The Bitcoin “Purchase Zone” Meme Is Actual Once more, What It Means within the ETF Period

Sure Bitcoin posts will seem on time. It normally arrives simply after the value stops feeling enjoyable.

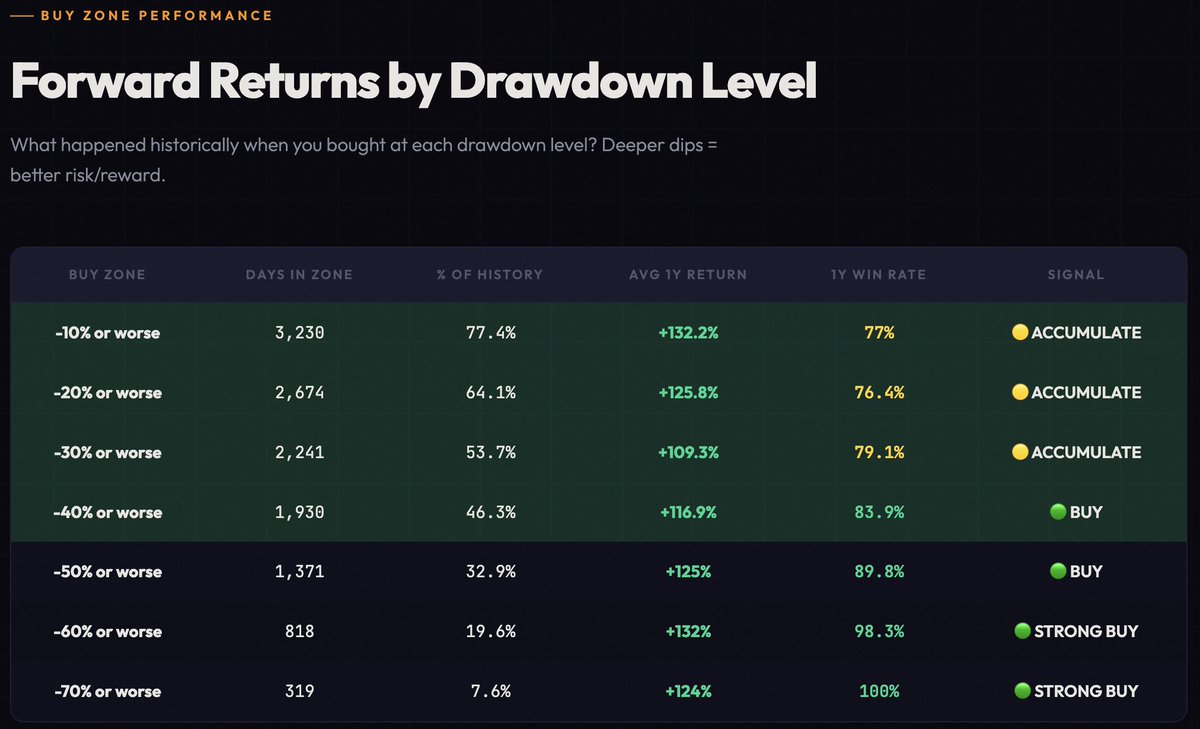

This week comes from PricedinBTC, organized right into a neat desk titled “Ahead Returns by Drawdown Degree.”

The headline quantity performs an essential function, and in case you purchase at a 50% drawdown, your odds of profitable subsequent 12 months will in all probability be round 90%, with a mean return nearer to 125%. The caption ends with the phrases “LOCK IN,” which appears like recommendation but additionally reads like a problem.

Individuals share these graphs for a similar purpose they bookmark their exercise plans. Drawdowns confuse the mind, even for holders who’ve vowed to not really feel something. Clear guidelines present a treatment, a means to attract the road, that lets you act with out rehashing your complete argument each time costs fall.

That is widespread at a time when arithmetic is sort of a meme. Bitcoin is buying and selling within the low $60,000s, with its final peak nonetheless hanging over the market. This ends in drawdowns within the mid-40% vary, which might be pushed into the -50% vary with sustained stress.

