Bitcoin continues to be execute a collection of value actions It looks as if we could also be in a deeper part of correction. Technical evaluation shared by crypto analyst Chiefy on social media platform X means that Bitcoin is repeating the macro construction seen after the cycle tops in 2017 and 2021. If this sample continues to develop with comparable symmetry, it’s predicted that Bitcoin might fall to $35,000 throughout the subsequent few days.

Bitcoin mimics 2017 and 2021 cycle construction

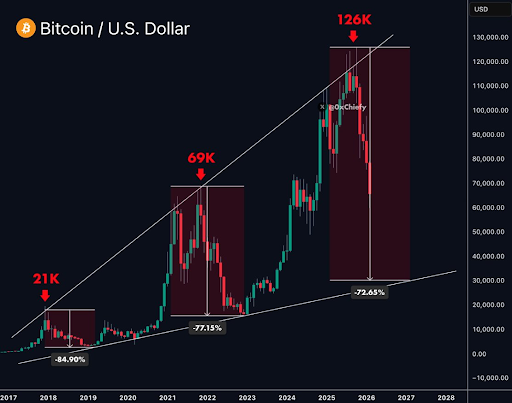

Chiefy's Chart compares three main peaks: A excessive of $21,000 in 2017, a peak of $69,000 in 2021, and a current excessive of simply over $126,000. The important thing development is that in each of the primary two instances, Bitcoin ended up experiencing extreme retracements of over 70%. Discovering the long-term backside value.

The primary retracement started shortly after Bitcoin broke above $21,000 in 2017, and Bitcoin fell 84% throughout the 2018 bear market. After peaking at $69,000 in 2021, the decline has reached about 77%. Chiefey stated the fractal correction is close to excellent, elevating the likelihood that the market is nearing a capitulation stage just like previous cycles.

The present correction from $126,000 is beginning to resemble earlier declines in construction. If Bitcoin repeats an identical proportion decline, value predictions would put the cryptocurrency within the $30,000 to $35,000 vary. The analyst goes additional and warns that such a transfer might unfold throughout the subsequent 10 days if this sample continues as earlier than.

Weak ETF demand and whale inflows add to bearish stress

Numerous knowledge on the on-chain suggests a cautious outlook Amongst crypto traders. In keeping with Glassnode, the 30-day easy shifting common of internet flows for each Bitcoin and Ethereum spot ETFs. It was adverse for Many of the previous 90 days. This reveals that there are at present no clear indicators that demand is robust sufficient. Absorbs sustained promoting stress.

Apparently, CryptoQuant’s whale influx sign indicator signifies the typical Month-to-month influx quantity $BTC Funds from whales to Binance elevated considerably as Bitcoin fell from $95,000 to $60,000. These influxes elevated from about 1,000 folks $BTC By late January, there have been almost 3,000 folks. $BTC There was a notable spike of about 12,000 folks in February. $BTC Even simply on February sixth.

Since February 1, greater than 5,000 instances have been recorded in seven enterprise days. $BTC Each day inflows of funds from this huge group of traders. Such actions point out an intensification of remittances to exchanges. Massive Bitcoin Holders to Binancea development that undoubtedly contributed to the value collapse. It is because the rise in overseas change inflows displays elevated promoting stress.

On the time of writing, Bitcoin was buying and selling at $66,015, down 1.7% up to now 24 hours.

Featured picture from Pixabay, chart from Tradingview.com