desk of contents

what occurs $ETH Will the value chart seem now? The place is the important thing? $ETH Assist degree?Why? $ETH Downturn regardless of document community exercise? How will establishments and huge holders be affected? $ETH Worth? What's occurring with BitMine and why does it matter? Are ETFs including extra downward strain? Is somebody accumulating? $ETH How low is it now? $ETH You’ll be able to navigate right here Assets FAQ

Ethereum If promoting strain continues and demand stays weak, we might see a decline in direction of the $1,500 to $1,800 vary. $ETH enamel Trades for lower than $2,000 After shedding about 30% within the final 7 days. This decline is going on even because the Ethereum community is recording its highest exercise ranges ever, creating a transparent hole between utilization and worth.

what occurs $ETH Will the value chart be seen now?

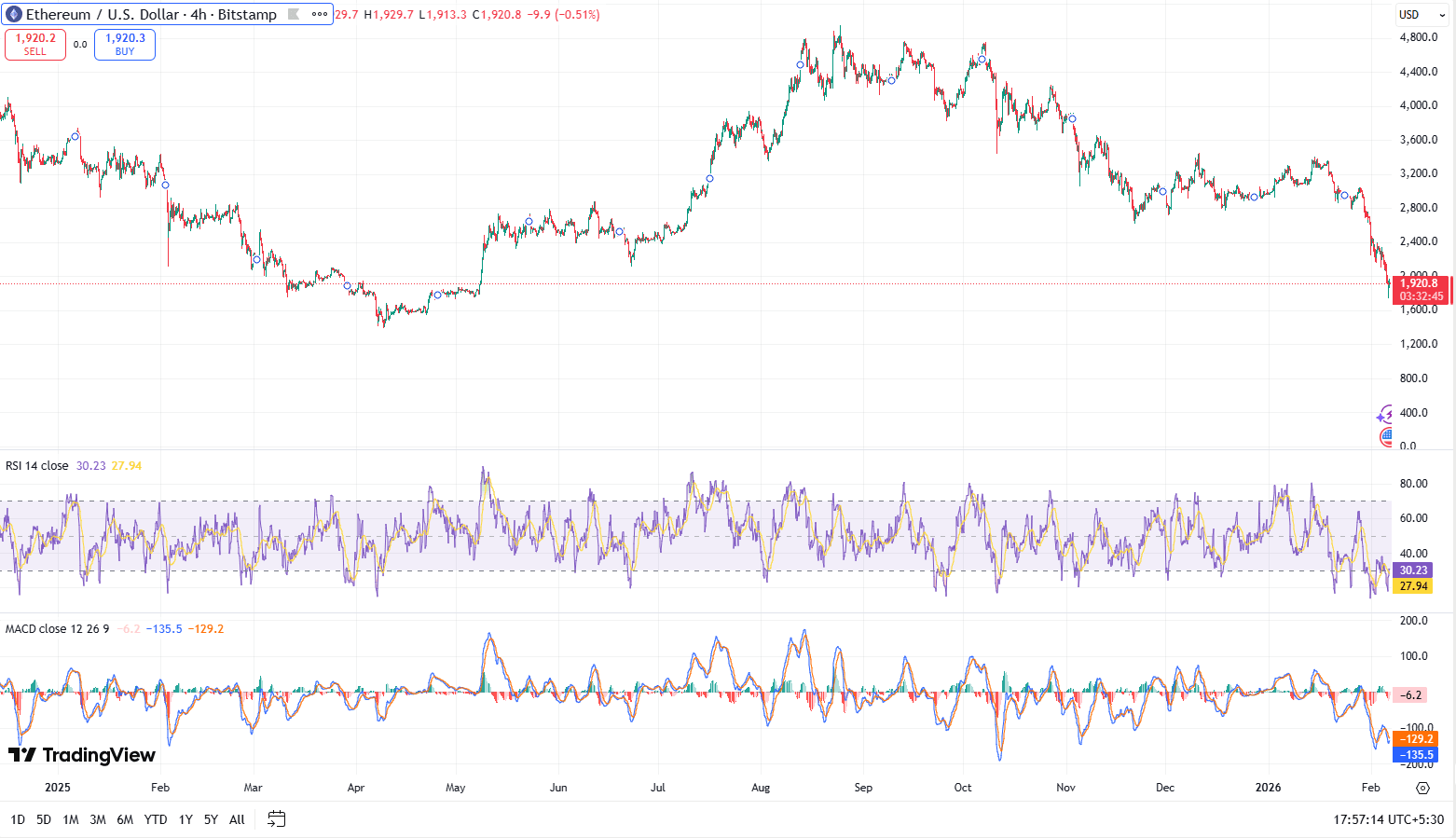

On the 4 hour chart, $ETH The regular downward pattern continues. The value fell under the $2,000 assist zone however was unable to regain it regardless of a number of makes an attempt.

Momentum indicators proceed to assist weak spot.

