It is a section of the Provide Shock E-newsletter. Subscribe to learn the total version.

Greetings, Glad forty first birthday to Ross Ulbricht!

Now, rehashing the Silk Street timeline doesn't appear completely helpful, from a secret psychedelic lab in a Texas cabin off-grid to a worldwide secret manipulation with six staff.

In addition to, a few years The historical past of bitcoin Readers are already strolling via the occasion that led to Ulbricht's dramatic arrest in 2013 on the San Francisco Public Library.

Anybody who missed final yr's electronic mail can discover it in our archives – it's undoubtedly price studying!

However keep in mind: telling the story misses a contented ending. Written earlier than President Trump forgives Ulbriccht earlier this yr, he launched him from double residing jail after almost a decade of service.

Let's pay tribute as an alternative to have a good time Ulbricht's first birthday for the reason that launch methodology He built-in Bitcoin funds into the Silk Street for causes which were largely misplaced in trendy cryptography.

This week's Bitcoin legend.

Silk Street Founder Ross Ulbricht | freeross.org modified by BlockWorks

I cannot flip again

Bitcoin was a transparent match to the Silk Street. It separates world funds independently from each authorities and company administration and company administration, infusing customers with monetary self-power that goes past real-world money.

“All transactions that happen outdoors the state-controlled ties are a victory for the people collaborating within the transaction,” Ulbricht wrote in 2012.

What suited his imaginative and prescient was the out-of-control nature of Bitcoin. That is price complementing the hidden existence of the Silk Street via the TOR.

Ulbricht totally understood that Bitcoin transfers had been immutable. This property, coupled with its pseudonymity, varieties the premise for what makes Bitcoin extraordinarily attention-grabbing because the foreign money of underground exercise, autonomy.

Utilized in the fitting means – with strict OPSEC in thoughts – Bitcoin permits for true freedom of commerce on the Silk Street.

