It is a section of the Provide Shock E-newsletter. Subscribe to learn the total version.

Bitcoin has a number of personalities, equal cash, freedom, resistance and hope.

Micro Technique Chairman Michael Saylor sits below all of them as Bitcoin id – Its most uncooked intuition, personification.

Thursday marked the twenty fifth anniversary of Saylor's lack of $6 billion in a day ($11 billion adjusted to inflation) as a dot-com bubble burst. The occasion was one of many greatest day by day private losses in human historical past to that time.

That is his comeback story.

Premium Area

Saylor wasn't at all times the head Bitcoin Bull. Nevertheless, he realized digital rarity lengthy earlier than the primary block was mined: Area identify.

After founding MicroStrategy in 1989 and constructing it as an information mining and enterprise intelligence operation, within the 90s, Saylor had the clear thought of buying a “premium” area identify.

Angel.com. alarm.com. Knowledge.com. emma.com. Speaker.com. alert.com. Voice.com. hope.com. Just one individual might personal every at a time, and microstrategy spent a complete acquisition of all these premium domains, on a median of round $100,000 every, together with a low-value secondary area of 1000’s of {dollars}.

“I believed, 'Is it nice to personal a portion of English?' and so I purchased all these domains.” My first million Podcast. He personally owns Michael.com, certainly one of which owns the nickname Mike.com.

“In different phrases, you personal “hope,” otherwise you personal “voice,” otherwise you finally have Google voice. Or, some telecommunications firms will need to begin companies.

Alarm.com and Angel.com had been then commercialized in actual firms, which had been then spin-up by Saylor and MicroStrategy's analysis and improvement departments, respectively.

MicroStrategy ultimately offered Alarm.com and its associated companies in 2009 for $27.7 million, and offered it to Enterprise Capital Agency ABS Capital Companions. In 2013, Software program Firm Genesys acquired Angel.com for its enterprise for $110 million in money and shortly rebranded it below its personal firm umbrella.

In the meantime, Saylor has asserted that Voice.com is value $1 billion for the correct patrons.

It was round this time that Saylor first made public feedback about Bitcoin.

He posted once more every week later after Bitcoin dropped by as much as two-thirds of its document excessive from $1,242.

Sinking prices

Saylor didn’t return to Bitcoin till mid-2020, a minimum of publicly. Within the occasion timeline, premium area gross sales to Crypto's startups might have been his mild bulb second with capital.

It was first introduced in Could 2019 when MicroStrategy first confirmed its intention to purchase Bitcoin. BlockChainEOS.

Block.One was beforehand calculated to lift $4.1 billion in ETH in the course of the providing of the primary 12 months of preliminary cash that started in mid-2017 and ended earlier than the voice was revealed.

“They (block.one) contacted us, certainly one of their area brokers, and requested, “Do you need to promote it? I'll provide you with $150,000.” I hadn't thought of it.

“They arrive again and say, 'They doubled it to $300,000.” I mentioned, “No to them.” A couple of days later, they (a colleague at Saylor) mentioned, “The dealer actually went to $600,000.” I mentioned no. I mentioned, “Don't say they’ve no real interest in something.”

