Ethereum costs have been in crimson for 3 consecutive weeks as buyers stay on the sidelines.

Ethereum (ETH) traded this week at $1,758, the bottom stage since October 2023. Greater than 55% fell sharply from the very best stage in November final 12 months.

The ether crashed for a number of causes. Spot Ethereum ETF continues to expertise spills, an indication of a decline in demand from Wall Avenue buyers. The whole outflow over the previous three weeks has been over $513 million, bringing the cumulative web influx to $2.64 billion.

Ethereum continues to lose market share in main industries resembling Stablecoin processing and decentralized exchanges. Tron (TRX) has develop into the most important blockchain for tethering, however Layer 2 networks resembling Base and Kinkai have gained market share.

Furthermore, Ethereum is now not probably the most worthwhile participant within the crypto trade. This 12 months, it earned $210 million, a lot decrease than what networks created by Uniswap, Solana, Circle, Jito, Tron, and Tether. For a very long time, Ethereum has been probably the most worthwhile firm in crypto.

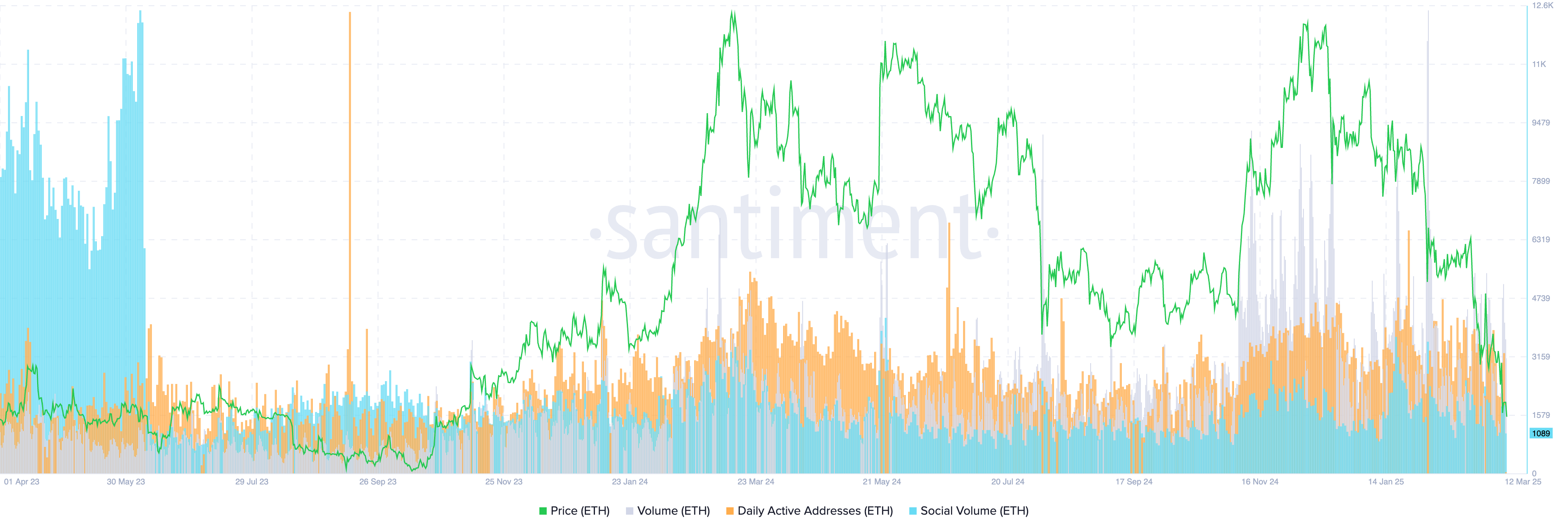

Santiment knowledge exhibits that the variety of energetic Ethereum addresses every day continues to lower. It is because ETH has an tackle of 293,000 on March twelfth, and has exceeded 717,000 earlier this 12 months. Social quantity has been transferring downward for the previous few months, as proven under.

ETH Day by day Energetic Deal with, Social Quantity | Supply: Santiment

Ethereum worth know-how evaluation

ETH Worth Chart | Supply: crypto.information

The weekly chart exhibits that Ethereum costs discovered a powerful barrier of $4,000, then fashioned a triple-top sample earlier than falling free. Ether is under key assist at this triple-top sample neckline of $2,135.

It’s also under the 50-week transferring common and the decrease aspect of the ascending channel. This decrease aspect connects the bottom swings in July 2022 and October 2023, September 2024, and September 2024. This lower is an indication that the bear has gained.

Ethereum is now not on sale, so there are downsides to return. The relative energy index strikes to 33 and additional factors to the draw back. The implausible oscillator moved beneath the zero line.

So you may see the trail the place the minimal resistance of the coin is bearish, and the preliminary goal is $1,500. A drop under that stage dangers falling to the subsequent psychological level at $1,000, 45% under your present stage. A transfer above the foremost S/R stage at $2,500 disables the bearish view.

You may prefer it too: Does the XRP worth crash to $1 or will it soar to $3.5 first?