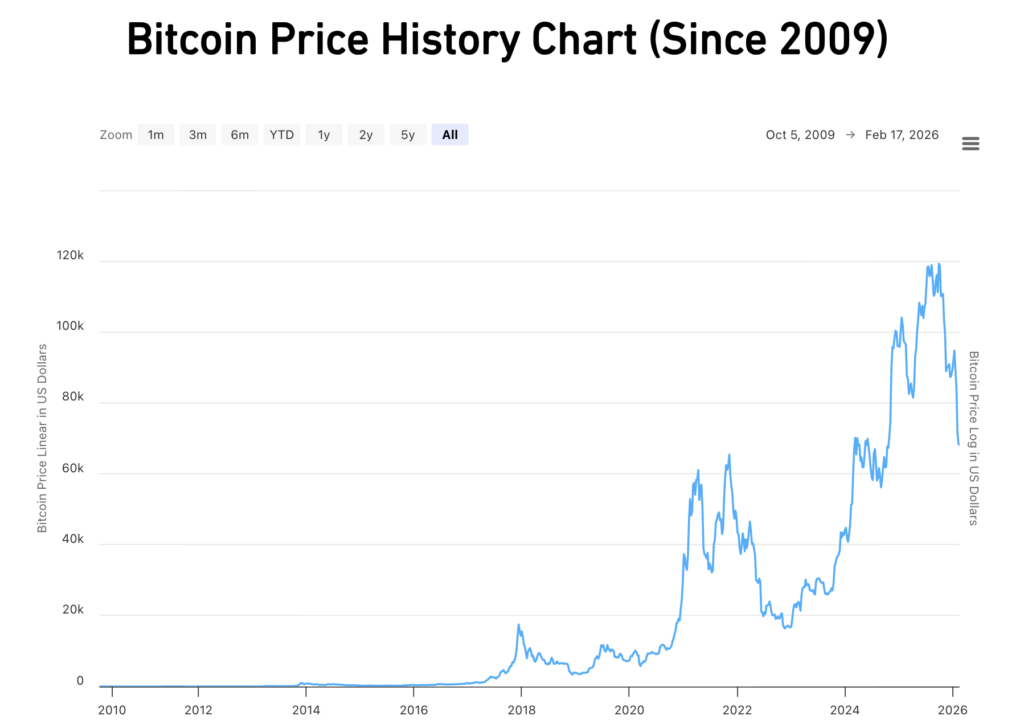

Charts make declines really feel like locations, and historical past gives solace. That very same historical past additionally comes with a warning label. In keeping with iShares analysis, since 2014, there have been 4 circumstances with drawdowns of greater than 50%, with the three largest having common declines of about 80%, and three out of 4 circumstances taking almost three years to get well.

The hole between “one 12 months from now” and “surviving it” is the place plenty of confidence is examined. At present, that testing is being carried out by new plumbing, spot ETFs, rate of interest forecasts, greenback and possibility hedging, all seen in actual time.

The minus 50% line seems like a promise and is correct across the nook

Utilizing the final peak above $126,000 as a reference level, the extent hits a well-recognized spot. Minus 50% is about $63,000, minus 60% is about $50,000, and minus 70% is about $38,000. Bitcoin is near $68,000, so the primary line is inside a couple of thousand {dollars}.

That proximity turns numbers into plans. Some folks wait for his or her tags to reach and begin piling up money. Some folks purchase early in order that they don't miss out. Some folks freeze when the chart lastly arrives as a result of the descending sound appears louder than what's on the display.

Memes act as psychological instruments as a result of they compress chaos into easy triggers.

The second the set off hits, the lived expertise expands once more and the drawdown continues to maneuver. iShares' drawdown historical past is essential right here. As a result of it factors to a deeper reality. Many “profitable” entries remained doubtful for a very long time, typically accompanied by much more extreme declines, till a restoration appeared.

Profitable with Bitcoin is just not as straightforward as shopping for Bitcoin early. Anybody who's been round for greater than 10 years in all probability has a minimum of one story a few time that got here too quickly. I definitely assume so. I’ve a 7 digit HDMI cable mendacity round that I purchased utilizing Dogecoin in 2014.

ETFs turned declines into each day earnings

The Spot Bitcoin ETF now has a scoreboard that everybody can see on daily basis. US Spot Bitcoin ETF holds roughly 1,265,000 shares $BTC As of the market shut on February thirteenth, it had roughly $87 billion in property beneath administration.

This measurement adjustments how the drawdown strikes by the market. Massive wrappers can help costs throughout calm durations, and can even amplify promoting stress when flows flip detrimental, as shifts are seen, measurable, and simple to trace.

There are roughly 55,665 objects $BTC Internet outflows over the previous 30 days quantity to billions of {dollars} at prevailing costs. Such a outflow can preserve costs weighing down even when social feeds are stuffed with confidence within the “purchase zone.”

