Nobody has a crystal ball, but when Bitcoin continues to behave in line with previous cycles, it's in all probability already peaked.

Bitcoin hit an all-time excessive on October 6, however was unable to increase its positive aspects because the post-halving clock approached the height zone seen in earlier cycles.

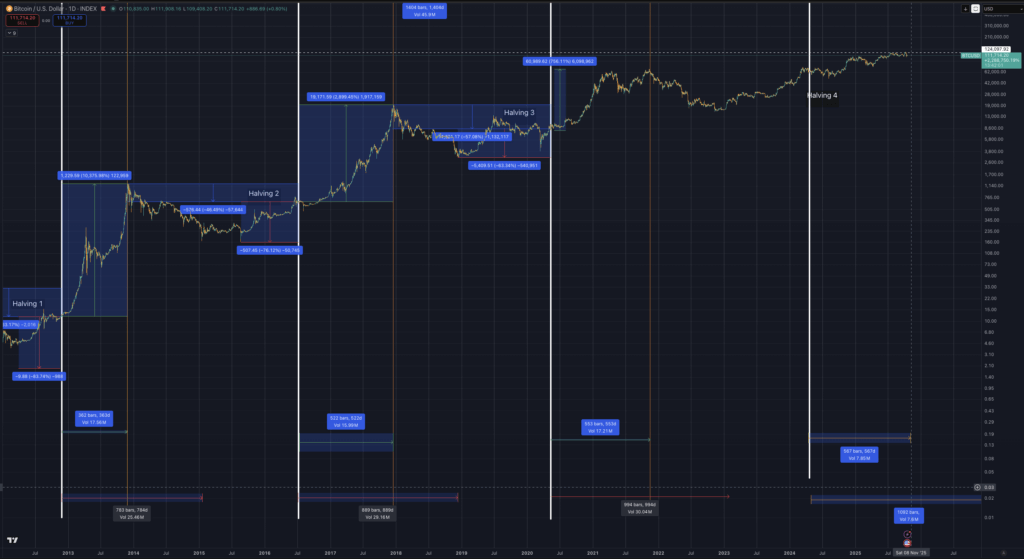

The 2024 halving will happen on April twentieth, with earlier peaks reached roughly 526 days after the 2016 halving and 546 days after the 2020 halving.

At this tempo, the present cycle peaks from roughly mid-October to late November.

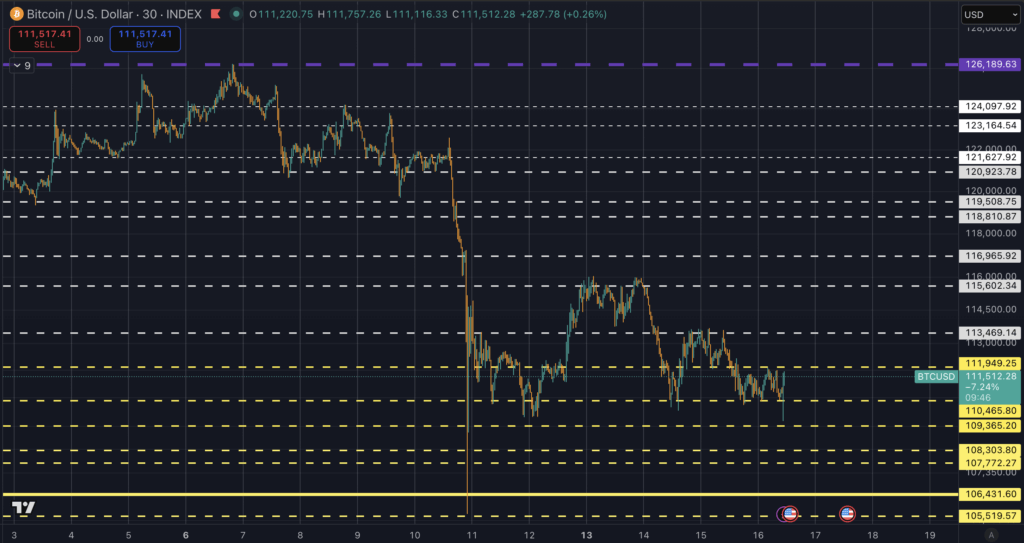

The inventory's worth round $126,200 on October sixth has not been recovered, and spot buying and selling has moved between $105,000 and $114,000, with main assist close to $108,000.

The timing case now intersects with clear macro shocks.

Since hitting file highs, the White Home has introduced new tariffs on Chinese language imports, together with imposing tariffs of as much as 100% on some merchandise. The headline despatched shockwaves via cryptocurrencies, as futures contracts deleveraged round $19 billion in liquidations inside 24 hours.

By-product positioning has modified as properly, with elevated demand for draw back safety following a wipeout. Funding stress on the standard facet flickered as Reuters reported an uncommon spike in using the Federal Reserve's standing repo facility, an indication that short-term greenback funding is tightening in the identical window.

