In accordance with the most recent on-chain statistics, Bitcoin's prime 10 mining pool at present controls 94.2% of the worldwide hashrate, collectively holding $6.52 billion in Bitcoin throughout its pockets.

Inside the key stash of Bitcoin's greatest mining pool and its counterparty

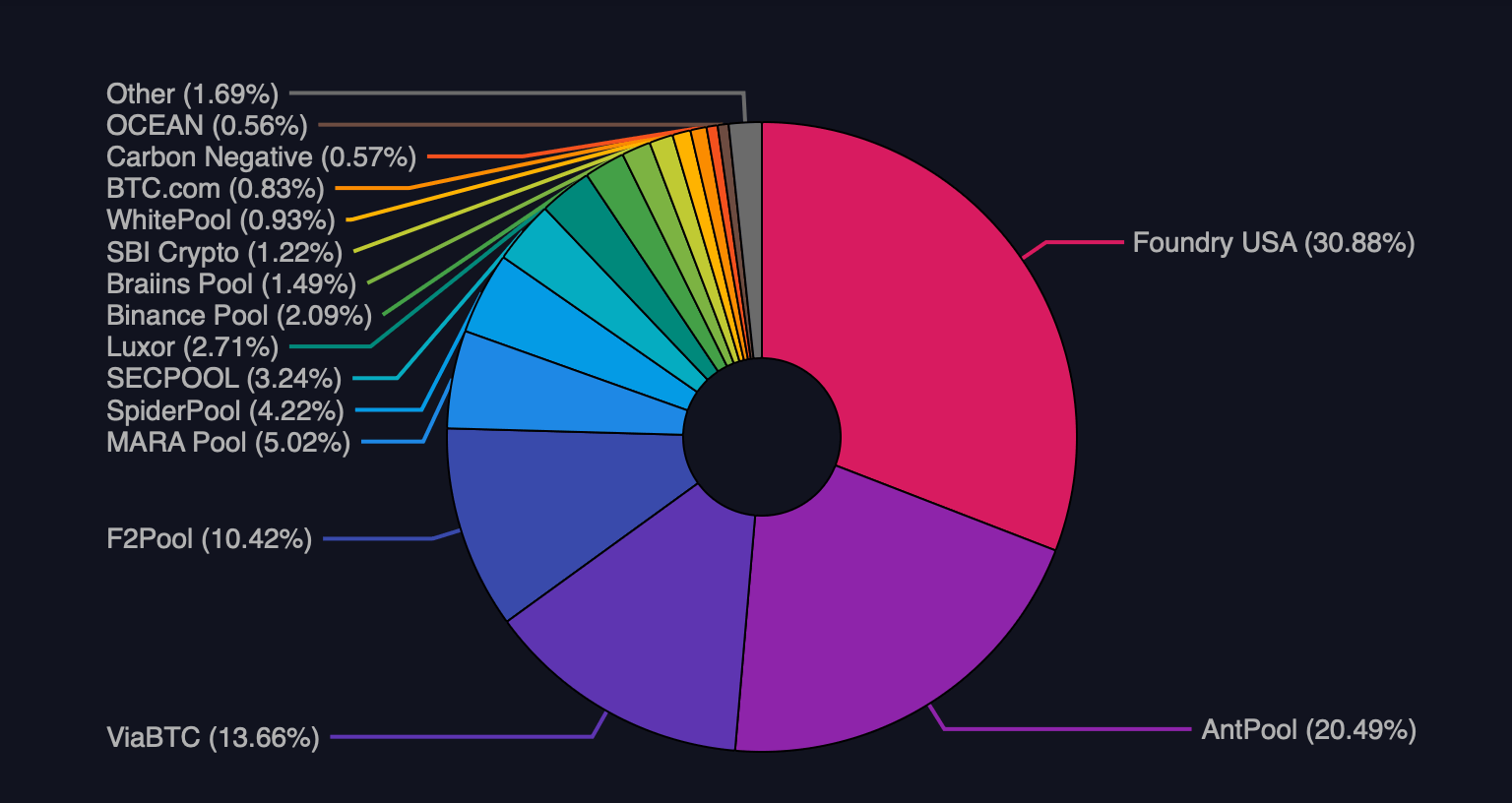

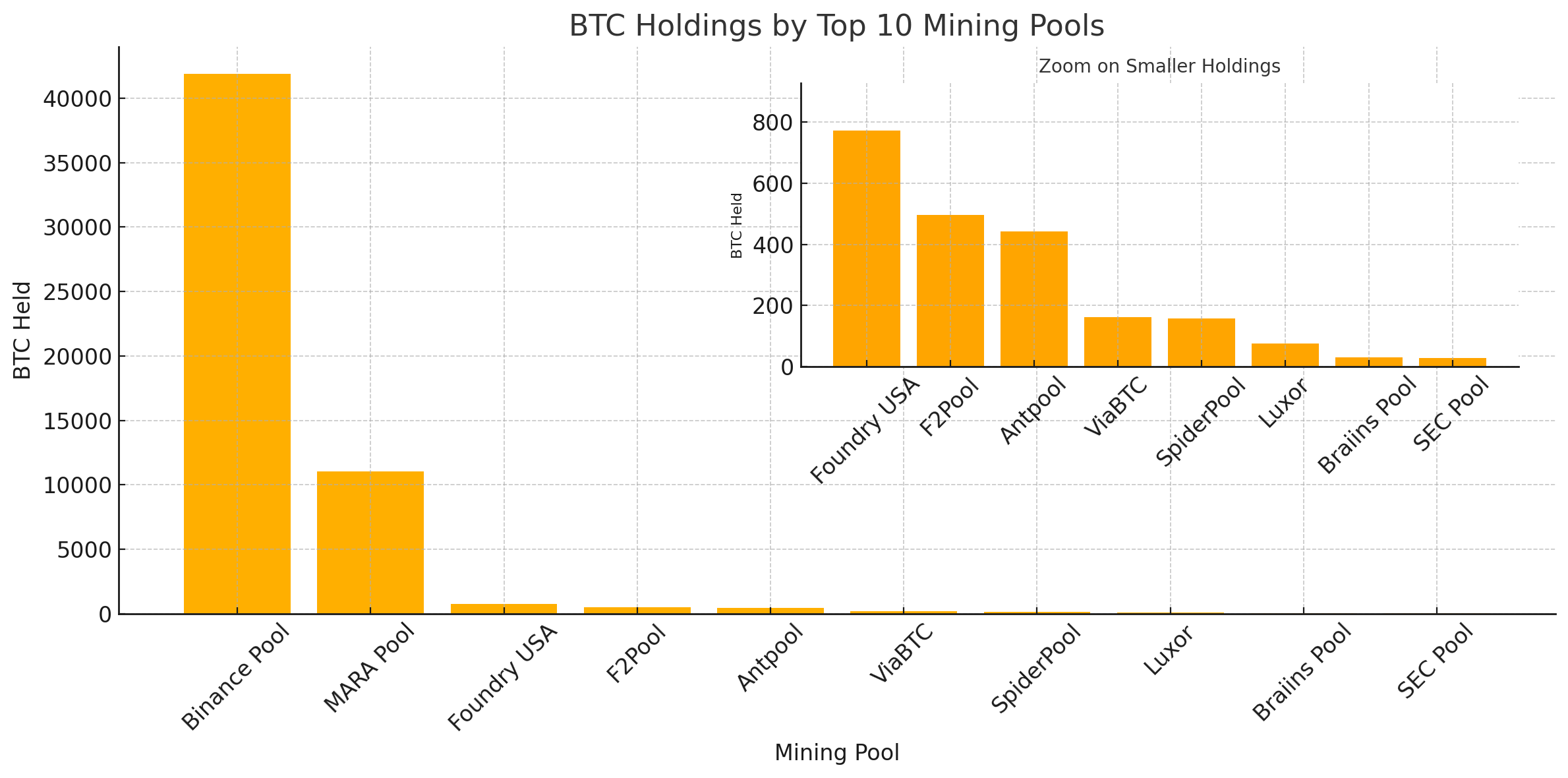

As of in the present day, the ten largest mining swimming pools by block manufacturing are Foundry, Antpool, Viabtc, F2pool, Mara Pool, Spider Pool, Sec Pool, Lucor, Binance Pool and Braiins Pool. Foundry leads the pack at 30.88% of the world's hashrate. Arkham Intelligence's on-chain knowledge exhibits Foundry's Wallets embrace 772.652 BTC value $91.2 million. This can be a notable DIP from over 2,000 BTC held in mid-March 2024.

Relating to counterparties, Foundries continuously commerce on Coinbase. Antpool is second in Hashpower, at present managing 20.49% of the worldwide complete. As of July thirtieth, Antpool held 441.839 BTC at $52.15 million, with Coinbase additionally serving as a serious counterparty. VIABTC ranks third at 13.65% of the worldwide hashrate, in keeping with Mempool.area Stats, with the entity nonetheless sustaining 162.086 BTC value $19.13 million on the time of writing.

In accordance with Mempool.area Stats, the hashrate distribution for July 30, 2025.