It additionally gives consumers on the sting with one other confirmatory device of stabilizing flows, as declines typically manifest as a slowing, flattening, and in the end reversal of outflows.

Rates of interest and inflation type alternative prices

A lot of Bitcoin's subsequent chapter will depend upon macroeconomic circumstances that look unattractive, together with yields, inflation traits, and the way buyers assess threat general.

In late January, the Fed stored its goal vary unchanged at 3.50% to three.75%. Inflation can be easing, with U.S. inflation at 2.4% in January, a knowledge level pushed by decrease rate of interest expectations and a shift in threat urge for food.

Cross-market brokers may also help form that tone. The S&P 500 proxy SPY reads broad threat urge for food, long-term Treasuries by way of TLT displays the rate of interest backdrop, and gold by way of GLD captures defensive bids.

When these markets tilt in the direction of security and yield, Bitcoin drawdowns typically really feel extra weighty, and because the temper shifts in the direction of easing, bullish consumers have a tendency to seek out extra oxygen.

The choices market is pricing huge lanes.

Viral Desk has a calmer look on its pages, and the choices market tends to have a broader voice. On Uncommon Whales, Bitcoin choices have an implied transfer of roughly 6.66% by February twentieth, with an implied volatility of roughly 0.5656.

Implicit excessive actions affect conduct in overt methods. Dip consumers need clear ranges and fast affirmation. When circumstances of excessive uncertainty persist, the hedger stays energetic.

Brief-term fluctuations turn into a part of the baseline, and the -50% line might turn into a by level quite than a ground.

This goes again to iShares' lengthy drawdown file. As a result of large-scale recoveries typically contain complicated paths and lengthy timelines.

Drawdown methods dwell and die by whether or not the customer can deal with the trail, not simply the endpoint.

The following chapter can have 3 lanes and ranges for folks to look at

The clearest method to develop a short-term perspective is to attach every to a sign that everybody can observe, as a conditional lane.

- Within the laborious base case, Bitcoin stays within the low-to-mid $60,000s, the market fluctuates, ETF outflows average to a flattening, and volatility declines. Movement tape is the proof right here, as a 30-day decline in outflows sometimes alerts waning promoting stress.

- Within the liquidity-friendly case, inflation stays average, rate of interest reduce expectations are solidified, and threat urge for food improves throughout markets. Bitcoin may pull again in the direction of its earlier highs as ETF flows reverse and stay constructive.

- In a case of a deeper capitulation, the outflow continues, macros flip off the danger, Bitcoin slides by the -50% line in the direction of the $50,000 zone, and the stress may lengthen to deeper drawdown ranges.

Purchase Zone Memes present a easy story and the market gives circumstances. Helpful variations of this chart might be discovered subsequent to the real-time scoreboard, ETF stream tape, rate of interest background, and uncertainty gauge.

That’s the true human curiosity angle on this cycle. That’s, the emotional drive for clear guidelines and the institutional mechanisms that form how these guidelines play out in actual time.

Strategic dollar-cost averaging and market timing

Traditionally, this a part of the cycle is the perfect time to purchase Bitcoin. However as we've mentioned many occasions in our evaluation over the previous eight months, “this time is completely different.”

The four-year cycle idea might be legitimately questioned. Six % of the provision is held in US ETF funds, and company treasuries are exploding.

That is completely different from the Bitcoin market of 2012, 2016, 2020, and even 2024.

Personally, I'm such an emotional dealer that I ended making an attempt to time the market years in the past.

One methodology that removes the dangers related to market timing is strategic DCA.

you purchase $BTC Ship on daily basis, however somewhat extra typically $BTC For change quite than on a regular basis purchases. This leaves you with extra money that grows over time. That means, when Bitcoin drops to a worth that appears low cost, you might have some funds that can be purchased the push. You could have already allotted these funds to Bitcoin. I simply don't pull the set off till I'm depressed. This manner you get the advantages of DCA smoothing, enhanced by bigger allocations throughout drawdown.

Traditionally, Bitcoin hardly ever stays beneath earlier cycle highs for lengthy durations of time. For $68,000, it's OK for 2021. In 2022, Bitcoin stayed beneath its 2017 excessive for about 30 days earlier than beginning to rise to $126,000 over the following three years.

Once more, none of that is meant to be funding recommendation to people, and any funding entails threat. Nevertheless, this text touches on what, in my view, Bitcoin buyers ought to think about when deciding when, and the way, to extend the Bitcoin allocation of their portfolio.