The widespread energy outage that lately plunged into the darkness of Portugal and Spain, make clear the enduring worth of money throughout important circumstances. The occasion additionally prompted questions concerning the really decentralized nature of cryptocurrencies, given its reliance on centralized energy infrastructure.

Beincrypto spoke with Certik, Brickken, Wanchain and Chain cash representatives and discovered what this implies for the general public's belief in Crypto, and what the sector wants to supply monetary companies, even when centralized gross sales channels fail.

Digital finance shall be suspended

The huge energy turmoil final week left thousands and thousands within the darkness of Spain and Portugal, knock-on results on elements of France and Morocco.

In keeping with a Baker Institute examine, Spain misplaced about 15 gigawatts of capability in simply 5 seconds. This represents 60% of the nation's electrical energy demand. The suspension lasted about 18 hours.

With out the web or electrical energy, each day monetary merchandise resembling residence banking companies, digital wallets, and ATMs have change into outdated.

“If the grid fails, the complete ecosystem behind these methods will go down. The cell phone can’t join, the ATM can’t shut down, and the internet-based wallets change into inaccessible. At such a second, the digital financial system exposes energy.

Throughout these occasions, money received the throne of preferential funds.

“Because of this entry to bodily cache is necessary not solely in creating international locations, but in addition in creating international locations, as seen throughout the current outages in Europe. Digital methods, whether or not centralized or decentralized, in the end depend on energy and connections. Money gives a dependable fallback in situations the place digital instruments fail.

The episode additionally raised questions concerning the ease of use of cryptography throughout occasions of disaster.

Is decentralisation in Crypto meaningless with out entry and energy?

The demonstrated want for banknotes throughout infrastructure disruptions means that, regardless of being a contemporary monetary innovation, Crypto continues to be out of attain of its predecessors in troublesome conditions.

Regardless of the central ideas of decentralization, blockchain expertise depends closely on centralized infrastructure.

“For instance, most blockchain nodes are hosted by a small variety of centralized cloud suppliers like AWS. This not solely creates a single level of failure, but in addition exposes the blockchain community to exterior management. Primarily, blockchain runs on the web. With out blockchain, blockchain received't work. Wanchain CEO Temujin Louie, who informed Beincrypto, signifies that flaws and bugs in its shopper software program can have an effect on the complete community.

The identical limitation applies to purposes that handle crypto property and course of transactions.

“Blockchain could possibly be decentralized, however entry isn't. Most customers depend on web service suppliers, central exchanges, and cell units. All of those are tied to the nation's energy grid and communications methods. With out these utilities, the decentralized promise of crypto would really be irrelevant to the common person.

Cryptocurrencies can inadvertently undermine public confidence of their capabilities by not appearing as a real different monetary resolution when obligatory.

Energy outages as a check of public belief

If a standard system turns into unstable as a result of an occasion resembling an influence outage, we assume that cryptocurrencies can’t present correct useful monetary alternate options. In that case, there’s a threat that the general public will lose religion of their skill to change into a viable and wonderful monetary system in the long term.

“Public trusts depend on perceived belief. If cryptography is taken into account to fail below stress, customers could hesitate to resort to it. That is very true for people who find themselves not but used to house.”

Belief in cost strategies grows from ease of use, so if crypto wallets aren’t accessible in emergencies, people could also be reluctant to make use of them as their major cost strategies.

Nonetheless, experiencing these points can pave the best way for future reinforcement.

“These occasions may spotlight weaknesses that result in higher options. Simply as early Internets needed to overcome outages, Crypto continues to be evolving to fulfill real-world calls for,” added D'Nofrio.

Current options inside Crypto expertise already enable for some offline use, and by extending these, it may present a transparent route for growth.

Offline cryptographic potential gives a faint gentle of resilience

Sure current cryptocurrency methods already incorporate a number of design options that scale back reliance on steady energy grids.

“Some {hardware} wallets with lengthy battery life and offline capabilities provide a glimpse of resilience, particularly with peer-to-peer transfers,” says Newson.

D'Onofrio identified different accessible instruments, however he revealed that it lacked the widespread adoption and ease of use required for widespread use.

“There are some attention-grabbing developments, resembling satellite tv for pc nodes, mesh networks, or ultra-low energy wallets. These methods are engaged on extra resilience, however haven’t but been extensively adopted. At present, most crypto ecosystems nonetheless depend on conventional infrastructures.

Comparable concerns have arisen when discussing the chances of decentralized bodily infrastructure networks (depins) to scale back general dependence on centralized energy grids.

Can Depin make cryptographic networks extra resilient?