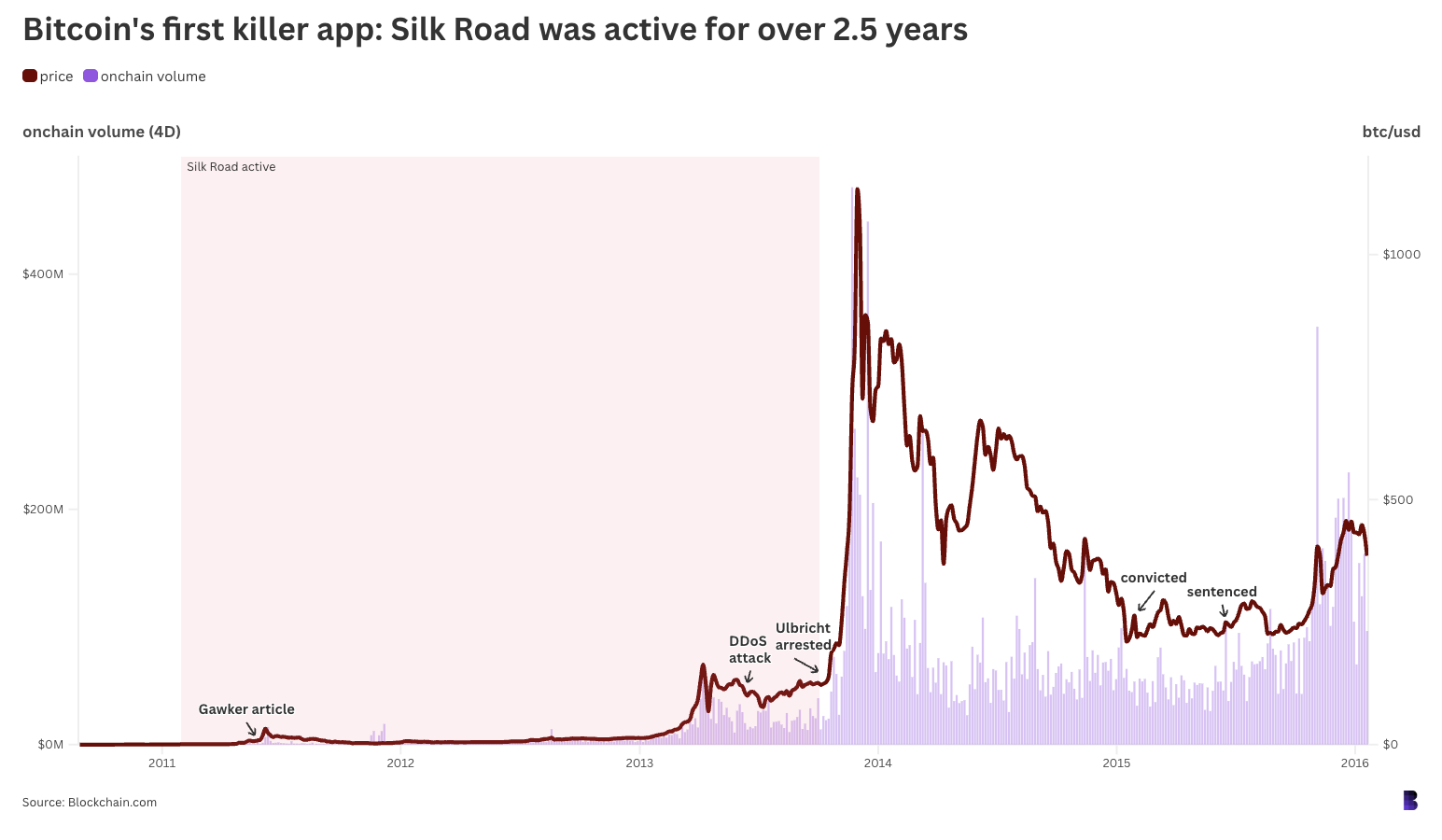

The Silk Street was lively in one among Bitcoin's first Nice Bull Runs, however was defeated for the primary time simply earlier than reaching $1,000. (On-chain quantity = not solely Silk Street, however whole on-chain quantity.

Ulbricht “supposed as a platform about giving folks the liberty to make their decisions and to pursue their very own happiness, however they thought it was applicable for every particular person.”

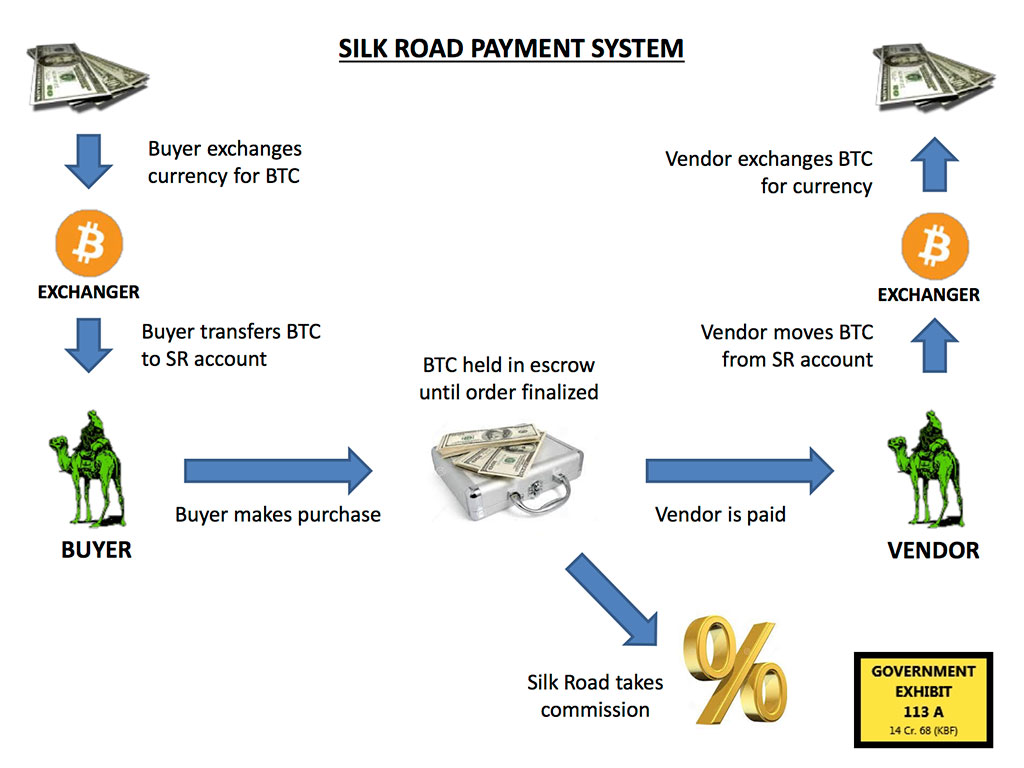

The Silk Street wanted guardrails to just accept solely Bitcoin for funds. High quality management was crowdsourced by way of a public overview system, and to guard customers from fraud, Ulbricht has deployed Silk Street because the mediator of all transactions on the platform.

It meant escrow. Within the automated system, every time a purchase order was made, the client's Bitcoin funds had been briefly held in a pockets managed by a Silk Street administrator, together with Ulbricht.

The Silk Street then knowledgeable the vendor that the cost had been acquired and the vendor was in a position to proceed with the cargo. As soon as the bundle arrived on the opposite aspect, the client submitted a affirmation to the Silk Street website, after which Bitcoin was launched to the vendor, and the vendor pulled the coin into his pockets.

Moderators dealt with disputes manually on a case-by-case foundation by way of the ticker system, much like how Amazon, eBay, and Airbnb work in the present day.

There isn’t a doubt that these processes are affected by the idea of belief. Each consumers and sellers needed to belief that the Silk Street wouldn’t disappear with all Bitcoin, and that the Silk Street was effectively geared up to guard the consumer fund.

This Silk Street cost stream chart was on show 113a throughout Ulbriccht trial.

Customers additionally needed to consider that moderators would correctly handle conflicts. Generally mods had to offer doubtlessly important photograph proof, comparable to delivery labels and monitoring data that wanted to be protected towards leaks and theft.

