Actual-world Asset (RWA) tokenization is quickly rising as one among Wall Avenue's most promising improvements, and the latest passing of business legal guidelines, significantly the US Genius Act, has accelerated the sector's development, in response to Solomon Tesfaye, newly appointed chief enterprise director at APTOS Labs.

In a dialog forward of the steerage with the Cointelegraph and passing the established Nationwide Innovation (Genius) Act landmark, Tesfaye emphasised that legislative appeals towards institutional gamers more and more sign their intention to enter the crypto house.

“We see extra open dialogue between policymakers and Web3 leaders which might be shaping the legislation and giving them the boldness to decide to an extended digital asset roadmap,” Tesfaye says. “Extra particularly, genius acts are one of the highly effective indicators that Congress is able to assist accountable blockchain innovation.”

Following political holds throughout Republicans' “Crypto Week,” the US Home of Representatives handed the Genius Act final Thursday together with two different crypto-related payments.

The legislation establishing a regulatory framework for the $260 billion stubcoin market was signed into legislation Friday by US President Donald Trump.

An excerpt from the President of the US Donald Trump reality sheet on Genius Legislation, launched on July 18th. supply: White Home

Stablecoins are sometimes excluded from RWA business metrics, however many are supported by authorities bonds and different tangible belongings, successfully classifying them as RWAS.

Stablecoins are additionally extensively considered a key on-ramp for future development in tokenization, offering predictability, lowered transaction prices, elevated liquidity, and a bridge between conventional finance and distributed finance (DEFI).

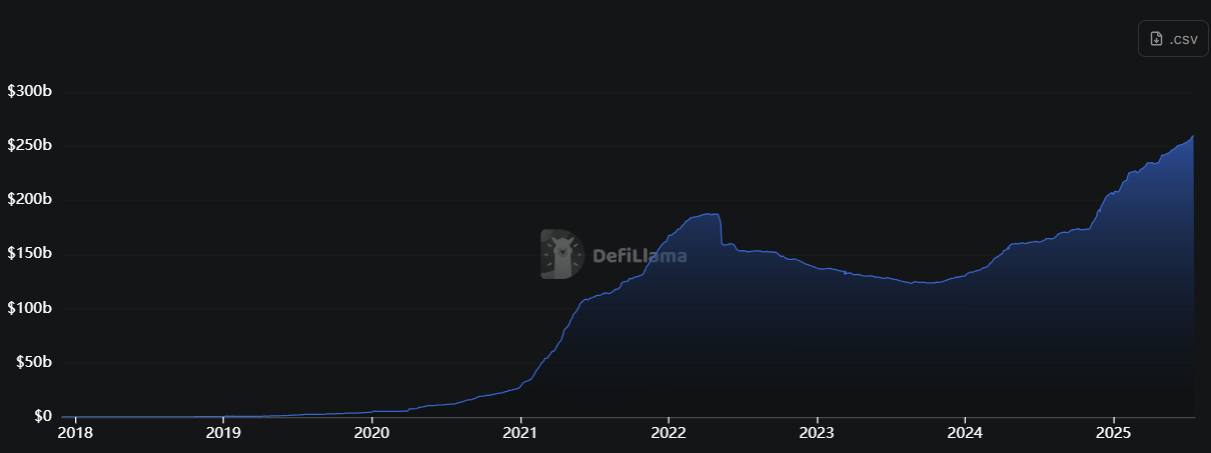

Stablecoins complete has risen practically $3 billion over the previous seven days to over $261 billion. sauce: defill

In line with Tesfaye, the US's favorable regulatory surroundings can be a significant catalyst for the continued evolution and adoption of tokenized belongings.

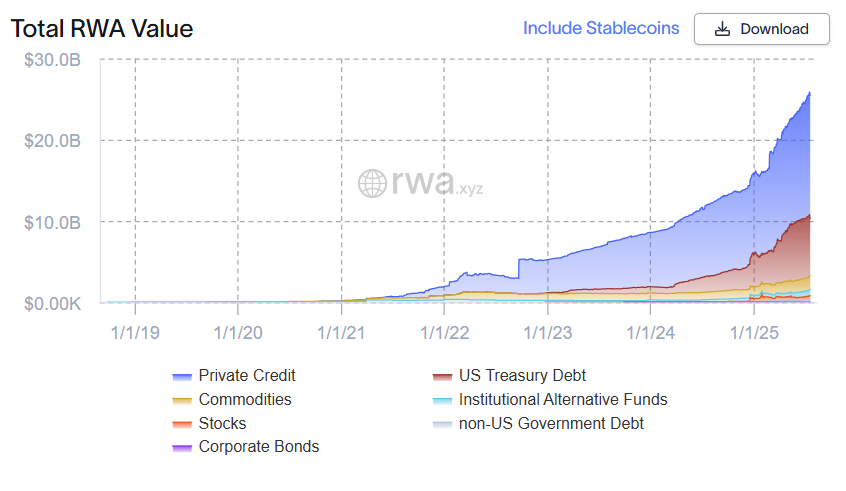

RWA has grown past personal credit score and has a US Treasury debt

Thus far, a lot of the expansion in tokenized belongings has been targeting personal credit score and US Treasury debt.

A latest report co-authored by Redstone, Gauntlet and RWA.xyz discovered that as of June it made up practically 60% of the RWA market, incomes a tokenized US treasure trove of creating up the second largest phase of round 28%.

Whole RWA values by class. sauce: rwa.xyz

“The preliminary adoption of tokenization focuses on bringing legacy monetary belongings to the most recent digital rails, and the Ministry of Finance and personal credit score are the right start line. On-chain, they will settle sooner, ease trades, and simply cut up,” Tesfaye says.

“Trying forward, it's not tough to think about a future the place RWA expands to extra advanced asset lessons, comparable to derivatives, IP, or esoteric asset lessons. As monetary infrastructure matures, it's not nearly entry and effectivity. It's targeted on unlocking all-new monetary merchandise and world participation.”

Aptos has emerged as a hub for RWA actions. As Cointelegraph not too long ago reported, the worth of the tokenized RWA of the APTOS blockchain coated $540 million in late June, led by publishers comparable to PACT consortium Berkle Sq. and BlackRock's Buidl.