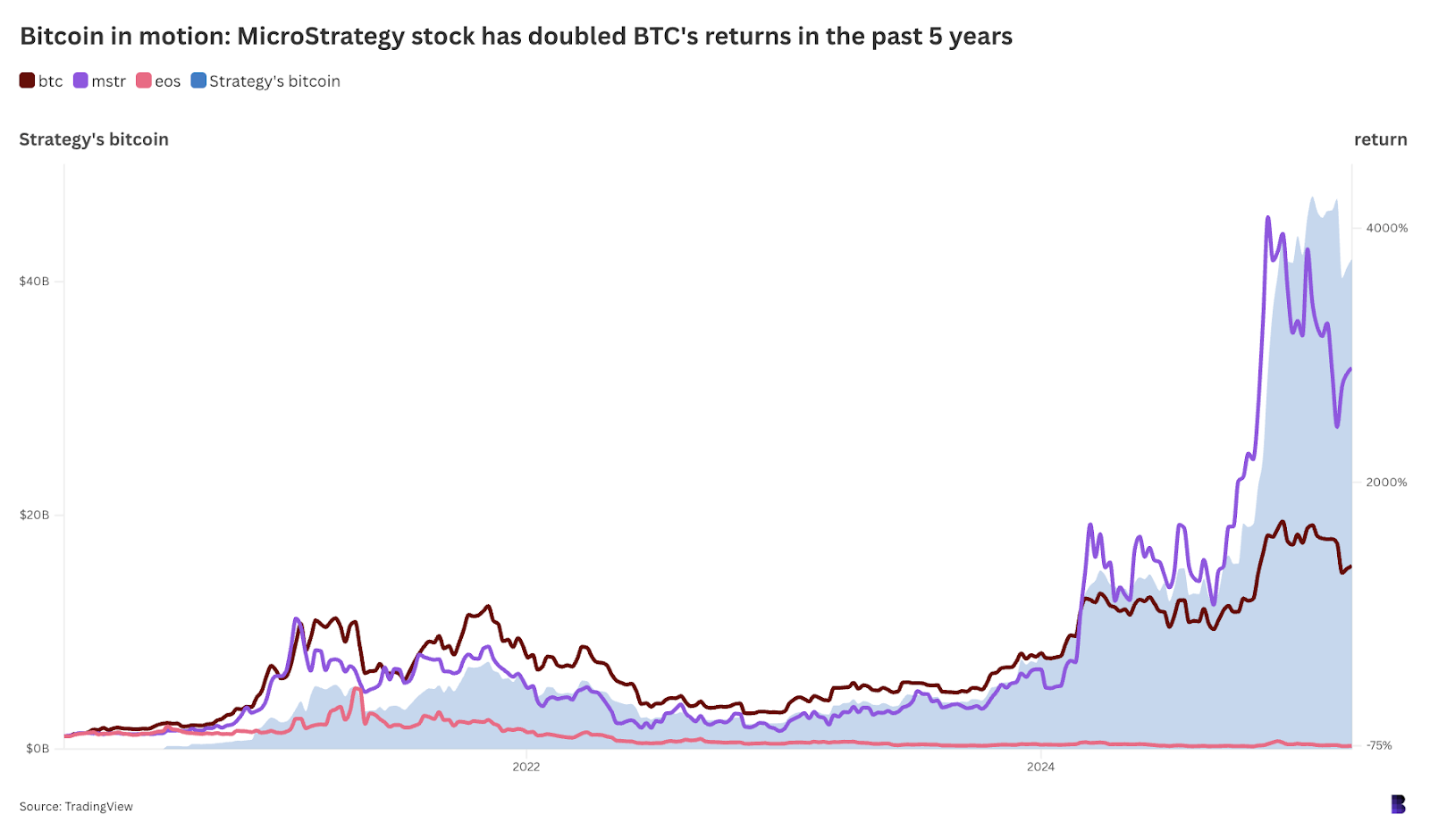

MSTR returned to its document excessive in November final 12 months, greater than 20 years later. Because of that Bitcoin plan. EOS has declined by 75% over the previous 5 years. Supply: TradingView.

Block.One supplied $1.2 million, however Saylor refused. Then it was $2.5 million. Then it was $5 million. Then it was about $10 million.

“After I reached $12 million, I mentioned I might reply the telephone for half-hour, and it began out as I mentioned, 'Nicely, what about $22 million?' And I mentioned, “Let me clarify, that is like my daughter. I need to marry her, however solely to somebody who values greater than I worth her.”

MicroStrategy closed in June 2019 at $30 million. I surpassed one first supply by 200 instances. It’s the largest pure area identify gross sales in historical past, virtually double the earlier document Qihoo paid 360.com in 2015 at $17 million.

Block.One has sunk one other $150 million into Voice.com improvement over the subsequent two years earlier than closing in late 2023. Voice mentioned “the continuing uncertainty within the Crypto and NFT markets will proceed for extra time than we do.”

Conversely, Saylor and MicroStrategy have began shopping for Bitcoin and positioned themselves in a extremely exploitative solution to gasoline the upcoming Bitcoin rally fueled within the hopes of ETFs similar to BlackRock, Constancy and others.

How did it start?

A 12 months after area gross sales resulted in July 2020, Saylor mentioned in a quarterly income name that MicroStrategy might start buying Bitcoin subsequent 12 months as a part of its new capital allocation technique.

The plan was to speculate $250 million in various property over the subsequent 12 months. “It could embody digital property similar to shares, bonds, gold, and Bitcoin, or different asset sorts.”

It took lower than a 12 months. MicroStrategy bought 21,454 BTC for $250 million in lower than two weeks, and in August 2020 Bitcoin declared its main Treasury reserve property.

Bitcoin was then traded for below $12,000, however inside 4 months it broke its $20,000 worth document.

Corners the market

By December 2020, MicroStrategy had began its first debt gross sales because it selected Bitcoin. This earned $400 million in curiosity on 0.75% curiosity. Then the second enhance was up two months later, and the third enhance after 4 months.

So, in September 2023, MicroStrategy sat at $4.2 billion in BTC within the very early phases of the Monster Bull Run.

Since then, MicroStrategy has spent practically $27.8 billion to amass an extra 340,860 BTC ($28.7 billion). Bitcoin has greater than tripled its worth at the moment, however MicroStrategy has eliminated “micro” from its identify and is just utilizing its latest technique.

The technique at the moment holds a complete of 499,096 BTC (2.5% of distribution provide), which is nicely value it to be included within the benchmark NASDAQ 100 Inventory Market Index. Saylor has been a squeal of his lentitude the entire time, choosing up from the place former evangelists like Roger Vere dropped out.

In fact, the technique raised billions of {dollars} throughout 9 accomplished debt gross sales to assist fund Bitcoin acquisition plans.

How is that going?

At present, the corporate has acquired a $9.3 billion conversion debt in opposition to BTC's $41.8 billion, and this 12 months it’s accountable for 30% of the US convertible market.

The technique totals $33.2 billion on Bitcoin, and Serviette Math successfully preempts the $700 million technique on the time of writing. Saylor's private internet value is estimated at $6.6 billion, and in January the corporate promised to lift it overtly $42 billion I'll purchase extra over the subsequent three years.

Whether or not Voice.com is actually value $1 billion or should you're sure that Bitcoin will “surge eternally,” Saylor's profession is marked by the identical primary instincts to nook the market, particularly with long-term digital property of digital property that function the premise of the Web financial system.

Saylor merely expanded from one excessive liquid digital asset class in domains (the area of interest house the place he’s thought-about legendary) to 1 deep liquid digital asset in Bitcoin.

Surprisingly, what follows the Voice.com deal additionally serves as an virtually good all-talk for crypto investments. block.1 sunk 9 numbers right into a token challenge pivoted by the NFT, however earlier than it began it went to zero and misplaced to the bear market.