Latest evaluation reveals the importance of the present Bitcoin worth degree and the way its subsequent transfer will form the continuing bull market cycle.

Bitcoin (BTC) Traders who purchased the asset originally of the 12 months are seeing much less and fewer return. Premier property have fallen from an all-time excessive of $126,200 in October, and year-to-date development has slowed to 9.72%.

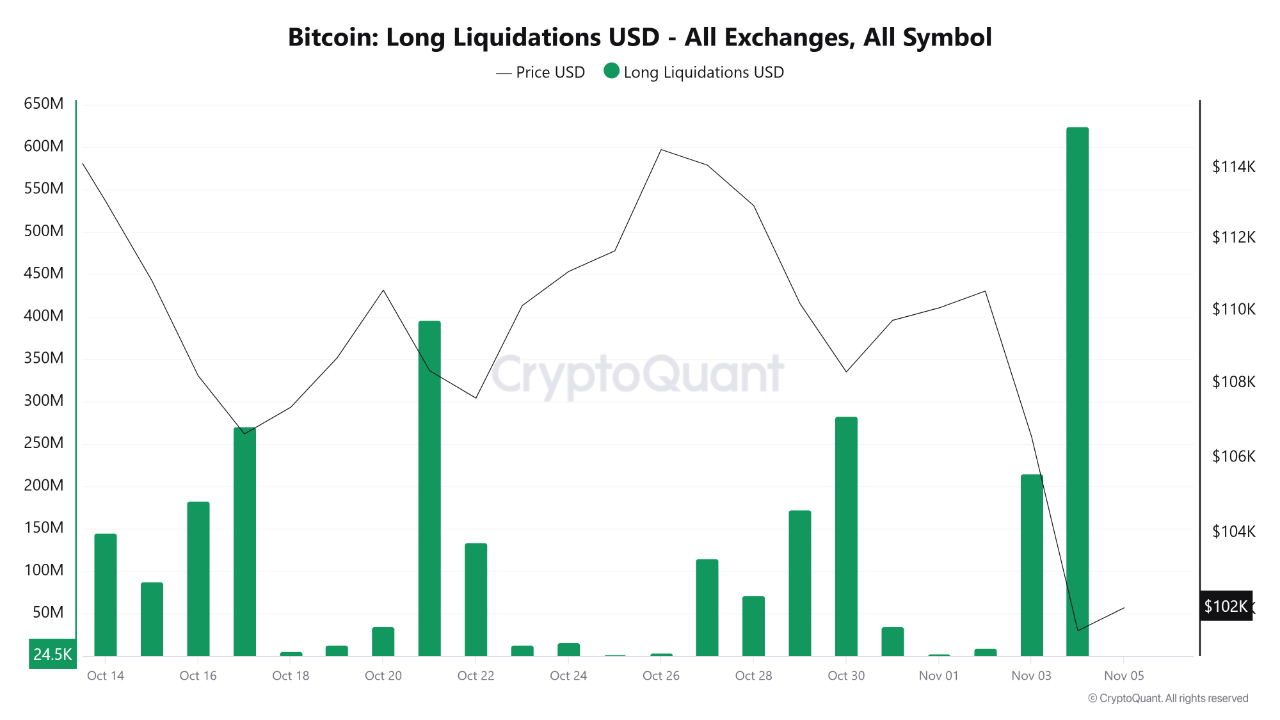

Yesterday, BTC skilled a correction in US shares. Whale aiming for revenue. Bitcoin hit an intraday low of $98,900 earlier than rebounding again to $101,000.

Bitcoin clearing knowledge

Nevertheless, Bitcoin has proven resilience, rallying to $101,000 yesterday and rising additional to $102,730 on the time of writing. In the meantime, Crypto Onchain has recognized vital particulars concerning the $101,000 help that can decide subsequent worth motion.

Bitcoin bulls’ final line of protection

Particularly, the evaluation highlights that the bulls intervened at $98,000, pushing Bitcoin to probably the most crucial degree for the bulls. This degree coincides with the decrease help development line of the ascending channel on the every day time-frame.

bitcoin rising channel

The report notes that the $101,000 help line is greater than a psychological line. That is the development line that decided Bitcoin's market construction from October 2023 onwards.

In the meantime, Crypto Onchain famous that defending the underside of the channel can be decisive in Bitcoin’s short-term worth trajectory. A pullback might happen if the $101,000 help is defended, and the present decline might grow to be a shopping for alternative.

