On-chain analytics agency GlassNode has revealed the Ethereum indicator that has definitely flagged the underside of costs forward of the current rally.

Ethereum Nupl fell into the Quote zone beforehand

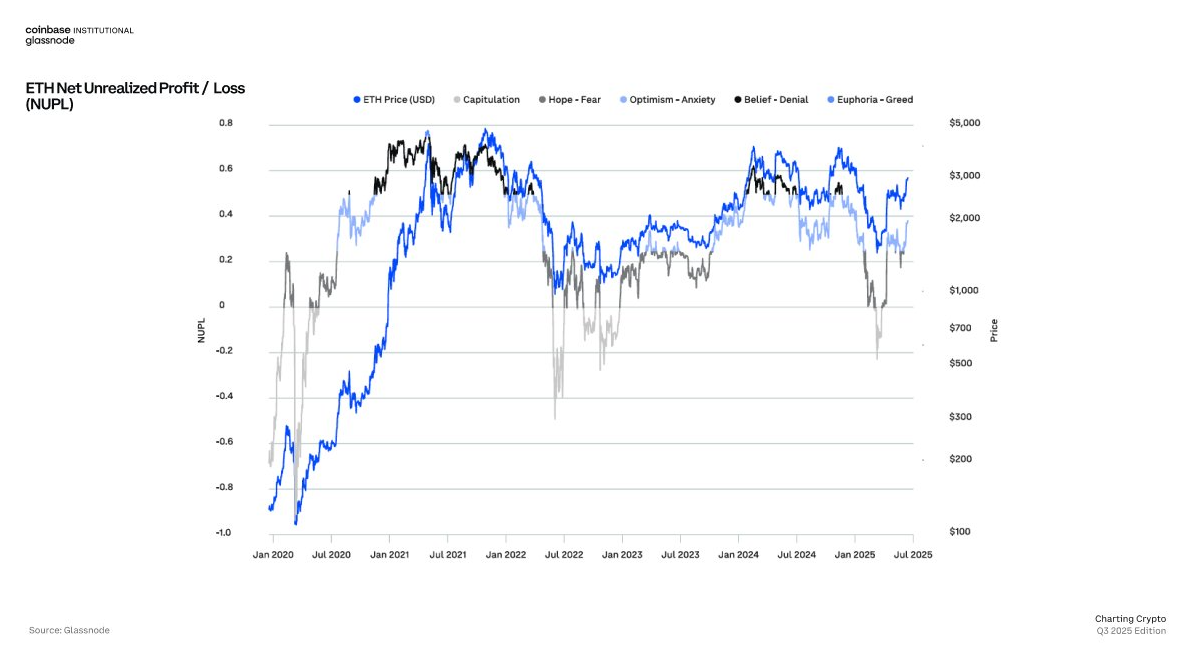

In a brand new put up on X, GlassNode mentioned the Ethereum indicator in its joint report with Cryptocurrency Alternate Coinbase. The indicator in query is “web unrealized earnings/losses.” This, because the identify suggests, measures the web revenue or loss at the moment held by traders throughout the property.

The metric works by going by means of the transaction historical past of every coin on the community to see the final value that was moved. If this earlier switch worth exceeds the present spot value of the token, then that individual token is assumed to be in a web unrealized loss state.

Equally, cost-based cash beneath the newest costs are thought-about in revenue. NUPL summarises the extent of revenue/loss included in each instances and calculates their variations.

A optimistic worth within the indicator signifies that the whole investor is sitting in a state of web unrealized revenue. However, being underneath the zero mark means controlling losses out there.

Now, right here is the chart shared by the analytics firm.

As seen within the graph above, Ethereum Nupl noticed a major decline initially of the yr when the costs of property fell sharply. On this cost the indicator went right down to about -0.2. This means that traders have fallen right into a web loss state.

Not solely that, the relative unrealized losses current on the community had been distinguished sufficient for feelings to flag them as “suffrage” underneath the GlassNode methodology.

The presence of huge losses can result in backside as cryptocurrency markets transfer within the course the crowds are least anticipated. From the charts, this seems to have occurred when the NUPL fell into the give up zone.

Costs proceed to surge as sentiment amongst this low Ethereum investor naturally improves. Nonetheless, NUPL might be a spotlight as a result of if the steadiness shifts overwhelmingly in direction of earnings, one other market change might be extra possible.

ETH Worth

Ethereum is away from Bitcoin as this value has grown by greater than 20% up to now week to succeed in the $3,600 stage.

Dall-E, Glassnode.com featured photographs, tradingView.com charts