The brand new GlassNode report revealed that $141,000 may change into Bitcoin's subsequent main resistance if costs are compellingly excessive.

Bitcoin is presently buying and selling between these two STH value ranges

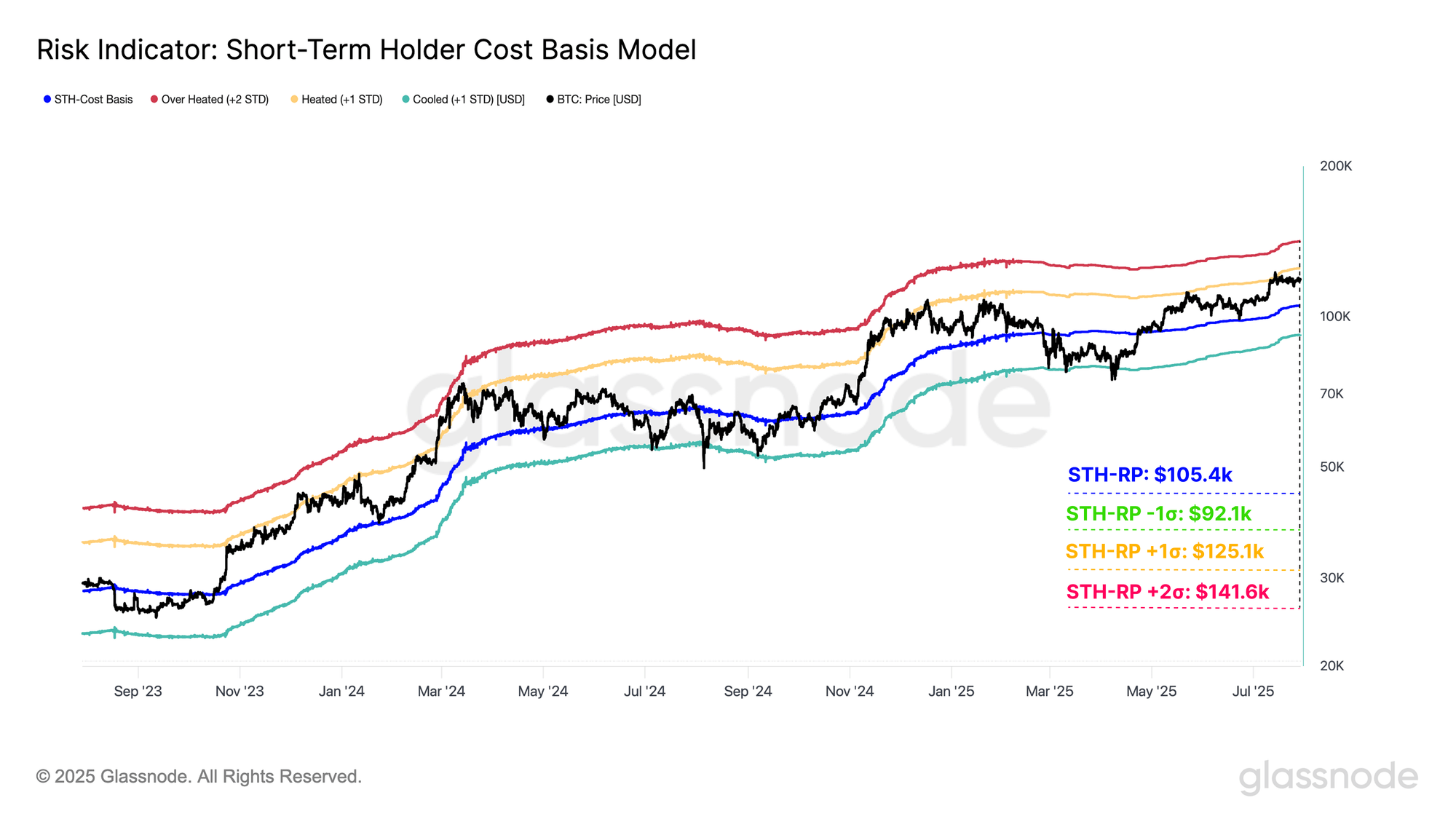

In its newest weekly report, on-chain analytics agency GlassNode discusses short-term holder (STH) value bases and derived value ranges.

This indicator, as its title suggests, measures the fee base or acquisition degree of the common investor portion of the STH cohort. Formally, STH is outlined as an investor holding a coin for lower than 155 days.

The group consists of latest entrants and excessive frequency merchants within the community. In different phrases, it represents the low conviction side of the market. A cohort referred to as the Lengthy-Time period Holder (LTH) group (retention instances larger than 155 days) corresponds to Hodlers of BTC.

If cryptocurrency costs are traded past the STH value base, that implies that the complete STH cohort is in a state of internet unrealized earnings. However, the worth of property below the metric suggests the management of losses between cohorts.

Traditionally, the STH value base has served as an necessary boundary between native bullish and bearish developments. Beneath is a chart shared by analytics corporations. This chart reveals that points are presently buying and selling.

As proven within the graph, Bitcoin costs broke the STH value base at first of the 12 months, after which acquired a big quantity of distance. The present metric worth is $105,400, with the newest BTC value, with STH sitting at 11.5% internet revenue. “You possibly can apply commonplace deviation bands to the STH value base so as to add statistical context,” the report explains. “These dynamic value ranges assist us establish areas the place development fatigue or breakouts are attainable.”

From the charts, BTC discovers resistance a number of instances on this cycle with a +1 commonplace deviation (SD) band, with two refusals repeating two refusals with bullish pushes just for the previous few months.

At present, this degree is $125,100. “From a broader perspective, this implies that Bitcoin may stay within the vary between $105,000 and $125,000 till a important breakout happens,” GlassNode stated.

What occurs if a breakout happens? Based on the analytics firm, the +2 SD degree, positioned at $141,600, may as an alternative change into the subsequent main space of resistance. At this degree, STH's earnings would have been considerably elevated. Giant quantity gross sales It arises from the motivation to earn earnings.

BTC value

Bitcoin has been consolidating inside that vary lately, as its costs nonetheless commerce at round $117,600.

Dall-E, Glassnode.com featured photographs, tradingView.com charts