Danger course merchants who precipitated a giant loss in one in every of Hyperliquid's swimming pools have come again once more with one other Ethereum (ETH) benefit. This time, the merchants used 25x leverage, poses the chance of a substitute as soon as extra.

The whale dealer, who precipitated greater than $4 million within the misplaced liquidity of Hyperliquid's pool, has returned once more in one other lengthy place at Ethereum (ETH). This time, the merchants shortly switched between the harmful brief and lengthy positions of ETH, once more exposing the trade to potential liquidation. Following the information, the high-lipid hype native token went down additional, slipping into $12.35.

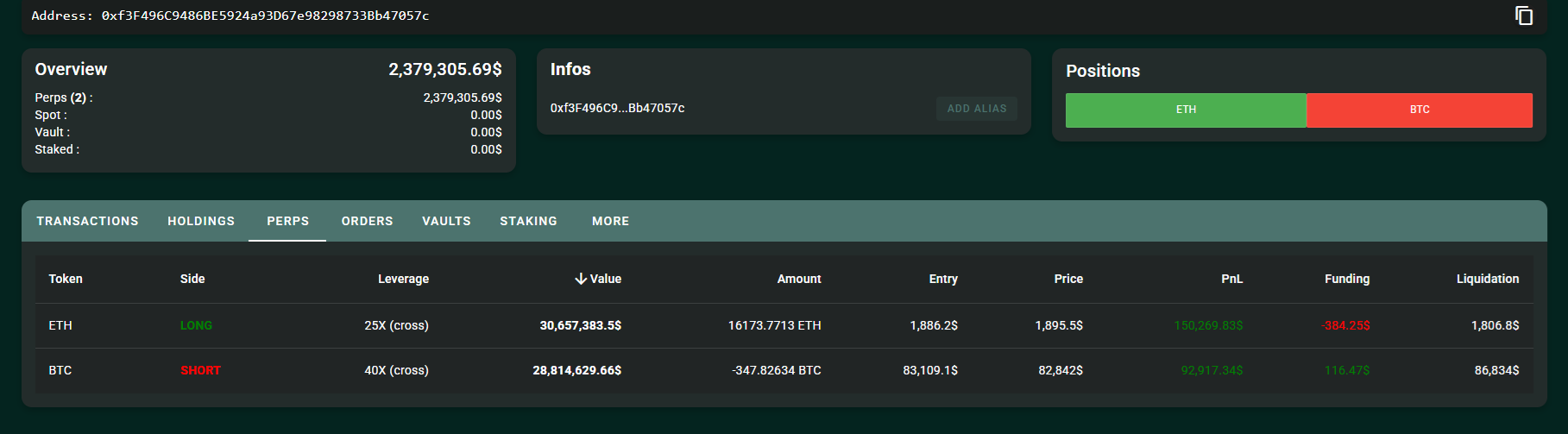

The brand new batch in place is smaller because the whales deposited $2.3 million on excessive lipids. Nonetheless, 25x leverage might have a particular impact in place. place The excessive lipid accounts of whales had been nonetheless energetic because the crypto market entered one other volatility.

The dealer's place was on the inexperienced as he bets on ETH bounce and additional slides in BTC. |Supply: Hyperliquid

On-chain information precipitated the whales to journey by the GMX, leading to a 4.08m USDC deposit. Initially, the whale shorted the ETH, however then closed its place and moved its property for a very long time. The whales secured a revenue of $177,000 by their place earlier than shifting to excessive lipids once more.

