concentrate on threat administration. The brand new stability of Bitcoin will be included in a various portfolio with out violating conventional threat thresholds, doubtlessly unlocking broader capital from institutional finance.

Worth Actions verify bullish developments inside the upward channel

This volatility falls towards the backdrop of whereas Bitcoin costs destroy robust, bullish patterns on weekly charts. As of June 9, 2025, Bitcoin (BTC) is buying and selling at $107,841, forming a transparent upward channel on the weekly chart. This sample is marked by two upward slope parallel development traces from late 2022 onwards, capturing highs and better lows.

BTC/USD Weekly Chart – Ascending Channel Sample. Supply: tradingView.com

The rising channel is a bullish continuation sample that reveals constant upward momentum inside outlined ranges. The 50-week index shifting common (EMA), which is at the moment at $85,136, has served as a strong dynamic assist for all vital DIPs since mid-2023 since we discovered the ground on this key indicator.

Associated: Bitcoin (BTC) Worth Prediction June 10: Volatility will enhance almost 106K as bullseye breakout stage

If this construction is confirmed in a breakout in the direction of the higher boundary, the value of Bitcoin might rise by about 46% from its present stage. This may deliver the goal to almost $156,730, as proven on the high of the projected channel.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version isn’t responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.