Nvidia (NASDAQ: NVDA) insiders offered greater than $1 billion value of the corporate's inventory in 2025, capitalizing on the chipmaker's sustained rally pushed by advances in synthetic intelligence (AI).

Notably, by means of 2025, the inventory has elevated over 52% for the reason that starting of the yr, buying and selling at $190 on the final market shut.

Regulatory filings present constant promoting by executives and board members all year long, with no reported insider purchases.

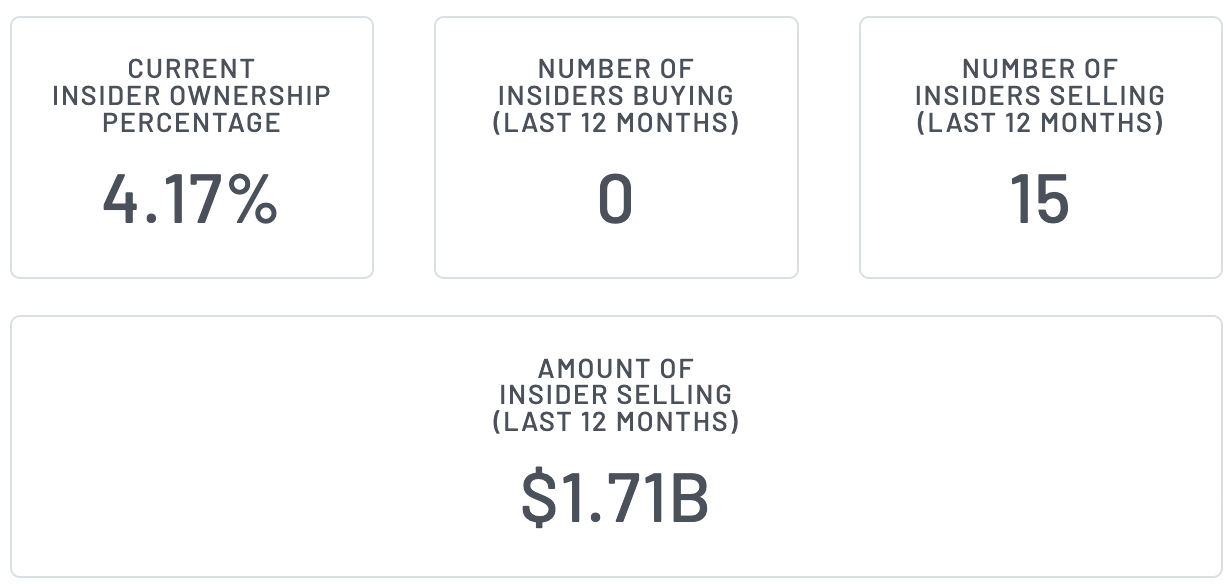

Within the final 12 months, NVIDIA's insider possession amounted to round 4.17%, with 15 insiders promoting and none shopping for shares. Whole insider gross sales totaled roughly $1.7 billion as of Dec. 29, in accordance with Finbold knowledge obtained from . market beat.

Greatest insider sellers of Nvidia inventory

The largest and most constant vendor was CEO Jensen Huang. All through 2025, Mr. Huang executed a collection of gross sales pursuant to a pre-arranged Rule 10b5-1 buying and selling plan.

For instance, in early July, it offered simply over 205,000 shares value about $36 million. The exercise continued into September, when he disposed of about 225,000 shares value about $40 million, adopted by similar-sized trades in October.

Different administrators additionally took benefit of the rise in inventory costs. In September, board member Harvey Jones offered about 250,000 shares of Nvidia inventory value about $44 million.

In direction of the top of the yr, director Mark Stevens revealed he had offered greater than 220,000 shares value about $40 million, and the corporate's chief accounting officer offered hundreds of thousands of {dollars} value of inventory in December.

The wave of promoting comes at a time when Nvidia's market capitalization has ballooned to greater than $4 trillion on explosive demand, and its income development and revenue margins far outpace a lot of the semiconductor business, serving to justify its premium valuation. In opposition to this backdrop, insider gross sales have primarily been seen as a diversification transfer somewhat than an indication of deteriorating fundamentals.

Influence of NVDA inventory insider sale

Nevertheless, the dearth of insider shopping for coupled with heavy promoting could have an effect on investor sentiment.

Giant seen gross sales may improve near-term volatility, particularly if broader market circumstances weaken or expectations relating to AI spending are average.

Whereas the pre-scheduled buying and selling plan limits the informational worth of particular person trades, the scale of the overall providing may weigh on confidence if Nvidia's development trajectory exhibits indicators of slowing.

Featured picture through Shutterstock