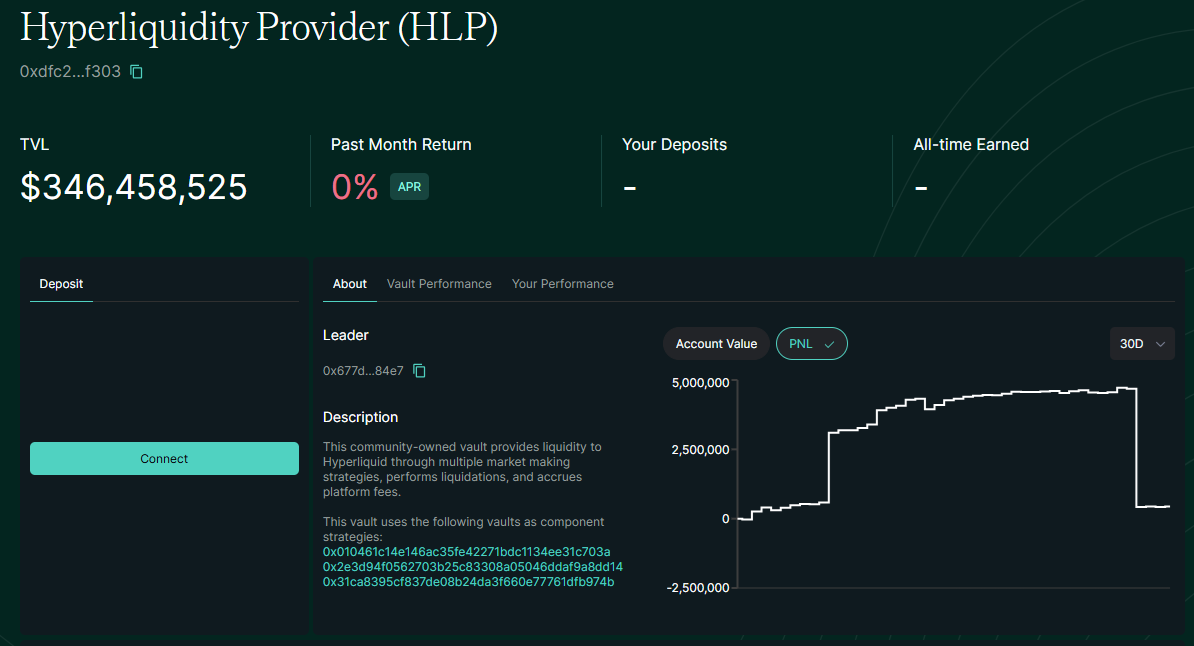

Excessive lipid neighborhood safes nonetheless carry a lot decrease liquidity after taking on the whale's first ETH ever after liquidation.

The brand new place for Whale needed ETH to be leveraged 25x and lowered Bitcoin (BTC) with 40x leverage. The brand new positions for merchants are once more utilizing the utmost accessible leverage with excessive lipids, even after current restrictions. Beforehand, whales took a dangerous place when buying and selling at 50x leverage.

Dealer whales are nonetheless inexperienced after BTC, ETH market strikes

A number of hours after establishing a leveraged place, the dealer whale was nonetheless within the cash. After ETH recovered, the place was worthwhile, however BTC slipped for beneath $83,000.

As of March 13, ETH was buying and selling at $1,898.86 and BTC had returned to $82,952.12.

The whale's location exceeded $100,000 with a comparatively small revenue. Nonetheless, ETH's funding fee has turned purple as a result of lengthy positions. The whales got here in at $1,886.20 per ETH as costs floated simply above the liquidation stage.

With no near-immediate whale gathering, the whales threatened to go away excessive lipids in one other poisonous, liquidated place.

ETH is at present attempting to carry a assist stage of $1,887, the place merchants put up the most important accumulation of liquidity. ETH stays extraordinarily harmful in terms of liquidation, with liquidation at $8.22 million.

Within the final 4 hours, ETH has seen $4.8 million in lengthy liquidation. $342 million With a brief settlement. As ETH has confronted lengthy drawdowns over the previous three months, the chance of lengthy positions stays largely contested. A rebound was anticipated, however it was all the time behind by deeper value slides. Beneath these situations, sudden gatherings will profit the leveraged whales most.

Bybit CEO doubts intentional technique

Bybit CEO Ben Zhou believes the whales are intentional to liquidate large-scale leveraged positions. He views extremely leveraged buying and selling as a possible downside for each DEX and centralized market operators.

Zhou believes that the whales selected a simple approach by liquidation.

“What occurred primarily was that the whales left the excessive lipid liquidation engine that was used. Think about opening a 300m lengthy place to the ETH and opening at a margin of about $15 million with 50x leverage. I commented X's Zhou.

Zhou proposed an answer that may be utilized in different exchanges. On this answer, massive positions robotically lowered leverage. This prevents whales from exploiting accessible liquidity and saddle exchanges together with poisonous debt. Zhou additionally believes that reducing leverage thresholds for prime lipids are nonetheless open to manipulation. One other potential vector is creating a number of accounts. That is meant to stop the trade from screening.

Excessive lipid neighborhood safes nonetheless have a lot decrease ranges of fluidity. |Supply: Hyperliquid

Zhou argues that as a result of its huge leverage, excessive lipids are nonetheless aggressive and reducing restrictions might be dangerous to the corporate. Due to this, Dex is extraordinarily susceptible to assault.

However, current liquidation has harm the high-lipid neighborhood that used safes for passive earnings. The involvement of dangerous merchants was Vault's Black Swan occasion, beforehand gaining liquidity of over $4.8 million.