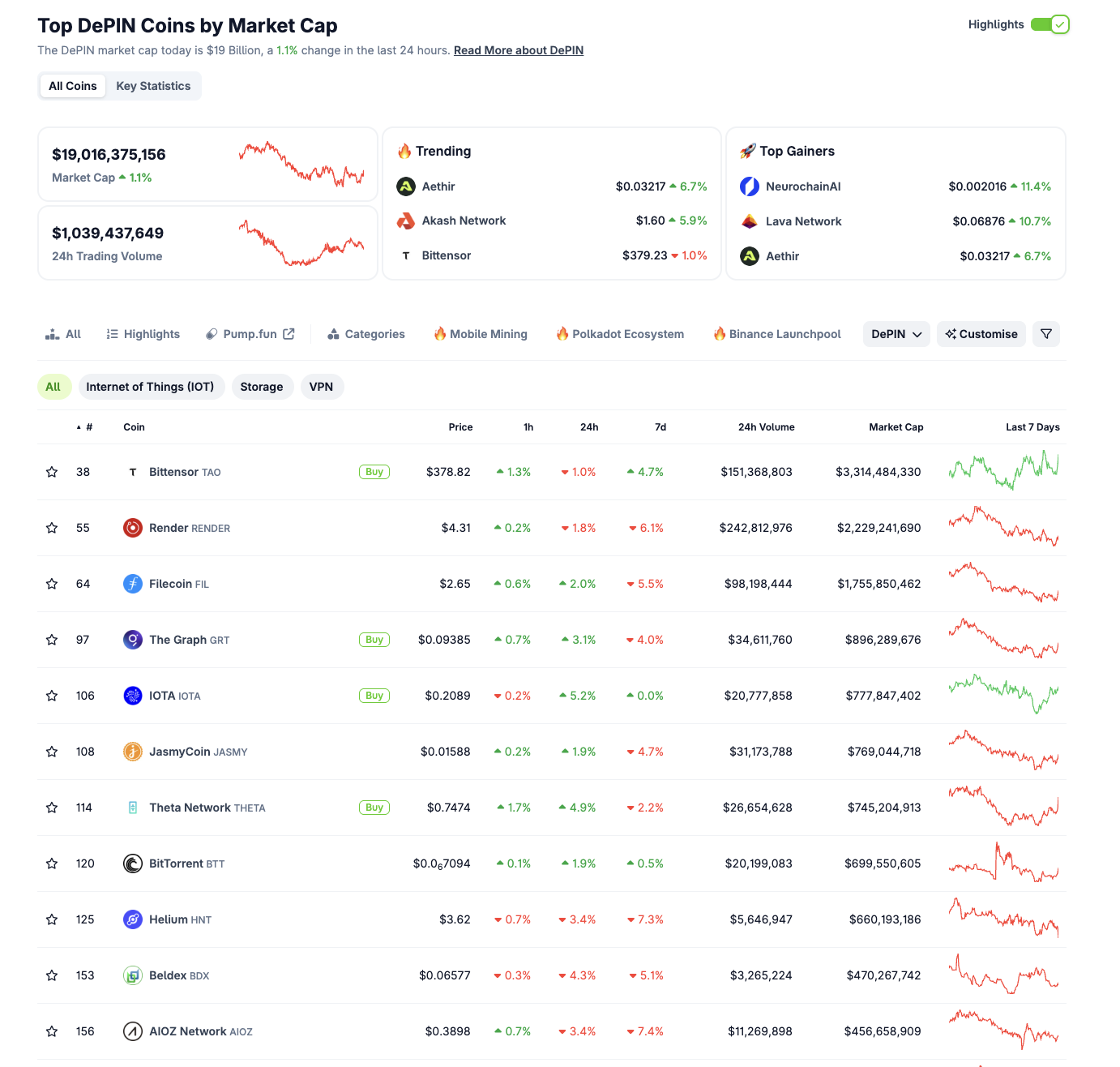

Dep gained important traction within the crypto sector final yr, final yr, because it may use blockchain and token rewards to handle, personal and function infrastructure. Right now, the Depin business boasts a market capitalization of over $19 billion and buying and selling quantity of over $1 billion.

Prime Depincoin by market capitalization. Supply: Coingecko

These networks are more and more selling community connectivity and community-based entry to energy. Some specialists have urged that the expertise could assist mitigate the affect of outages affecting centralized distribution channels.

“In idea, territory may enhance the resilience of the grid and doubtlessly scale back the possibilities of a nationwide blackout. They’d introduce flexibility and programmaticity that will theoretically promote demand response packages and encourage them to regulate vitality utilization throughout peak occasions,” Louie famous.

On the identical time, he identified that Depins alone can’t present a whole resolution to large-scale issues resembling widespread energy outages.

“Nevertheless, it’s too early to consider Depins as a complete resolution that may clear up the nation's electrical energy stability issues by itself. Reasonably, it ought to assist scale back grid stress and display the worth of depins in an actual world setting by specializing in goal integration into current grid infrastructure,” Louie added.

From his perspective, D'Onofrio mentioned Depins may present a extra full resolution when mixed with different instruments that improve native resilience to those threats.

“There’s a risk that there shall be extra integration with distributed infrastructure, resembling community-run mesh networks and photo voltaic nodes. When mixed with instruments resembling delayed broadcast wallets and peer-to-peer communication protocols, these methods can proceed to be encrypted even when conventional companies go down.

Regardless of that distinction, crypto and conventional finance in the end sort out most of the identical underlying points when working amidst infrastructure disruptions.

Coverage Options for a Resilient Digital Financial system

Final week's blackouts on the Iberian Peninsula highlighted the enduring significance of money as a monetary lifeline in a time of disaster. With the worldwide financial system counting on digital finance, specialists highlighted the necessity of policymakers to develop lasting options that guarantee infrastructure resilience and emergency preparedness.

“Policymakers should deal with infrastructure resilience as a bedrock in digital finance, together with diversifying vitality sources, supporting native microgrids, encouraging offline crypto options, and regulatory frameworks.

Going ahead, the energy of the digital financial system shall be decided by its bodily infrastructure, and by prioritizing it, it may place cryptos for long-term success.