Anyway, the system labored. By the point the Fed closed the Silk Street, it bought 9.5 million btc (80% of Bitcoin's circulation provide on the time), and in September 2013 it gained 600,000 btc, price $1.2 billion and $80 million respectively.

Nonetheless, Silk Street has built-in Bitcoin largely in all the fitting methods. The platform robotically generates new Bitcoin addresses for all transactions, making it tough to trace. All transactions are additionally completed by way of TOR, and when used accurately, they will disguise the IP tackle.

If the Silk Street was being constructed in the present day, perhaps it might have had escrowed cash in a multi-sig pockets. A minimum of that spreads a few of the belief. Bitcoin Multisigs didn’t turn out to be efficient till April 2012. This has been greater than a yr for the reason that Silk Street was first launched.

It fits your objective

Placing these considerations apart, Bitcoin and solely Bitcoin was in a position to do what Ulbriccht wanted.

That is very true. Within the heyday of the Silk Street, there was solely a handful of other cryptocurrencies, together with Litecoin, Peercoin and Namecoin, so there was a small portion of Bitcoin's market capitalization and liquidity.

For instance, let's say the Silk Street was launched at Ethereum in 2025. Maybe on account of quicker funds, extra versatile escrow options, or Stablecoin help (Silk Street really managed to lock the greenback worth of Bitcoin on the time of buy to attenuate the affect of worth volatility).

In that case, hypothetical, one sanction on the Silk Street contract would shortly make the transaction considerably tough to course of. In November, that determine exceeded 70%.

Evidently, in actuality, each main stubcoin has a characteristic constructed to permit the issuer to liberate and confiscate the tokens at will, and may be completed often on demand from regulation enforcement.

Such options clearly battle with the idea of an unbiased libertarian market, whatever the forces held by Ulbricht and the remainder of the Silk Street group on the platform.

The Silk Street heritage is as follows: For all of the philosophical distances that separate “Bitcoin” from in the present day's “Bitcoin”, the idealistic platform Ulbriccht constructed was a divergent catalyst. It was a splitting level that cut up an enormous fault line that now divides the area.

By Bitcoin, the Silk Street undermined the standard monetary system and additional critically undermined all the social order. Ulbricht had no cosplay.

It’s a rather more eliminated purpose from Stubcoin and its sensible contract platform, which emerged within the wake of the top of the Silk Street and its sensible contract platforms aimed to serve.

These techniques have grown to strengthen Legacy Finance moderately than unlocking Legacy Finance in the best way Ulbricht wished.

Surprising consequence

After all, even Bitcoin's sturdy censorship resistance was not sufficient to guard Ulbricht from the US authorities. The identical may be mentioned for different Silk Street operators and energy customers.

In whole, 144,000 btc ($26 million, in the present day $12.6 billion) was first seized from Ulbricht-controlled wallets, and an extra 120,000 BTC was added from two hackers who stole Bitcoin individually from the Silk Street throughout their actions.

In a few years of well-known instances, tens of 1000’s of extra cash could have been seized from customers of the Silk Street.

There's friction there. Bitcoin is clearly proof against digital area, and Ulbricht was nice sufficient to grasp that the Silk Street may very well be the primary killer crypto app. In lots of respects, there has by no means been a second finest to this point.

The identical can’t be mentioned in our bodily meat area. The cash of Ulbricht had been actually taken by drive from him and bought for relative pennies at present greenback worth.

Second, the US authorities's response to the Silk Street incident shaped a playbook for what would turn out to be the Fed's strategic Bitcoin sanctuary.

The seized cash won’t ever be bought once more. At this stage, the one means the reserve can get one thing greater is for the authorities to grab much more cash from the sovereigns.

And these cash are of some worth as a result of implicit promise that they can’t be tampered with below regular circumstances.

No passable irony may be squared, and when Bitcoin really advantages the Ministry of Finance, it awkwardly appreciates having Ulbricht and Silk Street.

Fortunately for Ulbriccht, he acquired a a lot larger present than any Bitcoin Stash – freedom – which is the happiest of his forty first birthday that I can think about.

To Loss. Bitcoin couldn’t be what it’s in the present day with out him.

– David

Lizzo's take from a Bitcoin historian

“What did you do that week?”

This was the US authorities topic of Elon Musk's present notorious emails, however as David factors out above, that very same electronic mail may be despatched to the crypto trade in the present day.

Or perhaps it's Ross Ulbricht's response to his notion this week. Which means eBay is gradual to confirm his identification.

Is that an actual consumer friction? An elaborate troll? As we speak's hyper-comsexual web, the place Snoop Dogg might “hand over smoke” there’s a risk that grills will probably be bought. Maybe you may forgive your mistrust. I hope Ross skipped the online descent into the maze of ref-links.

Nonetheless, it may well't assist however suppose that Ross is perhaps questioning what Bitcoin and Cryptocurred in his absence. As eBay's instance exhibits, regardless of the preliminary promise that Bitcoin will subdues them, on-line commerce friction stays fairly vital.