VIABTC works intently with its owned and supported Coinex. The 2 are tightly linked via shared infrastructure and providers. On Wednesday, F2Pool held 10.42% of its complete hashrate, with its pockets containing 495.322 BTC value $58.46 million. F2Pool works with two main counterparties: Coinbase and Custody Agency Cobo.

Mara Pool accounts for five.01% of Bitcoin's complete computing energy. The corporate additionally serves because the Bitcoin Treasury Ministry, with a substantial 50,000 BTC within the guide. Mara's mining pockets alone prices 11,034 BTC at $1.3 billion. Most of this stash is probably going protected by NYDIG custody, and the Onchain sample means that Mara will recurrently commerce with Foundry. The Spider Pool controls 4.22% of Bitcoin's complete hash energy and holds 157.994 BTC at $18.65 million.

Spider Pool trades on Coinbase each day. Subsequent is the SEC pool, which contributes 3.24% to the community hashrate. As of in the present day, the SEC Pool pockets holds roughly 28.616 BTC, value $3.38 million. On-chain exercise exhibits that the SEC pool interacts with each Cobo and Coinbase, however Coinbase seems to be a extra frequent associate. Ranked eighth in hashrate, Luxor Expertise operates 2.71% of the community's energy. Presently, Luxor Tech owns 75.278 BTC, $8.91 million. Like some others, Luxor additionally has common transaction flows utilizing Coinbase.

The ninth on the record is the Binance Pool, which has a comparatively small 2.09% slice of world hash energy. Nonetheless, the Binance Pool Pockets tracked by Arkham exhibits an astounding 41,919 BTC, managing 41,919 BTC value $4.96 billion. Ending the highest 10 is Briins Pool, a pool beforehand generally known as the slash, at 1.49% of the worldwide hashrate. Braiins' pockets contains 30.983 BTC, value $3.67 million at in the present day's charge. The highest 10 Bitcoin mining pool collectively holds 55,117.77 BTC as of in the present day, with an estimated complete of $6.52 billion.

The huge quantity of Bitcoin held by these prime miners underscores the twin function of each infrastructure suppliers and long-term stakeholders. Their collective stash, value billions, locations them in one of many protocol's most influential financial actors and never merely safe a community.

Such a concentrated holding means that these swimming pools are accumulating for strategic functions, not merely promoting block rewards. Some are brazenly and a few secretly. Whether or not the Treasury protects, collateral, or institutional leverage, this rising BTC serves as a miner as a robust participant in Bitcoin's evolving monetary ecosystem.