Ethereum (ETH) costs could also be set for additional gatherings, suggesting on-chain information and market exercise may probably rise by $3.40.

Particularly, this will occur instantly in case you are above the principle assist degree. Based mostly on this outlook, analysts and market observers are carefully watching the current whale motion.

ETF influx and price foundation distribution are additionally noticed for clues as to the place costs go subsequent.

The associated fee-based distribution exhibits an depth of round $2,750

In keeping with lately launched information by GlassNode, Ethereum occurred over $2,700. This occurred when the 200-week transferring common served as a key degree of assist.

For every replace, the cost-based distribution exhibits 1.3 million ETHs held between $2.7000 and $2.740 and between 800,000 ETHs at $2.760.

Picture Supply: GlassNode for x

This degree has been examined since March 2025, when $1,890 was thought-about a key worth vary.

It’s important so as to add that the chart additionally highlights that Ethereum (ETH) has skilled 53% inexperienced days within the final 30 days and volatility measured at 2.29%.

These alerts are reasonable, however present that the market is leaning in direction of steady earnings slightly than sharp swings.

Resistance was near $2,832, however analysts imagine that if it exceeds $2,750, the worth might be triggered at $3,500.

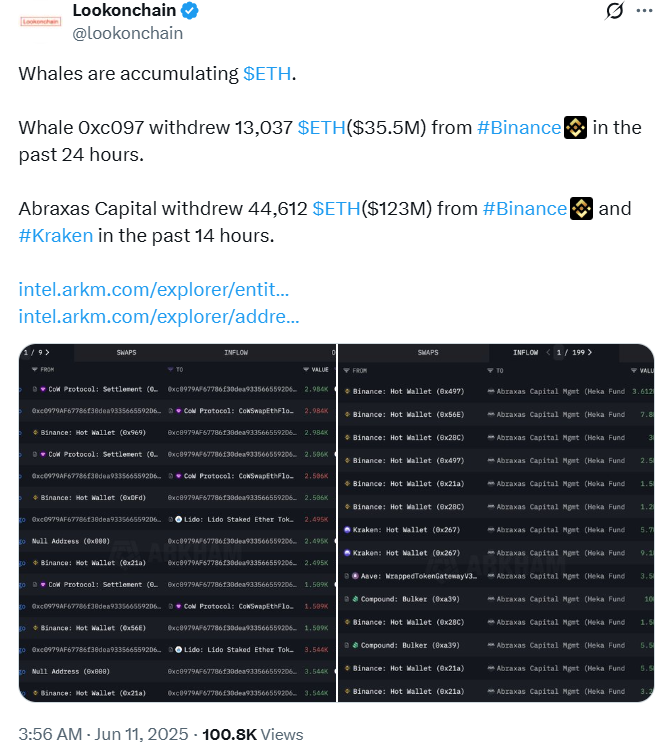

Moreover, the whale motion provides weight to this outlook. LookonChain, for instance, experiences that within the final 24 hours, one pockets has withdrawn all funds value round $35.5 million from Binance.

Picture supply: lookonchain for x

In a extra aggressive transfer, Abraxas Capital collected 44,612 ETH, bringing it to about $123 million from Binance and Kraken over 14 hours.

This accumulation degree suggests that enormous buyers imagine Ethereum (ETH) has a robust potential within the present worth vary.

Ethereum (ETH) ETF Market Log 14 Days Influx

It is very important add that recent momentum within the Ethereum ETF market can also be boosting confidence.

In keeping with Farside Traders, the Ethereum ETF had a 14-day inflow streak.

Present information confirmed a internet influx of $125 million as of June tenth.

This streak drives Eta and Constancy festivals primarily in BlackRock, accounting for greater than 80% of internet inflows since July 2024.

Grayscale ETH and Bitwise ETH recorded $9.7 million and $8.4 million on June tenth, respectively.

These inflows tighten provide. Particularly, 70 million ETHs have already betted, following the stay Pectra improve rollout initially of the quarter.

Some market members additionally imagine that SEC's current approval of ETF choices buying and selling is contributing to the state of affairs.

This approval has boosted buyers' belief, particularly amongst establishments, making Ethereum (ETH) one of the highly effective belongings by way of earnings on the funds.

The outlook stays bullish, however assist should be retained

In keeping with present bullish outlook, the query is: The place can I discover Ethereum costs?

Ethereum (ETH) costs are buying and selling above the 200-day index transferring common, showing to kind a bullish flag sample.

On the time of this writing, market information exhibits that ETH costs had been buying and selling at $2,770.06, a rise of two.28% over 24 hours. If the worth goes above $2,870, the push to $3,500 may quickly observe.

Nevertheless, merchants must carefully monitor key ranges as Ethereum may probably retest beneath $2,600 as they failed to keep up assist of $2,750.

Advantages embrace sustained assist, ongoing ETF curiosity and enormous accumulation, all may gas the rally to $3,400 by mid-2025.

With sturdy assist, decrease gross sales pressures and institutional inflow, Ethereum is nicely suited to swing this big worth.