Flowtape will stay because the interim arbitrator. The US Spot Bitcoin Change Traded Fund has been performing as a marginal purchaser this cycle. Farside Traders integrates and publishes each day creations and redemptions, which makes it simple to learn whether or not money is getting into or exiting the wrapper.

Context for weekly capital flows is supplied by CoinShares, which tracks a broader vary of digital asset merchandise. Broad internet inflows over a number of classes would go away the door open for late-cycle marginal highs.

The unstable detrimental growth will strengthen the view that October sixth marked the highest of the cycle.

A situation framework helps translate these inputs into costs and instances.

Bitcoin's historic bear market lasted about 12 to 18 months, with a peak-to-trough drop of about 57% in 2018 and 76% in 2014, a sample demonstrated by NYDIG.

For the reason that present market construction consists of spot ETFs and deeper derivatives markets, a lighter vary of 35-55% is an inexpensive benchmark for draw back danger administration. Making use of it to $126,272 produces a trough zone of roughly $82,000 to $57,000.

That schedule would roughly match the tempo of the halving referenced above, with costs hitting a low someplace in late 2026 to early 2027.

If the timing, macros, and stream are all leaning in the identical path, the likelihood that the highest is already there’s excessive. The halved clock is delayed inside regular limits.

The tariff shock created uncertainty in the true financial system and a visual danger premium in derivatives. Tight greenback liquidity has led to a surge in using repo services.

Bitcoin worth has did not maintain above its early October excessive and is at the moment buying and selling under its preliminary assist. The burden of proof is on demand, however ETF tapes are the cleanest on a regular basis instrument.

Whereas some argue that the standard Bitcoin cycle ended with the launch of ETFs, new demand has by no means ended previous cycle patterns. Are we actually going to do it now?

Up to now, every Bitcoin cycle has seen diminishing returns. If $126,000 is certainly the height of this cycle, you’d have made an 82% revenue.

The primary decline (cycle 1→2) diminished returns by as much as 57%.

The following drop (cycle 2→3) confirmed an extra lower of roughly 84%.

If this charge of decay had continued proportionately (roughly 70-80% lower per cycle), the anticipated return would have been roughly 50-70% as a substitute of 82%.

Due to this fact, the potential 82% acquire already exhibits a small decay in comparison with the exponential decay sample implied in earlier cycles.

The relative returns for this cycle are above development, which can counsel that although this can be a high, the cycle is maturing however nonetheless resilient.

Though historic returns present a transparent decay curve, the potential 82% rise on this cycle barely breaks the anticipated downward slope, suggesting both the onset of a extra gradual decay section or structural adjustments (e.g., ETF demand, institutional capital) that average the long-term development of diminishing returns.

Within the reverse case, a particular sequence is required.

5 to 10 consecutive days of widespread internet additions throughout the ETF advanced would point out sustained demand for money.

Choices skew must pivot in direction of greater than a short lived pullback, a change that third-party dashboards corresponding to Laevitas are exhibiting.

The spot ought to then clear and maintain above $126,272 with growing quantity.

This path might see a slight new excessive within the $135,000 to $155,000 space earlier than circulation resumes, a sample that was repeated in our previous cycle commentary.

If this example doesn’t develop by the tip of the standard 518-580 day interval, time itself will develop into a headwind.

Miner provides one other ahead queue. After the halving, income per unit of hash has been compressed, and the spring surge has eased price shares, tightening money stream for older fleets. Financial situations and fleet turnover dynamics are adopted by the hashrate index.

If costs decline whereas power prices stay sturdy, miners might periodically promote to cowl working prices and repair obligations. This provide tends to endure from skinny orders after shocks. On-chain ranking bands corresponding to MVRV and MVRV-Z will help body late-cycle danger, however shouldn’t be used alone as absolutely the thresholds range from cycle to cycle.

Macro has its personal scoreboard.

The greenback's efficiency interacts with danger urge for food, and the Reuters Foreign money Wrap gives an replace on its relative energy. Rate of interest expectations are tracked by CME FedWatch and will help interpret whether or not tariff shocks and subsequent inflationary pressures are altering the path of coverage.

If easing expectations decline whereas repo services proceed to rise, liquidity in speculative property might proceed to be constrained.

Readers can monitor the framework utilizing the desk under.

Leverage profile requires persistence. As an alternative of chasing upside, merchants added draw back hedges after the tariff shock. That is in line with the market focusing extra on capital preservation than momentum.

If ETF inflows don't resume quickly, sellers can hedge in opposition to the flows from put purchases, limiting the market's rally. The tape requires each day consideration because the construction can change quickly as soon as influx resumes.

None of this reductions the structural bid for Bitcoin created by the ETF wrapper or the long-term results of fastened provide. This maps out a late-cycle setup that’s at the moment driving macro strain. The halving timer is nearing the tip of its historic interval.

The excessive worth on October sixth is the highest worth. The distribution case stays simpler to learn till the stream adjustments the stability.

talked about on this article