Ethereum continues to take care of its bullish tone above $3,000, supported by each a technical breakout and renewed on-chain energy. This resilience comes at a time when macro and geopolitical occasions, from rising tensions within the Center East to monetary instability throughout rising markets, proceed to place Bitcoin within the highlight.

Ethereum Worth Evaluation: Day by day Chart

What we will see from the day by day construction is that Ethereum has damaged out of the descending parallel channel and reversed into robust help on the $3,000 zone. Worth lately broke into a serious resistance zone between $3.3K and $3.7K, however confronted promoting strain and recorded a number of consecutive bearish candlesticks. This zone overlaps each the 100-day and 200-day transferring averages, making a technical barrier that the bulls must regain for continuation.

Regardless of the rejection, the RSI continues to be in wholesome territory and has retreated from its present overbought ranges. A possible low close to the $3,000 vary might act as a bullish springboard. The bullish outlook stays legitimate if the important thing day by day trendline additionally stays in place and the worth maintains the construction above the $2.7,000 zone. Nevertheless, regaining the $3.5,000 resistance degree is now essential to overriding the native prime.

Ethereum/USDT 4 hour chart

On the 4 hour chart, Ethereum After final week's impulsive rally, it’s consolidating round $3,000, simply above the earlier breakout zone, forming a possible base. The asset respects the $3,000 degree, however the higher downtrend line limits the final transfer at round $3.3,000. The present vary of $3,000 to $3,1,000 is appearing as an intermediate worth space and determination zone.

If consumers can escape of the $3.3,000 degree, it’ll open the door for a retest of the $3.5,000 degree and probably a breakout in direction of $4,000. Nevertheless, if the worth together with quantity falls under $3,000, the market might revisit the decrease sure of the sample close to $2.9,000 and even revisit the excessive confluence demand space at $2.6,000. Up to now, the construction continues to be favorable to consumers, however warning is suggested within the brief time period.

On-chain evaluation

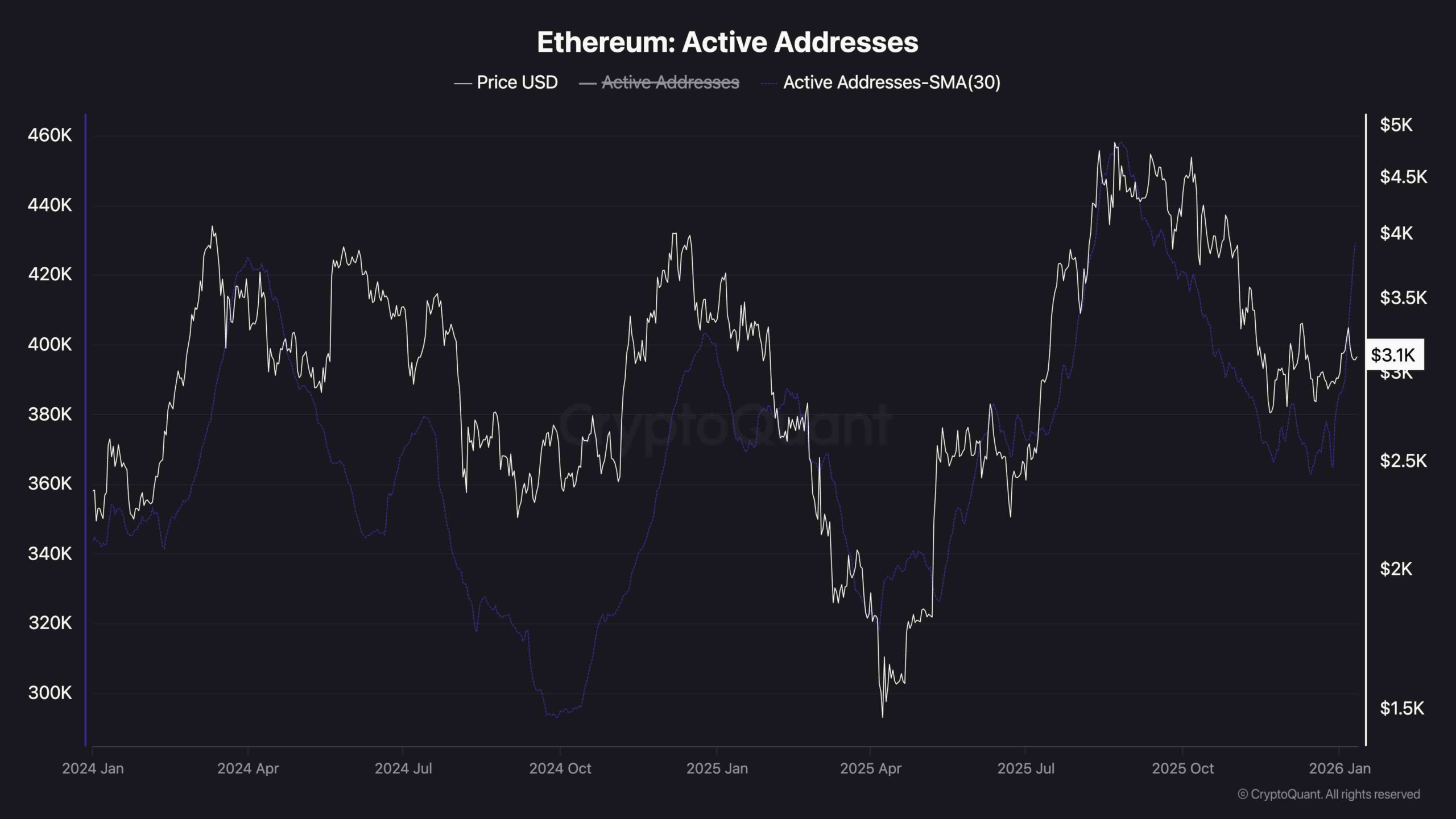

The 30-day SMA of Ethereum lively addresses is trending upward once more following a major drop from Q3 to This fall 2025. Traditionally, will increase in handle exercise typically precede or coincide with sustained worth will increase, and the newest improve isn’t any exception. In the mean time, lively addresses are hovering above 400K, mirroring the degrees seen in the course of the earlier massive uptrend.

This restoration is probably pushed by elevated DeFi exercise and re-staking of flows, suggesting that the community's fundamentals have improved. If this on-chain momentum continues and the variety of lively addresses will increase additional, it could strongly help sustained demand and strengthen our bullish view on Ethereum within the medium time period.