- RSI is close to 30, indicating oversold circumstances, however no backside confirmed

- MACD stays unfavorable, indicating bearish momentum stays lively

- Market construction continues to type highs and lows

Oversold numbers alone don’t sign a reversal. In previous drawdowns, $ETH It stays oversold for an prolonged time period as liquidity continues to empty from the market.

the place is the important thing $ETH Assist degree?

Primarily based on historic buying and selling exercise and liquidation knowledge, a number of worth ranges stand out.

- $1,800: Psychological ranges and former assist zones the place the value has reacted a number of occasions

- $1,650 to $1,700: Congested space from early accumulation stage

- $1,500 to $1,550: Excessive-risk liquidation zones flagged by derivatives knowledge

Liquidation danger nonetheless exists between $1,509 and $1,800. A transfer inside this vary might set off compelled promoting from leveraged positions and enhance draw back volatility.

why is that this so $ETH Decline regardless of document community exercise?

Ethereum is at present in its most lively section on-chain.

In accordance with cryptoquantThe variety of Ethereum transfers, measured on a 14-day transferring common, reached an all-time excessive of 1.1 million this month. Switch depend refers back to the complete variety of token actions on the community and is commonly used as a proxy for utilization.

This knowledge reveals sturdy community adoption. Nevertheless, costs are decided by capital flows, not simply utilization.

Retail demand fell sharply. Many merchants shut positions as a substitute of opening new ones. This shift was additionally seen within the derivatives market, the place open curiosity in futures fell from $26.3 billion to $25.4 billion in at some point.

The mixture of excessive exercise and weak demand typically results in worth compression quite than a fast restoration.

What influence do establishments and huge holders have? $ETH worth?

Giant holders are rising short-term promoting strain.

Development analysis, gross sales 170,033 $ETH ($322.5 million) previously day, nonetheless holding 293,121 $ETH ($563 million), In accordance with on-chain knowledge. Analysts are linking the transfer to a sale and mortgage compensation.

Different notable gross sales embrace:

- Aave founder Stani Kulechov mentioned: Gross sales 4,503 $ETH Common worth is $1,857

- Vitalik Buterin Gross sales 2,961.5 $ETH $6.6 million in 3 days, common worth $2,228

These trades should not an indication of panic, however they do enhance circulating provide when demand is weak.

What's occurring at BitMine and why does it matter?

BitMine Immersion Applied sciences is the most important monetary firm specializing in Ethereum. Holds roughly 4,285,000 items $ETHor roughly 3.55% of Ethereum's circulating provide.

The corporate has amassed $ETH Estimated value is $15.65 billion. At present costs, that place is price about $9 billion, with $6 billion to $8 billion remaining. unrealized loss. BMNR inventory has fallen 88% from its July excessive.

Vital particulars present context.

- $ETH The holdings had been acquired via inventory challenge quite than debt.

- Roughly 2.9 million $ETH staked and generates an estimated $188 million in annual staking income

- BitMine has $538 million in money and added $41,788 $ETH final week

CEO Thomas Lee mentioned unrealized losses throughout financial downturns are a part of a long-term monetary technique, just like index funds throughout market downturns. Nonetheless, giant authorities bond holders stay a danger issue if liquidity circumstances worsen.

Are ETFs including additional downward strain?

sure. spot $ETH There was a constant outflow of funds from US exchange-traded funds (ETFs) since January twentieth.

SoSoValue knowledge present spot $ETH The ETF recorded internet outflows of $80.79 million on February fifth. Of this quantity, Constancy's FETH accounted for $55.78 million.

ETF outflows characterize passive promoting quite than discretionary buying and selling, including regular strain with no speedy reversal.

Is anybody saving cash? $ETH Now?

Some long-term traders and whales are piling up cash $ETH selectively.

On-chain knowledge reveals that accumulation is seen throughout worth declines whereas short-term merchants proceed to exit. This sample is commonly seen throughout mid-cycle corrections quite than the market's closing backside.

Accumulation can restrict long-term declines, however can’t cease short-term drawdowns.

how low $ETH You’ll be able to go from right here

Primarily based on the present chart construction, by-product knowledge and on-chain circulate, $ETH If promoting strain continues, the pair might take a look at the $1,500 to $1,800 vary. Momentum stays bearish, demand is weak and huge holders are including provide to the market.

On the identical time, Ethereum community exercise is at document highs, liquidity provide continues to dwindle as a consequence of staking, and a few long-term traders are piling up capital. Whereas these components can assist stabilize the market over time, they can’t forestall additional declines within the brief time period.

For now, $ETH Costs react to liquidity circumstances, not community utilization.

useful resource

Ethereum on TradingView: $ETH worth motion

Report by CryptoQuant: Ethereum Transfers Surge: A Historic Warning Signal?

Arkham’s Vitalik pockets knowledge: For particulars $ETH motion

Report by Benzinga: Tom Lee's Bitmine drops $6 billion in Ethereum, however right here's why he retains shopping for