Injective (Inj) is a layer 1 blockchain devoted to tokenized shares, belongings, and actual world belongings (RWA), with dramatic spikes in day by day energetic addresses (DAAs) in July.

Regardless of the Inj tokens falling 80% from their all-time excessive (ATH), the community's revival governs optimism. What is that this sudden development? On this article, we discover the vital elements behind surges.

Injective Community rebound in 2025, Daas was the very best hit since December 2023

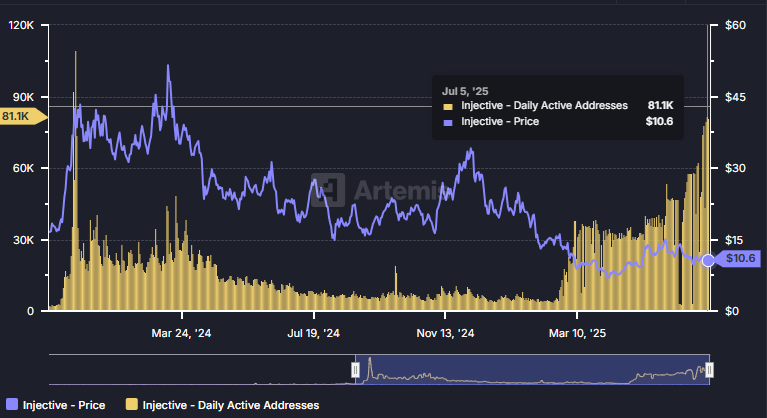

Artemis Analytics information exhibits Inj's day by day energetic addresses have skyrocketed from 4,500 in early 2025 to over 81,000 in July, a surge of over 1,700%.

That is the best stage since December 2023, when INJ costs rose from $1.25 to greater than $50.

Every day energetic handle for injection. Supply: Artemis

Consequently, many traders speculate that the community's up to date actions might mark Inj's new worth rallies in 2025.

“From 1,500% +1,500% +1,500% +1,500% in 82,500 indiactive addresses in six months. Injections are rising exponentially, and that is just the start,” commented analyst Renato Snyder.

The rise in DAAS seems to have began after February seventeenth. Injected a significant protocol improve often known as the Nivara improve of that date. The group was anticipated to approve it with excessive participation, enhance community efficiency and appeal to extra customers and builders.

By July, DAAS had doubled in comparison with the Q2 common. One of many main drivers behind this development was Injective's launch of Ethereum Digital Machine (EVM) Public TestNet.

On July 3, 2025, Injective introduced the launch of the testnet. Builders can straight construct and run Ethereum-compatible distributed purposes (DAPPS) on Injective's Layer 1 blockchain.

Is Injective (Inj) underrated?

In 2025, Injective accelerated token burn charges by 5 instances because the launch of Inj 3.0. The weekly protocol income combustion mechanism lowered token provide and launched deflationary strain. Nevertheless, amid the continuing winter of Altcoin, it has not but been translated right into a worth restoration.

Regardless of venture improvement and powerful on-chain metrics above the 2024 stage, Inj remains to be 80% beneath the $52 ATH. In keeping with Beincrypto information, Inj has fallen 60% because the begin of the 12 months, hovering at round $10.5.

Injective (Inj) worth efficiency. Supply: Beincrypto

Some traders now consider Inj is severely undervalued.

“Injective Inj may be very underrated. For those who're paying consideration: the important thing builders, companions and launches line up behind the scenes, getting ready for a wave of product rollouts that make the whole lot appear small,” says investor Cryptobusy.

With rising curiosity in exchanges for tokenized shares and belongings, Injective might doubtlessly re-emerge as a significant layer 1 community for real-world asset tokenization.