Whereas weekend storms within the US disrupted Bitcoin, BTC$87,708.96 Cryptocurrency merchants will flip to a metric generally known as the hash ribbon as rising prices of mining hit profitability and prompted corporations to scale back computing energy, or hashrate. This indicator is an indicator constructed on the premise that the costs of the most important cryptocurrencies usually attain lows in periods known as miner capitulations.

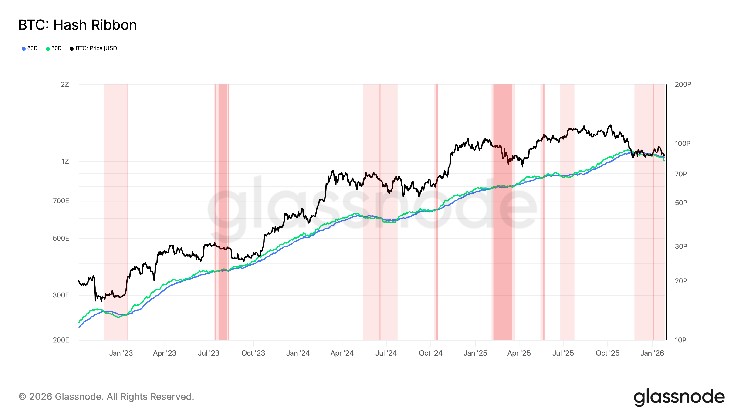

Previously, there have been durations the place miners had been pressured to decelerate or shut down their machines, adopted by durations the place Bitcoin strengthened when situations stabilized. That is mirrored within the hash ribbon, an indicator that tracks the 30-day and 60-day transferring common of hashrate on Glassnode.

When the short-term common falls beneath the long-term common, capitulation is signaled (proven in gentle purple). The worst stage is taken into account to be over when the 30-day studying is bigger than 60 days and is represented by darkish purple. Traditionally, when this restoration coincides with a change in value momentum from unfavorable to optimistic, marked by a transition from darkish purple to white, it coincides with a long-term shopping for alternative.

Hashrate, a measure of the overall computational energy securing the Bitcoin blockchain, has dropped by about 20% from about 1.2 zetahashes/second (ZH/s) to about 950 exahashes/second (EH/s). Which means the subsequent problem adjustment, used to take care of constant 10-minute block instances, is predicted to be roughly 17% decrease, which might be the most important problem drop since July 2021, when China banned Bitcoin mining.

The final time the hash ribbon capitulated was in late November, when Bitcoin hit a low of round $80,000. It's presently round $88,000.

An identical sample emerged in mid-2024. Following the capitulation of the hash ribbon and the unwinding of yen carry trades, Bitcoin bottomed out round $49,000 in August and rose to $100,000 the next January.

With the collapse of the cryptocurrency trade FTX in 2022, Bitcoin bottomed out at almost $15,000 amid the capitulation of miners. As soon as the hash ribbon normalized, the worth recovered to round $22,000.

The important thing query now could be whether or not the sample repeats and Bitcoin enters a brand new growth part because the hashrate and hash ribbon start to normalize.