Nevertheless, if Bitcoin is unable to maintain this degree and the bearish momentum continues, it would go towards its market construction and put the bull market in danger. This may mark a big correction to new lows for the most important cryptocurrency by market capitalization.

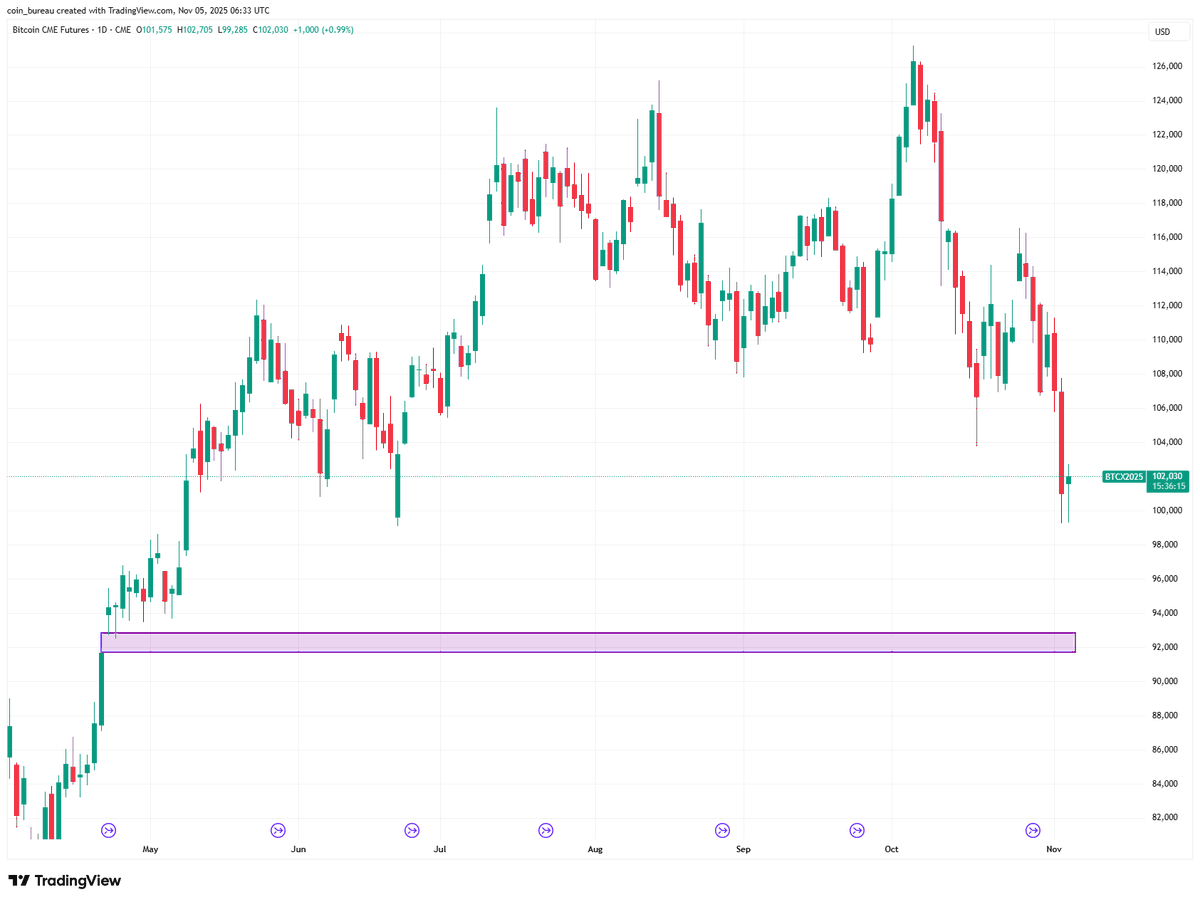

Is it potential for Bitcoin to succeed in $92,000?

Nonetheless, one other evaluation exhibits that there’s a CME hole close by that Bitcoin might shut. The futures market chart exhibits a niche between $92,000 and $93,000, which is 10% away from the present market worth.

Bitcoin CME Hole is $92,000

Bitcoin has traditionally tended to shut these CME gaps earlier than the following rally, and market observers usually are not ruling out that risk. Nevertheless, sturdy help close to present ranges might thwart this transfer and push BTC northward.