This can be a section of the Provide Shock Publication. Subscribe to learn the total version.

Everyone knows that halving doubles manufacturing prices. That is the truth that media have a tendency to decorate each 4 years as an existential risk to Bitcoin.

Miners in search of earnings should additionally compete with fluctuating difficulties and power prices. However when costs go up, a minimum of they'll get more cash for each coin they mine.

At $88,500, Bitcoin has been 36% forward since half. Extra importantly, it has elevated by 130% on common value on the final stage of the earlier harving cycle (greater than doubled!)

Because it progresses, the upper costs appeal to extra miners. This has resulted in Bitcoin's complete hashrate to an all-time excessive, in addition to troublesome.

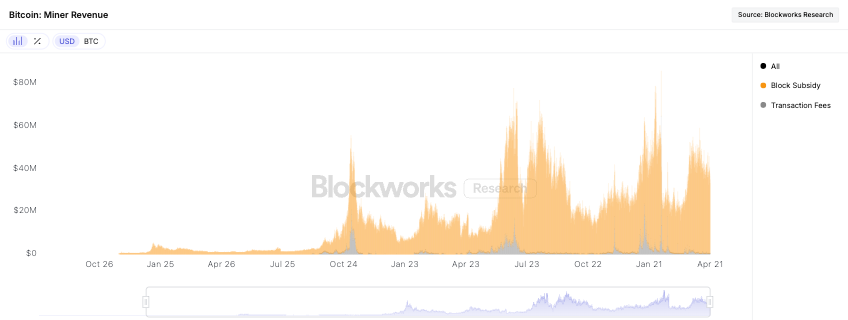

In actual fact, mining revenues are kind of constant alongside the five-year common, however are actually 5 occasions greater than in April 2021, 40% greater than the earlier half earlier than.

Due to this fact, producing Bitcoin is harder than ever. However how a lot does it price to mine 1 BTC now? Cambridge at the moment estimates $48,671 per coin, however the solutions all the time make it troublesome to rely closely on electrical energy and different overhead prices.

The value of robust Bitcoin maintains miners' revenues roughly equal to the height of the 2021 and 2024 bloom market (Supply: Analysis on Blockworks).

For instance, let's use Marathon, a $4 billion mining large liable for round 7% of Bitcoin's complete hashrate.

Three-quarters, right down to the newest half, the marathon's mining income price $224.95 million, in accordance with SEC filings.

The marathon was mined at a complete of 10,542 BTC over the identical interval, so the estimated price of manufacturing every coin is slightly below $21,500. Bitcoin trades at a median of $39,300 throughout that point, which means potential earnings of $17,800 per coin.

Over the third and fourth quarters of final yr, the estimated manufacturing price for a marathon utilizing the identical methodology works at $43,270. That is appropriately doubled alongside Cambridge's estimate since Harving, in comparison with the common commerce value of $72,250. This implies a possible advantage of practically $29,000, which is even greater than half earlier than.

(Marathon CEO Fred Thiel stated in February that the direct power price of a marathon per Bitcoin total was $28,801 final yr, which would come with a number of the earlier period earlier than manufacturing prices doubled.

A half to a yr later, based mostly on marathon figures, a minimum of on the present value of essentially the most capitalized operations, Bitcoin block subsidies are nonetheless well-off. Different miners could run in defeat through Luxor's hashrate index. This refers to a number of the lowest profitability on report. It's comprehensible provided that the 5 halvings are previous.

In any case, Bitcoin doubles its three-year value to counteract the next: Sufficient time.

Cash is a speech

“I'm certain there can be no very massive transaction volumes or volumes in 20 years.”

Satoshi stated about 15 years in the past on Valentine's Day 2010.

This was an addendum to a touch upon the necessity for transaction charges within the system, which considers block rewards to be diminished to zero over time. “In a long time when rewards have turn into too small, buying and selling charges turn into the node's most important reward.”

So, lower than 5 years after his speculation, how shut is Satoshi to the reality?

Month-to-month transfers have declined in latest months, however are nonetheless rising till 2023 (Supply: Analysis on Blockworks).

Bitcoin processes greater than 11.5 million transactions per thirty days, ranging from beneath 8 million in early 2022, changing on common to $1.8 trillion in BTC.

On the one hand, as Satoshi predicted, it might be “very massive”, however greater than 98% of miners' revenues nonetheless come from block subsidies.

At the moment, Lizzo's view

The phrase “Bitcoin bubble” could sound lots today, however its costs are over $100,000. Nonetheless, wanting again at previous media articles, it hasn't modified a lot.

On Reddit, this chart jogged my memory of how lengthy the trope lasted. In actual fact, the chart above was Posted 14 years in the past by Jerry Brito, founding father of Coin Middle.

So he wrote about expertise staying right here, even when Bitcoin dies. He was proper with one warning – the expertise was Bitcoin.