Bitcoin is under its 200-day, important transferring common of $83,000, displaying indicators of great bearishness. Nonetheless, the worth was encountered on the purchaser's ultimate defence line for $80k, with potential breakouts dropping considerably to $75,000.

Technical Evaluation

By Shayan

Each day Charts

Bitcoin was rejected with a $92,000 resistance, inflicting a powerful sale, bringing the important thing 200-day MA under the 0.5 Fibonacci retracement stage at below $83,000. The zone was anticipated to offer robust demand, however bearish stress overwhelmed the overwhelmed patrons, leading to a protracted liquidation and a destructive change in market sentiment.

At the moment, Bitcoin is testing its ultimate line of protection from regional patrons of $80,000, coinciding with the rising channel decrease restrict and 0.618 Fibonacci retracement stage. If this stage fails, one other sale may increase the worth to $75,000, marking a deeper market correction.

4-hour chart

Within the decrease time-frame, Bitcoin costs might be merged between $80k and 92K. Latest rejections on the high of this vary spotlight market hesitation. A transparent breakout from this zone is critical to determine a crucial development.

Moreover, the liquidity pool exists just under the current $78,000 low, the place quite a few cell cease orders have been amassed.

This pool serves as a beautiful goal for good cash, growing the probability of bearish breakouts within the mid-term. Because of this, Bitcoin value motion is predicted to stay risky within the coming weeks, additional consolidation earlier than a crucial transfer.

On-Chain Evaluation

By Shayan

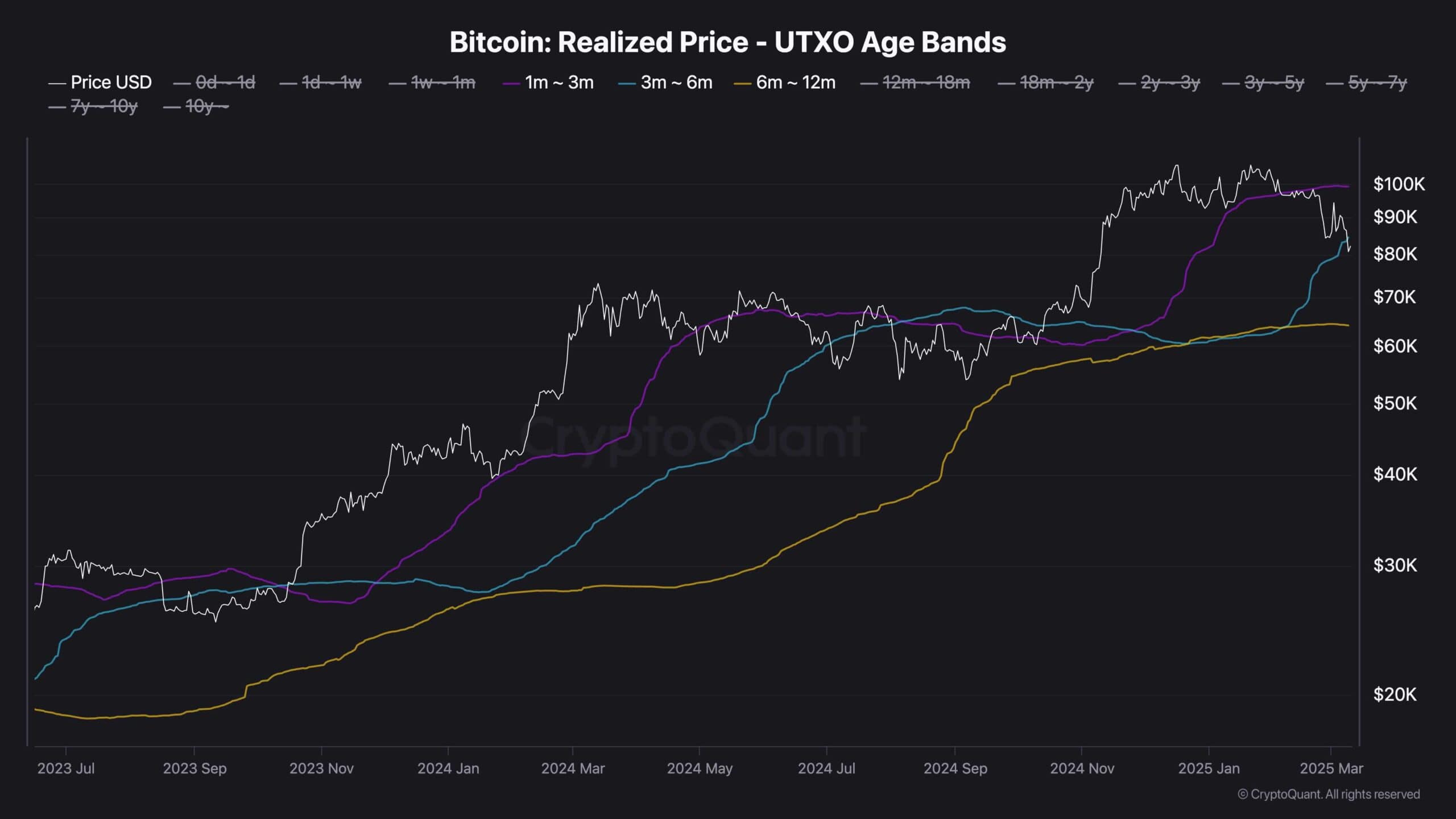

Traditionally, the interplay between Bitcoin and the realised value of UTXOS for 3-6 months has performed a pivotal function in defining market route. This metric usually features as a powerful help or resistance zone, reflecting the common acquisition value of medium time period holders.

At the moment, Bitcoin is testing realised costs for 3 to 6 months of holders at $83,000. Holding above this zone exhibits robust market confidence, strengthens bullish sentiment and will increase the potential of even the other momentum.

Nonetheless, if Bitcoin fails to take care of help at this threshold and breaks under, it could actually trigger a change in emotion to worry. This situation may result in a distribution part, offering alternatives for short-term traders to dump their holdings, pushing costs to deeper corrections, and good cash accumulates at decrease costs.

Subsequently, Bitcoin's value motion across the $83,000 stage is vital in shaping its short-term orbit from medium-term orbit. Whether or not it rebounds or collapses may decide the subsequent main development out there.