Ethereum continues to commerce under main resistance ranges after weeks of correction. Regardless of some short-term rebound, the general market construction stays unsure. There are indicators of restoration within the value development, however a change in momentum has not but been confirmed.

technical evaluation

Written by Shayan

each day chart

On the each day timeframe, ETH continues to be buying and selling under a major downtrend line, which has been performing as a dynamic resistance line for the previous few weeks. The asset has rebounded from the $2,700 help zone, however has but to interrupt above the wedge and the 100-day and 200-day shifting averages, that are converging across the $3,600 mark.

Within the quick time period, a bearish crossover between the shifting averages can also be very probably, which may result in additional declines within the coming weeks. In the meantime, for patrons to regain management, the value wants to interrupt out of the $3,500 to $3,700 provide zone. Nonetheless, every part has to start out with a breakout from the downtrend line.

4 hour chart

The 4-hour chart reveals a clearer rebound after a false break under the decrease channel boundary close to $2,750. Worth shortly regained its stage and resumed its short-term uptrend throughout the ascending channel.

The worth is at present testing the identical $3,000 stage that triggered the earlier decline. If patrons are capable of flip that zone into help, we may count on additional bullish motion in direction of the $3,400-$3,500 zone. Nonetheless, if it fails right here, ETH will probably pull again in direction of $2,900 and fall under the channel once more.

The RSI can also be steadily rising, however it’s not overbought but. This reveals that regardless of momentum, the value continues to be weak to resistance zones.

On-chain evaluation

trade reserves

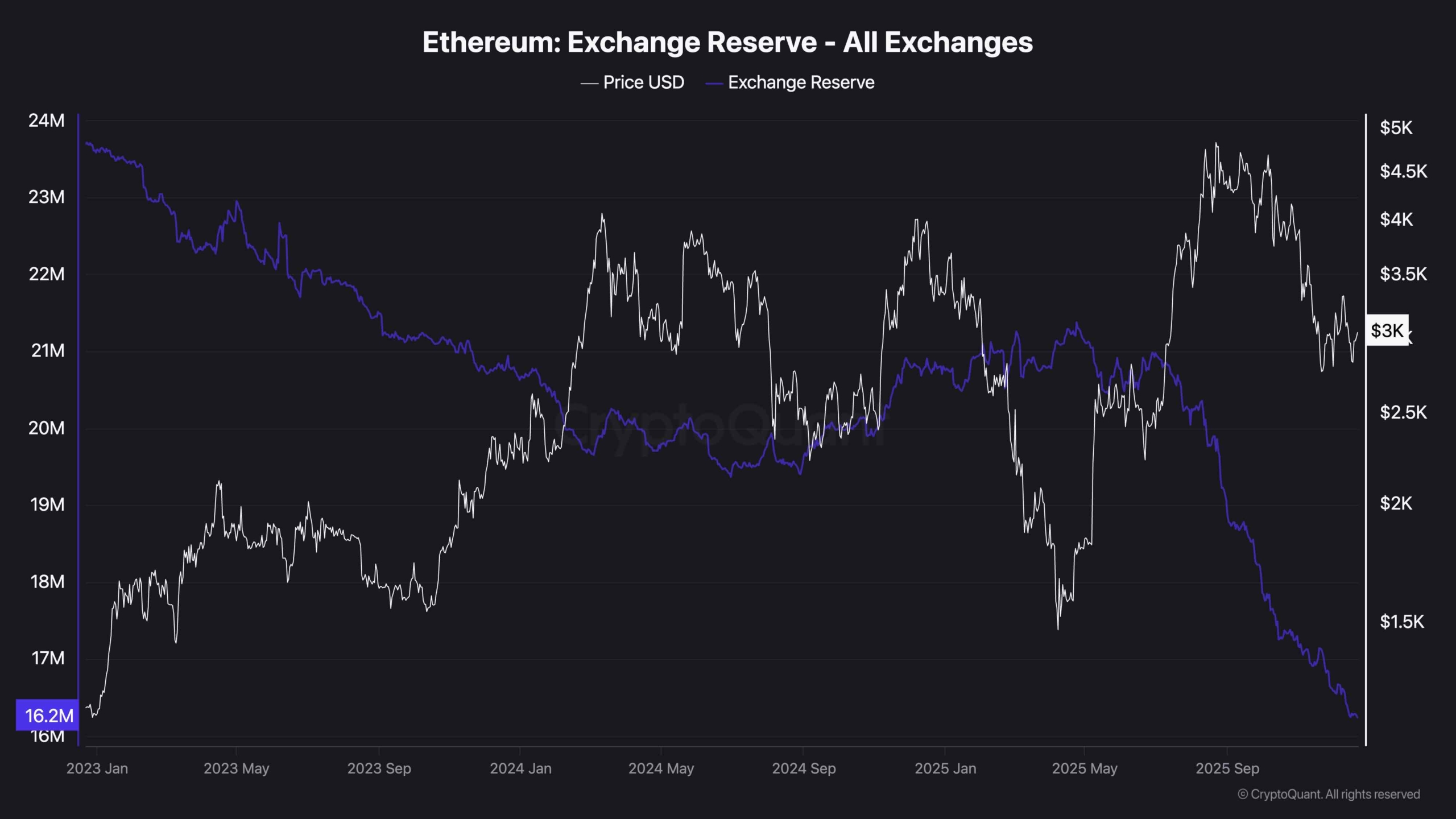

Ethereum’s international trade reserves proceed to say no aggressively and are at present at their lowest stage in years (roughly 16.2 million ETH). This implies long-term accumulation and lowered sell-side stress from holders.

Traditionally, a decline in international trade reserves is bullish within the medium time period and signifies cash are being moved from exchanges to chilly storage. Nonetheless, costs haven’t but mirrored this, which can counsel that market individuals are nonetheless ready for macro affirmation or exterior components earlier than shopping for aggressively.

Subsequently, whereas on-chain knowledge helps the long-term bullish case, short-term technicals stay fragile.