Hyperliquid Methods Inc., a digital asset treasury firm, introduced that its board of administrators has approved the repurchase of as much as $30 million of its excellent frequent inventory at a par worth of $0.01 per share.

The share buyback program will run for as much as 12 months. The Firm states that repurchases could also be made occasionally in open market transactions at prevailing market costs at administration's discretion.

Hyperliquid is dedicated to offering traders with entry to HYPE

HyperLiquid mentioned the timing, quantity and worth of shares truly repurchased beneath this system might be decided on the discretion of administration. It additionally relies on a number of components, together with the market value of HSI's frequent inventory, common market and financial circumstances, and relevant authorized necessities.

Firm CEO David Shamis mentioned the buyback is aimed toward growing shareholder worth and growing every share's publicity to HyperLiquid's ecosystem-native token HYPE by means of capital administration.

David Shamis mentioned: “We’re dedicated to maximizing shareholder worth by means of the disciplined execution of our monetary technique. Our major goal is to supply traders with environment friendly entry to HYPE, the native token of the dominant HyperLiquid ecosystem. We’ll use the money to extend our shareholders' per-share publicity to HYPE in essentially the most environment friendly method doable.”

Nevertheless, the Firm can not assure the variety of shares that can in the end be repurchased. Moreover, the Buyback Program could also be prolonged, suspended, or terminated at any time and with out discover at our discretion.

Moreover, Hyperliquid Methods Inc. is on the core of the Hyperliquid ecosystem. Hyperion DeFi lately introduced the receipt of a Kinetiq airdrop and a partnership with Native Markets. The corporate's report claims that these adjustments will enhance the worth of the HYPE token and make it simpler to commerce.

The corporate additionally took steps to increase its holdings by buying a further 150,000 HYPE tokens.

HYPE token development is at its weakest degree since Might

Hyperliquid Methods Inc. holds 12 million HYPE tokens, representing 1.20% of the overall provide, and has money reserves of $300 million. These sources enable the corporate to repurchase shares and enhance its publicity to HYPE in a capital environment friendly method. Nevertheless, the success of HYPE tokens will not be assured. It relies on the present state of affairs out there.

The HYPE token has remained steady with a slight enhance of 0.67% up to now 24 hours after seeing some decline over the weekend. The decline resulted in additional than $11 million in liquidations, in response to CoinGlass knowledge.

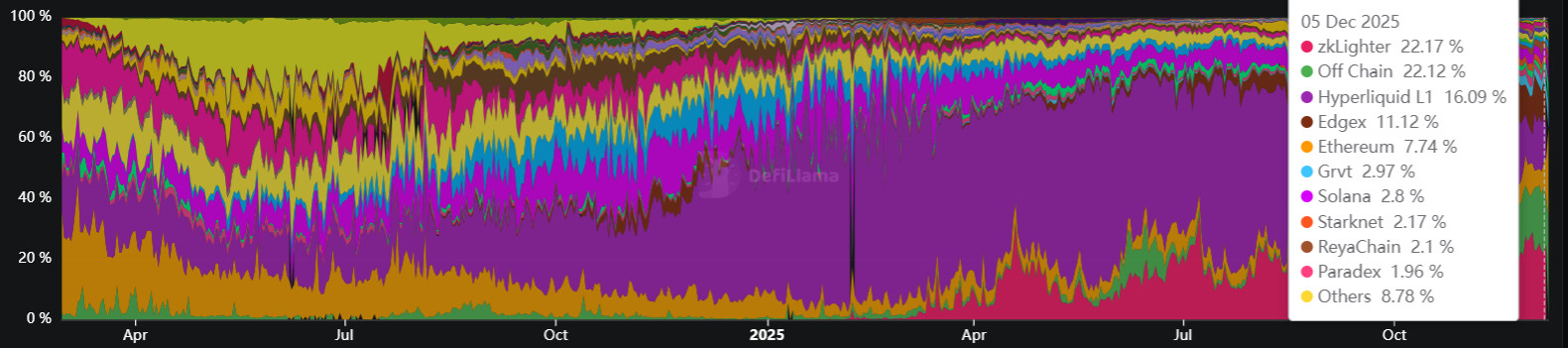

This alteration represents a reversal of the protocols that when dominated on-chain perpetual markets. Earlier this yr, Hyperliquid dominated the decentralized perpetual market with near-total authority. However that edge is lengthy gone.

Hyperliquid's market energy. Supply: Defilama

With the emergence of extra aggressive rivals reminiscent of Aster and Lighter, the protocol's share of the persistent market has declined from a peak of practically 70% to lower than 20%.

Moreover, HYPE has misplaced roughly 30% of its worth over the previous 30 days, making it the worst performing asset among the many high 20 cryptocurrencies by market capitalization. Consequently, crypto merchants have change into fairly bearish on the token, suggesting the token's worth might drop to as little as $10.

Finally, regulatory instability, macroeconomic components and market volatility could all influence HYPE's efficiency. The token is buying and selling at its lowest degree since Might. It’s presently buying and selling at $29.80.